DOJI

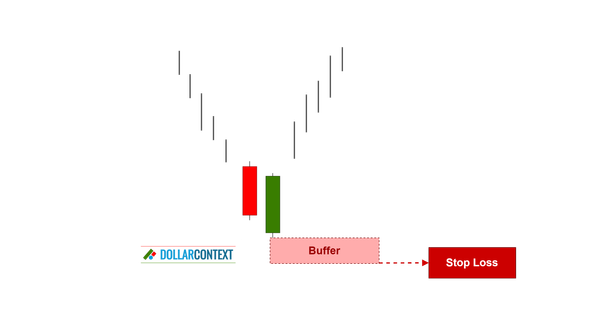

Doji Candlestick: How to Set Your Stop-Loss

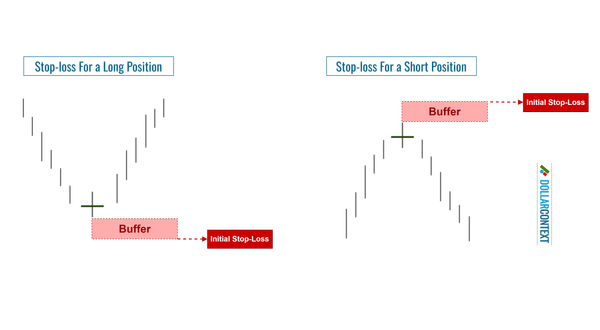

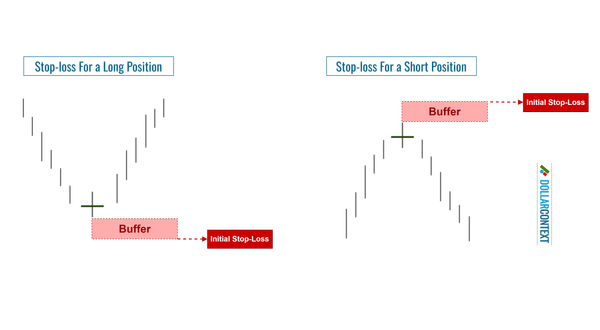

In this post, we'll explore effective methods to set a stop-loss when leveraging a doji candle to initiate a market position.

DOJI

In this post, we'll explore effective methods to set a stop-loss when leveraging a doji candle to initiate a market position.

BONDS

We discuss the forces that have shaped the trajectory of Treasury yields since 2020 and provide our view on the prospective factors impacting this market.

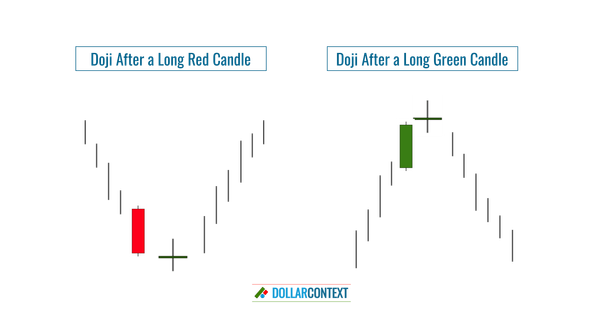

DOJI

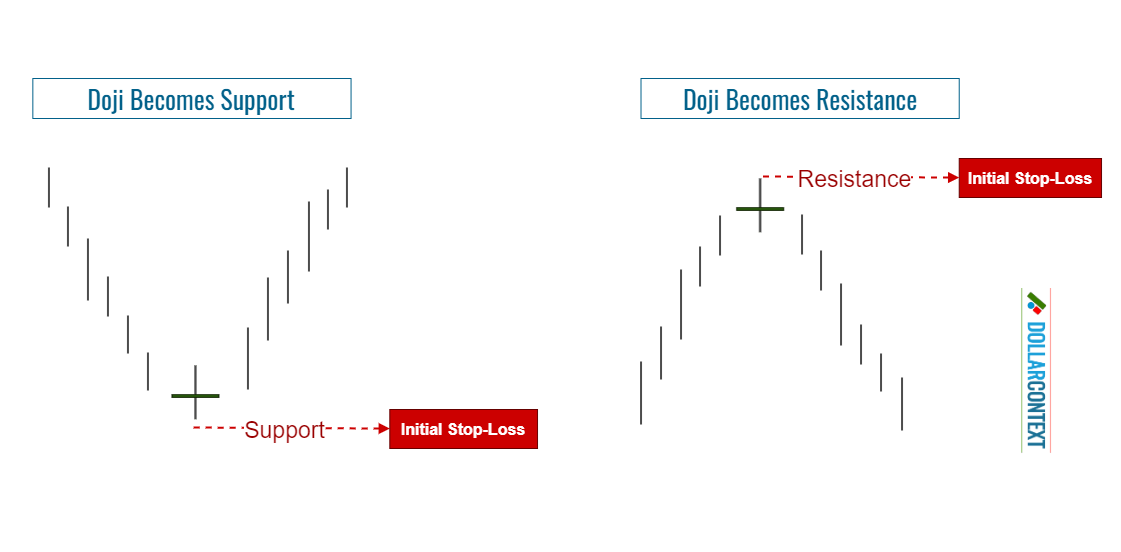

After an uptrend, the price range associated with a doji candle typically evolves into a resistance area. The same works in reverse.

BONDS

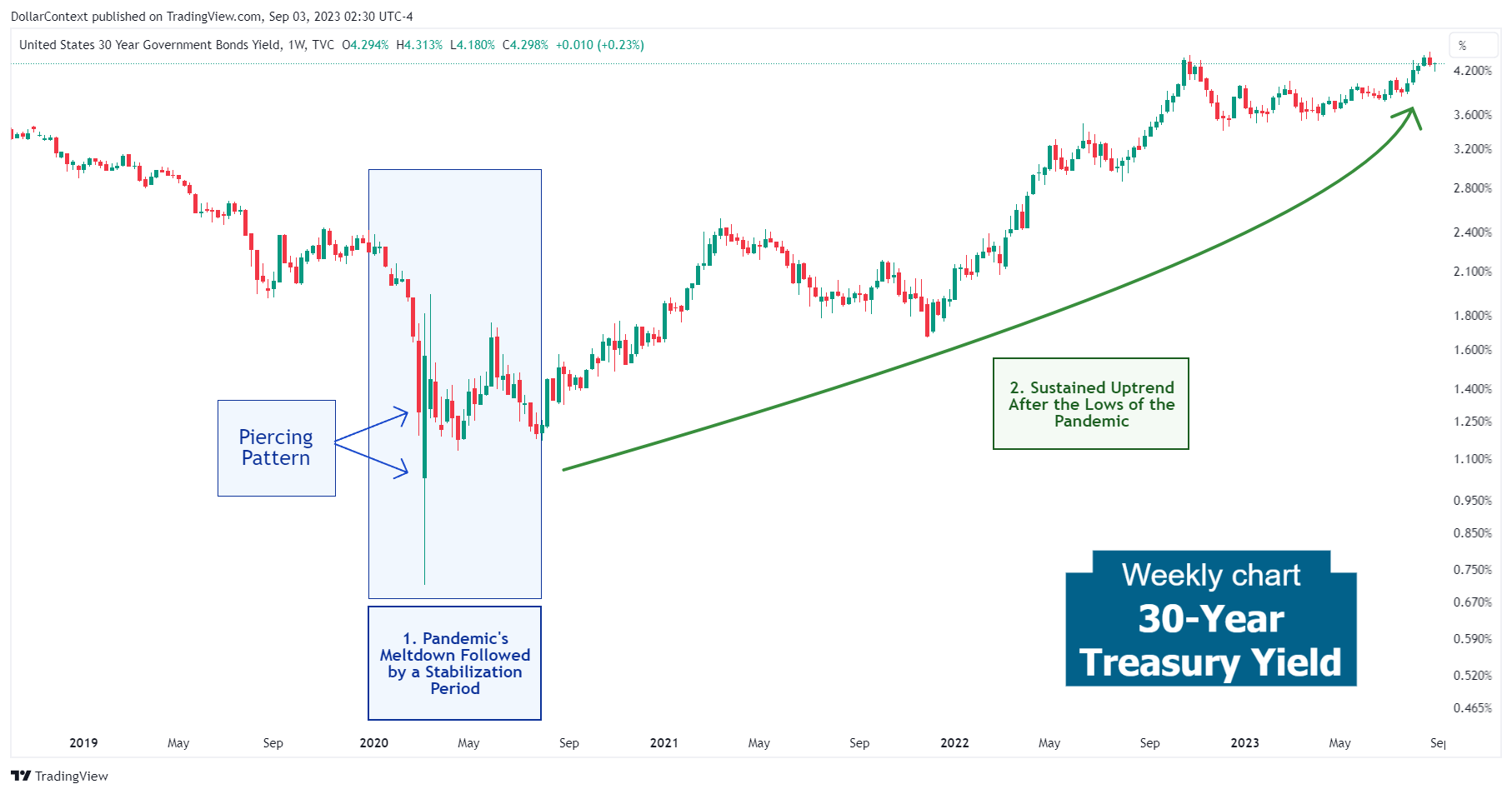

We discuss the intricacies and dynamics that have affected the 30-year Treasury yield since 2020 and provide our insights on the future of this market.

DOJI

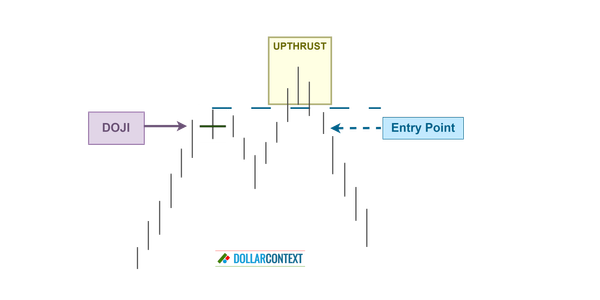

Here are different options for entry points after the appearance of a doji.

BONDS

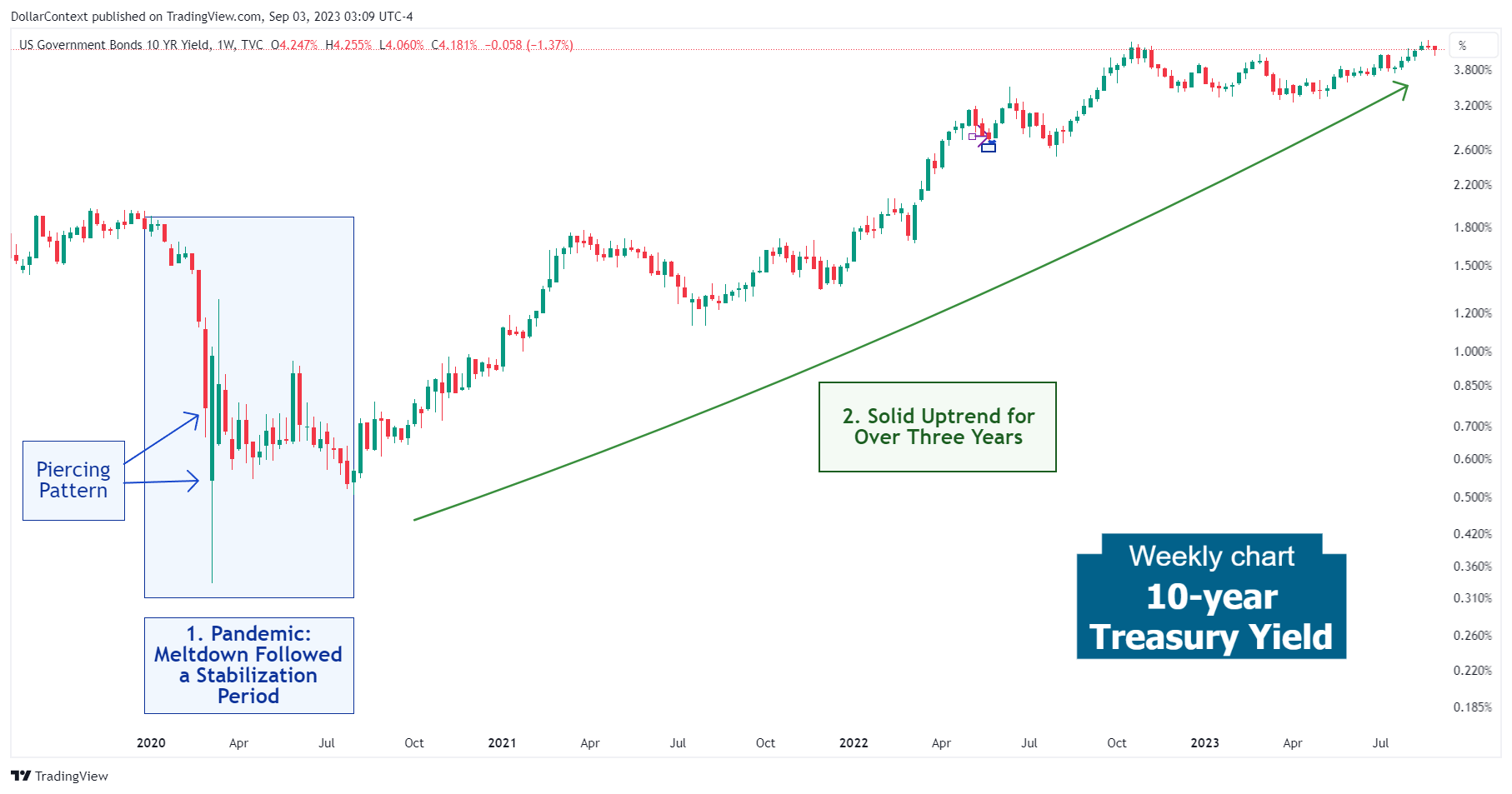

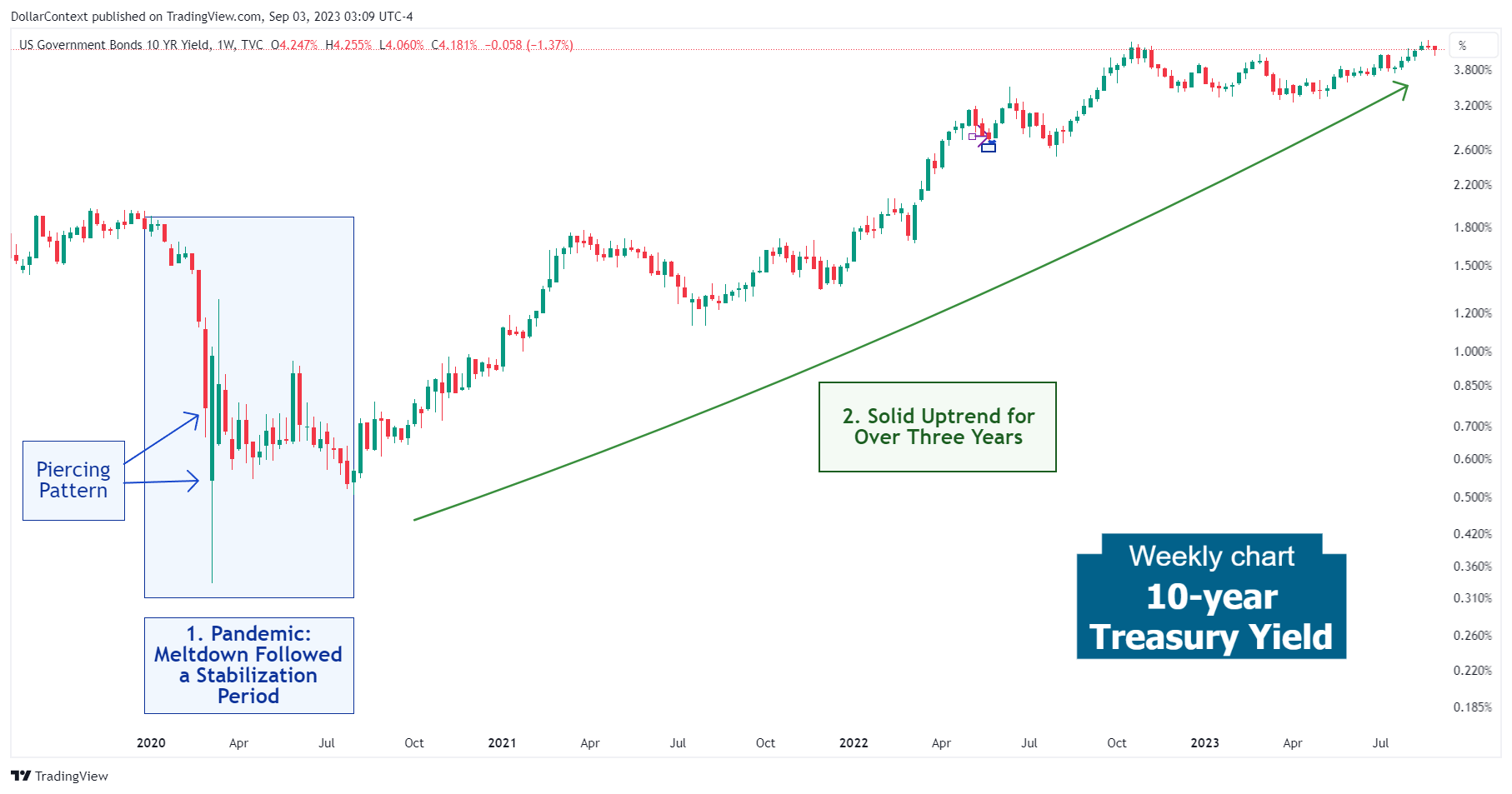

We cover the forces that influenced the 10-year Treasury yield starting in 2020 and wrap up with our perspectives on upcoming factors that might impact this market.

DOJI

Today we examine the implications of a doji candle in market psychology.

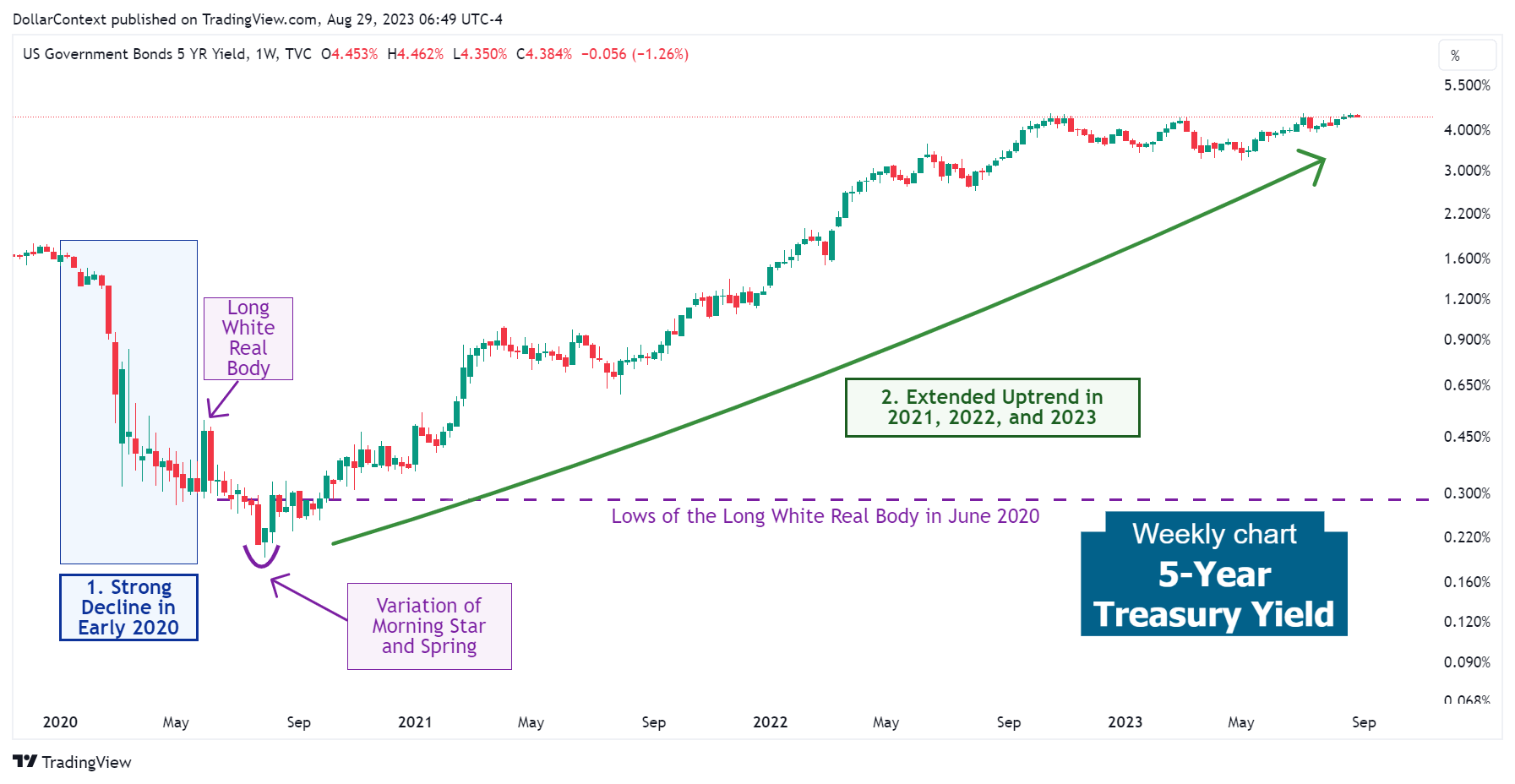

BONDS

We discuss the trends that have shaped the movement of the 5-year Treasury yield since 2020 and provide our insights on potential dynamics affecting this market.

DOJI

A doji is a candlestick where the opening and closing prices are the same. That is, a doji session displays a horizontal line instead of a real body.

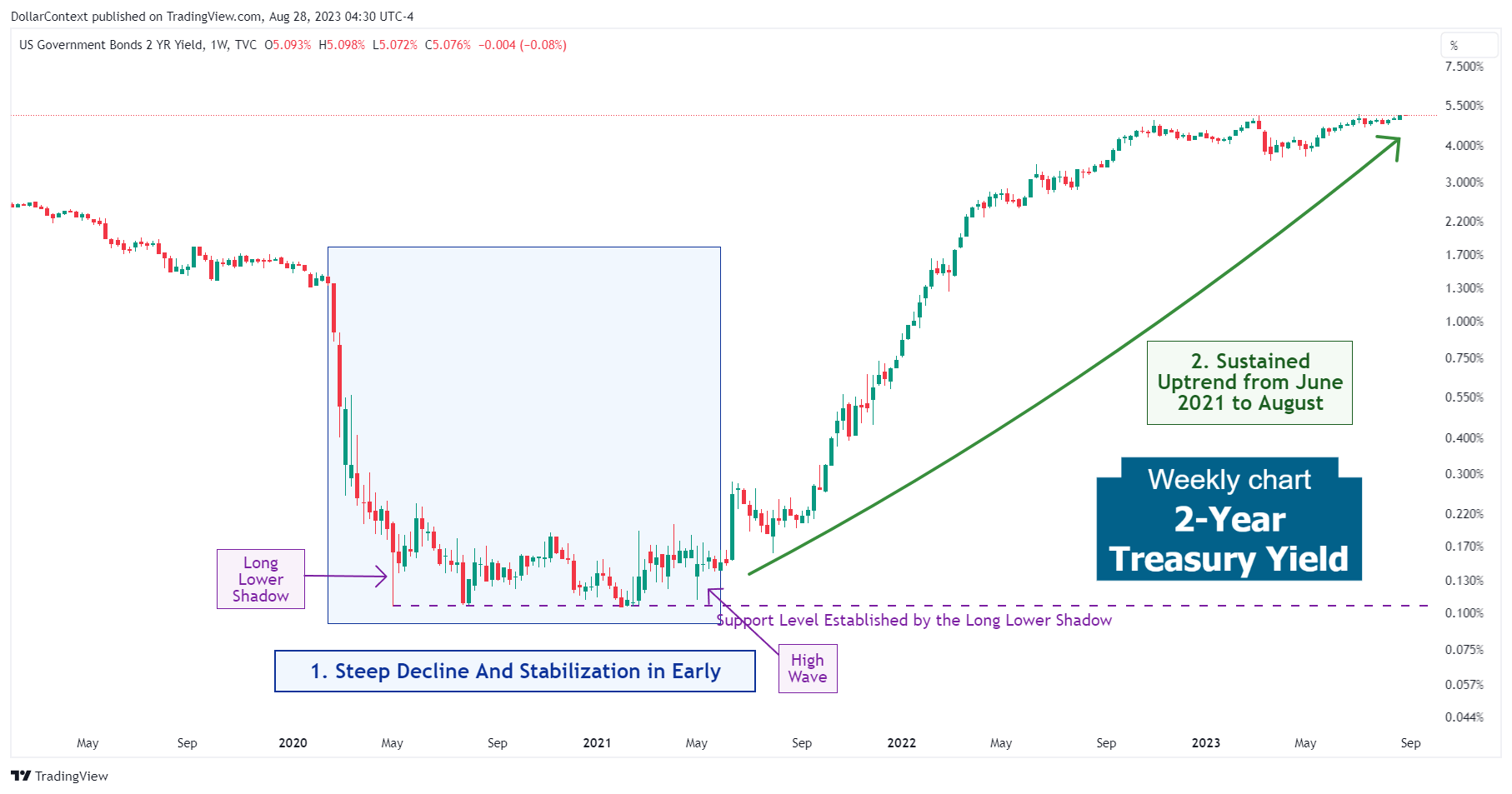

BONDS

We explore the dynamics and patterns that have influenced the 2-year Treasury yield and wrap up by forecasting potential trends in this market.

CANDLESTICK

Today we're exploring an important indicator of Japanese candlestick charting: the piercing pattern.

COMMODITIES

We discuss the trends and forces that have influenced the commodity market's path and offer our perspective on future shifts in this market.