U.S. Dollar Index (DXY): Comprehensive Review and Outlook

In-depth U.S. Dollar Index analysis covering fundamentals, technicals, and sentiment. Macro forces and technical structure favor a weaker dollar, but measured positioning and active channel support prevent disorderly decline. Updated regularly.

✅ Last Reviewed: | 📝 Last Updated:

U.S. Dollar Index (DXY) at a Glance

Directional Pressure on DXY:

No directional catalyst, fiscal constraints bind

🌎 GLOBAL FACTORSSafe-haven erosion and declining foreign demand

🧠 SENTIMENT & POSITIONINGReluctant bulls, consolidation over conviction

📈 TECHNICAL STRUCTUREPost-bull weakening confirmed, channel intact

🎯 FINAL VERDICTMacro and technicals favor a weaker dollar over time, but measured sentiment and active channel support prevent disorderly decline. Path of least resistance: lower, but gradual.

〰️ Forces Shaping the U.S. Dollar Index (DXY)

The U.S. Dollar Index faces bearish macro headwinds. While domestic factors remain neutral—Fed patience and inflation stability provide no clear catalyst—fiscal constraints, reduced safe-haven demand, and April 2025's safe-haven breakdown all create structural downward pressure. From a macro perspective, weakness or consolidation with downward bias appears most likely.

| Component | Current Assessment |

|---|---|

| FEDERAL RESERVE POLICY STANCE |

Policy patience reduces dollar impulse

|

| SHORT-TERM INFLATION DYNAMICS |

Sticky but tolerated inflation is dollar-neutral

|

| LONG-TERM INFLATION REGIME |

Structural floor established, but no trend extension

|

| FISCAL CONSTRAINTS |

Persistent deficits create ceiling on sustained strength

|

| GLOBAL GROWTH & RISK APPETITE |

Non-crisis environment limits safe-haven demand

|

| SAFE-HAVEN STATUS EROSION |

Safe-haven reliability eroding

|

🧠 Sentiment & Positioning

Sentiment data reveals measured dollar support without euphoric extremes. Fund managers maintain bullish positioning (#3 crowded trade) but acknowledge overvaluation and specific unwind risks—"reluctant bull" sentiment that favors consolidation over explosive moves. Economic news sentiment remains moderately constructive but cooling, providing mild tailwind without strong directional catalyst.

| Component | Current Assessment |

|---|---|

| Bank of America Global Fund Manager Survey Jan 2026 |

Measured dollar bullishness with awareness of constraints

The January 2026 BofA survey shows sustained but cautious dollar positioning, with "Long USD" as the #3 most crowded trade. The "reluctant bull" character suggests tactical support rather than conviction-driven positioning:

|

| DAILY NEWS SENTIMENT INDEX (DNSI) |

DNSI readings moderately above historical median

|

📈 Technical Structure

Technical structure provides critical insight into whether the U.S. Dollar Index is navigating an orderly weakening phase or showing early signs of disorderly breakdown. The following analysis examines monthly and weekly charts to distinguish between structured consolidation and accelerating decline.

| Technical Factor | Current Status | Structural Signal |

|---|---|---|

| POST-BULL WEAKENING PHASE | 2008–2022 bull market concluded; DXY moving lower in controlled, non-disorderly manner since late 2022 |

Confirmed

The conclusion of the multi-decade bull phase marked a structural regime transition rather than a cyclical pullback. Price action has consistently failed to recover the September 2022 highs, and the April 2025 safe-haven breakdown further confirmed that the prior bull market's structural support mechanisms are eroding. |

| DESCENDING CHANNEL | Well-defined descending parallel channel in place since September 2022 with repeated boundary tests |

Structured weakening, not disorderly decline

The descending channel reflects an orderly adjustment phase rather than panic-driven liquidation. Both boundaries have been repeatedly tested and defended, suggesting the weakening is being absorbed gradually. Channel can break in either direction, but its descending nature and position below the 2022 highs favors continued containment with a downward bias. |

| CANDLESTICK BEHAVIOR | Symmetric absorption at both boundaries: hammers at lows, long upper shadows and double-top at highs |

Both boundaries actively defended

Lower boundary tests have produced hammer formations (e.g., September 2025, late January 2026) signaling buying absorption, while upper boundary advances have stalled via long upper shadows and double-top rejection. This symmetry confirms the channel's structural validity but provides no clear directional bias—neither side is gaining decisive control. |

| VOLATILITY & MOMENTUM | Range-bound behavior; no momentum expansion in either direction |

Contained, directionally neutral

Price action remains compressed within channel boundaries without sustained momentum in either direction. This is characteristic of an adjustment phase rather than pre-breakout accumulation or distribution. Directional resolution will likely require a catalyst from fundamental or policy shifts rather than purely technical momentum. |

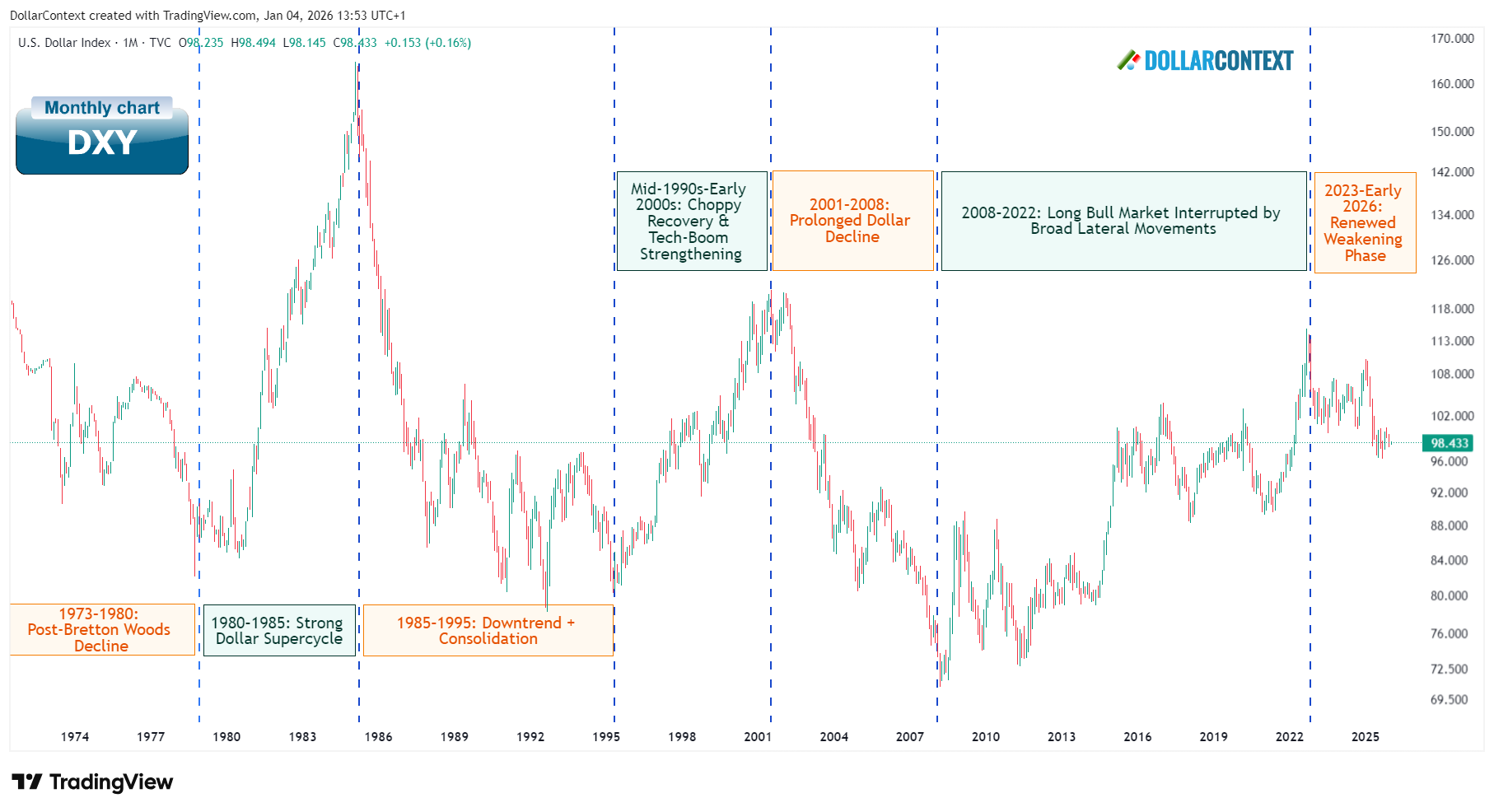

Monthly Chart — Seven Regimes, New Weakening Phase

Viewed on a monthly logarithmic scale, the U.S. Dollar Index (DXY) has moved through multiple structurally distinct macro regimes since the early 1970s. These phases align more closely with shifts in inflation dynamics, policy frameworks, and global capital flows than with conventional technical cycles.

Across five decades, the dollar has alternated between prolonged advances, extended declines, and wide-ranging consolidation phases—often violating prior support and resistance zones in the process.

Summary of major dollar regimes

- 1973–1980: Post–Bretton Woods adjustment and inflation-driven decline.

- 1980–1985: Volcker-era tightening and strong-dollar supercycle.

- 1985–1995: Plaza Accord–driven decline followed by extended range behavior.

- Mid-1990s–2001: Partial recovery during the tech boom and U.S. economic outperformance.

- 2001–2008: Prolonged decline amid twin deficits and global diversification.

- 2008–2022: Long bull market with internal consolidations, driven by crisis dynamics, relative growth strength, and persistent safe-haven demand.

- 2023–Present: Renewed weakening phase following bull market conclusion, characterized by controlled declines and eroding safe-haven behavior.

Renewed Weakening Phase (2023–Present)

- The DXY has moved lower in a controlled, non-disorderly manner, with current levels near 98.4 testing historically relevant support.

- Declines have occurred without sustained funding stress or crisis-driven dollar demand.

- Notably, during episodes of equity volatility—such as the April 2025 selloff—the dollar failed to exhibit strong safe-haven behavior.

From a structural perspective, the repeated violation of historical support and resistance zones underscores a key limitation of technical interpretation at this horizon: long-term dollar behavior is regime-driven, not level-driven.

Key takeaway (monthly chart)

The DXY's multi-decade history confirms that major turning points coincide with fundamental regime shifts rather than durable respect for technical price levels. The post-2022 weakening phase represents a new macro phase, but monthly structure alone does not yet distinguish conclusively between extended consolidation and a broader downshift—what it does confirm is a transition toward increasingly constrained, context-dependent dollar behavior.

Weekly Chart — Descending Channel, Both Sides Defended

The weekly chart reveals how the post-2022 weakening phase is contained within a descending parallel channel, reinforcing range behavior rather than trend acceleration.

Descending channel structure

Following the September 2022 peak, the DXY entered a descending parallel channel that has governed price behavior across multiple cycles. Both advances and declines have repeatedly stalled at channel boundaries, highlighting the absence of sustained directional control.

Recent price action shows the index stabilizing near the lower channel boundary, after repeated support tests through mid-to-late 2025 and again in late January 2026.

Weekly Candlestick Behavior

Candlestick behavior at both channel boundaries reveals symmetric absorption patterns. The second test of the lower boundary in September 2025 formed as a hammer candlestick, signaling absorption of selling pressure rather than capitulation—mirroring earlier upper boundary interactions where advances stalled via long upper-shadow candles and a double-top formation.

A late-January hammer confirmed a bounce off the lower channel boundary at a confluence of support: the descending channel's lower boundary and horizontal support from the late-June 2025 low. This symmetry suggests both boundaries are being actively defended, reinforcing the channel's structural validity.

Key takeaway (weekly chart)

The weekly chart reinforces the monthly message: the U.S. Dollar Index is navigating a weakening phase within a broader regime transition. Price action remains contained within a well-defined channel, with repeated absorption at both boundaries. There is no technical evidence yet of a disorderly breakdown or a renewed trend impulse.

Key Technical Levels

Descending channel boundaries

The descending parallel channel established since September 2022 remains the primary structural framework governing DXY price action. Both the upper and lower boundaries have been repeatedly tested and defended, making them the most relevant reference points for evaluating directional breakouts or breakdowns.

Lower boundary and confluence support

The lower channel boundary near current levels (~96) coincides with horizontal support from the late-June 2025 low, creating a dual support confluence zone. The late-January 2026 hammer candlestick confirmed absorption at this level. A sustained weekly close below this confluence would signal accelerating weakness and potential channel invalidation, opening the door to a broader downshift consistent with the macro thesis.

Upper boundary resistance

Advances within the channel have consistently stalled at the upper boundary, where long upper-shadow candles and double-top formations have marked rejection. A breakout above the descending upper boundary on a sustained weekly basis would challenge the weakening phase thesis and signal a potential regime shift toward renewed dollar strength.

Channel breakdown vs. consolidation

Within the descending channel, rallies toward the upper boundary remain possible and should not be interpreted as trend reversals. The key distinction lies in whether price action respects or violates channel boundaries on a sustained closing basis—temporary breaches followed by rapid reversal are characteristic of channel behavior, not confirmation of new trends.

The role and limitations of descending channel formations

Descending channels represent structured consolidation within a weakening trend, but they do not guarantee continuation. Channels can break in either direction, and false breakouts are common. These levels should not be treated as mechanical trading signals—dollar behavior at this horizon is regime-driven, as confirmed by the monthly analysis, and channel violations may reflect fundamental shifts rather than purely technical dynamics.

Technical Bottom Line

The DXY appears to be navigating a structured weakening phase within a descending channel, not yet entering disorderly breakdown territory. Price action remains contained with both boundaries actively defended, suggesting range-bound behavior until a sustained close below the ~96 confluence zone or above the upper channel boundary confirms a new directional leg. The late-January hammer at confluence support does, however, leave room for a near-term rally toward the upper boundary before the broader weakening phase resumes.

🎯 Final Verdict

Our comprehensive analysis across four key dimensions—domestic drivers, global factors, sentiment and positioning, and technical structure—points to a bearish macro backdrop with measured near-term support for the U.S. Dollar Index in early 2026.

Macro forces tilt decidedly bearish. Domestic factors—Fed patience, stable inflation, and the established regime shift—provide no directional catalyst, while fiscal constraints, diminished safe-haven demand, and the April 2025 breakdown in crisis-response patterns all create structural downward pressure.

Sentiment is cautious, not euphoric. "Reluctant bull" positioning reflects necessity rather than conviction—managers acknowledge overvaluation and specific unwind triggers. This measured character limits both explosive upside and panic-driven selloffs, supporting range-bound behavior rather than sharp directional moves.

Technical structure confirms weakening but not collapse. The descending channel since 2022 reflects an orderly adjustment phase with both boundaries actively defended. Price action near the ~98.4 confluence zone shows absorption rather than capitulation, but the channel's descending nature and the post-bull regime transition reinforce the macro bearish thesis. The late-January hammer at the lower boundary suggests a short-term rally toward the upper channel resistance should not be ruled out before the broader weakening phase resumes.

The bottom line: Macro fundamentals and technical structure both favor a weaker dollar over time, while measured sentiment and active channel support prevent disorderly decline. The path of least resistance appears lower, but consolidation within the descending channel is more likely than a sharp breakdown absent a catalyst such as a policy shift, growth disappointment, or safe-haven demand shock.

📝 Update History

- February 3, 2026: Initial publication

This analysis reflects market conditions and information available at the time of publication. It is provided for informational and educational purposes only and does not constitute financial, investment, or legal advice.

The financial markets are inherently volatile, and past performance is never a guarantee of future results. Readers should conduct their own independent research or consult with a licensed professional before making any investment decisions. Any actions taken based on the content of this report are at the sole discretion and risk of the reader, and the author assumes no liability for any potential losses or damages.