Morning Star Pattern: Criteria to Qualify

This article covers the criteria and conditions to qualify a morning star pattern as a bullish reversal indicator.

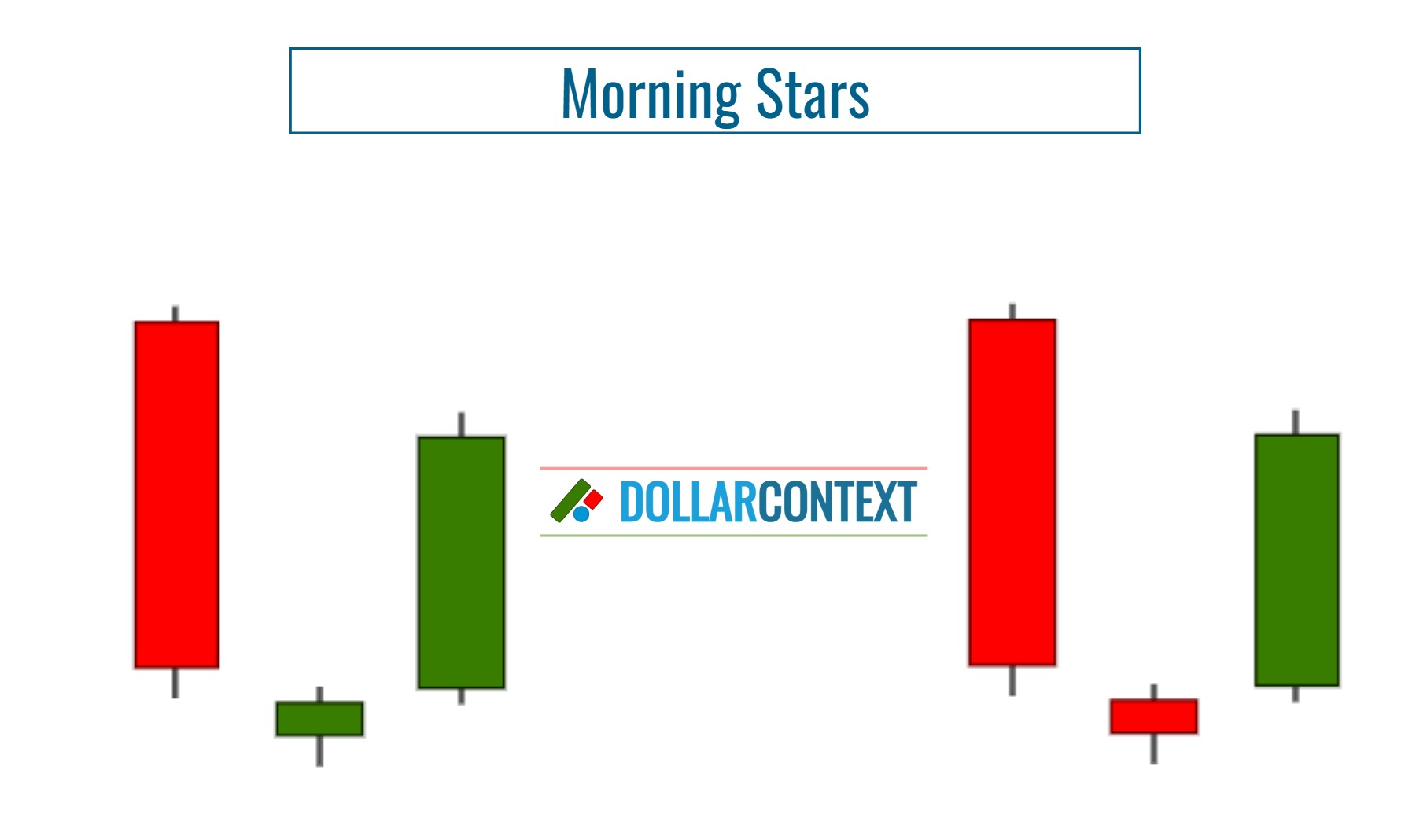

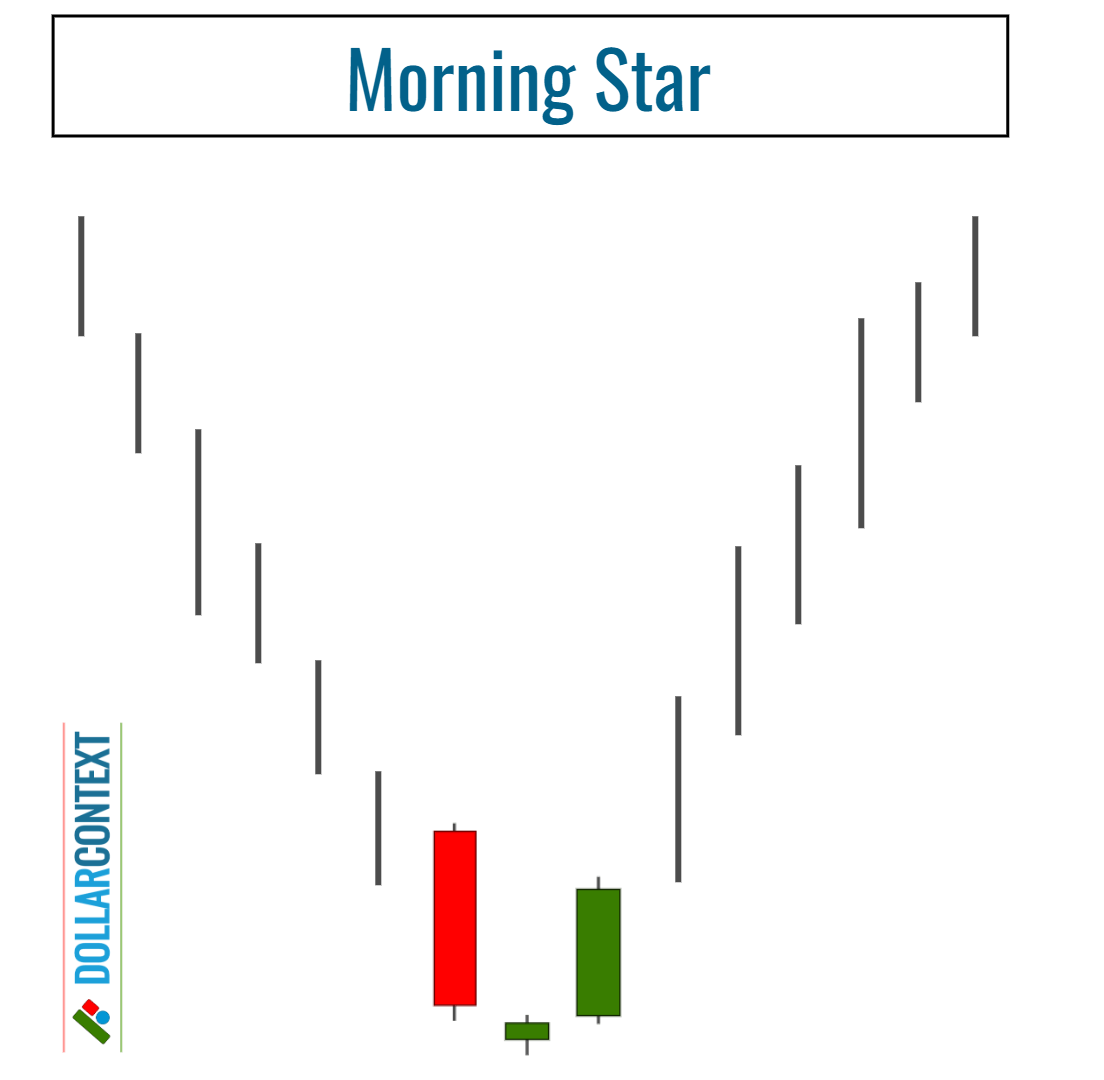

The morning star is a three-candle bullish reversal pattern that appears at the end of a downtrend.

Basic Criteria

Four basic conditions must be met for a pattern to be classified as a morning star:

- Downtrend Precedence: The pattern must form after an established downtrend in price. The longer the downtrend and the more oversold the market, the more reliable the signal of this pattern becomes.

- First Candle: The first candle should be a relatively large bearish candle (red or black).

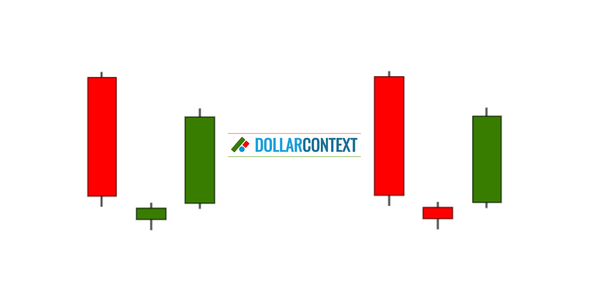

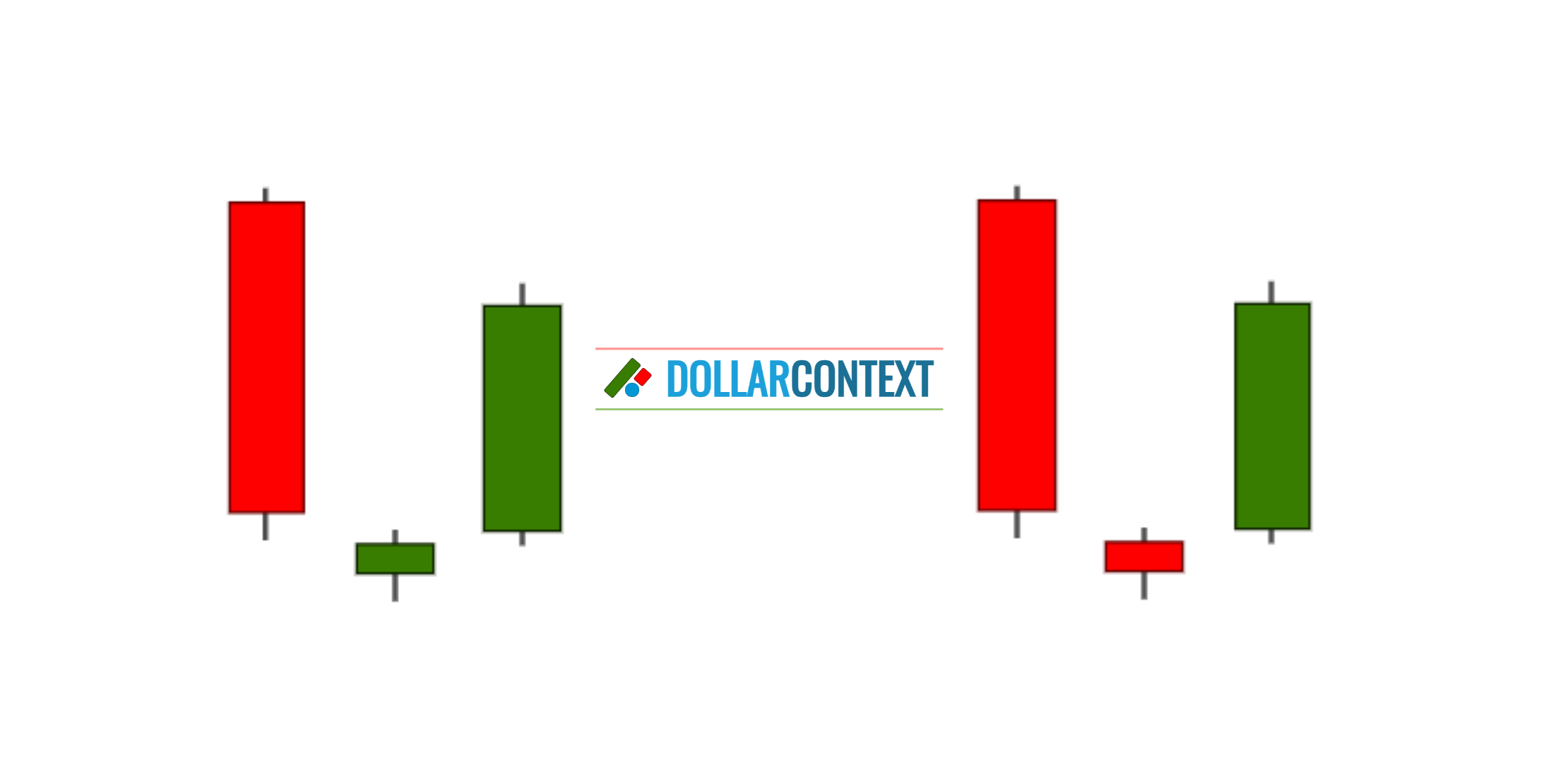

- Second Candle (Star): This is a small-bodied candlestick (which could be green or red). Ideally, it should gap below the close of the previous candle. The star indicates market indecision and a potential change in trend.

- Third Candle: The formation concludes with a large bullish (green or white) candle that opens above or at the close of the second candle and almost always closes at least halfway up the body of the first candle, showing a shift towards buying pressure.

Variations

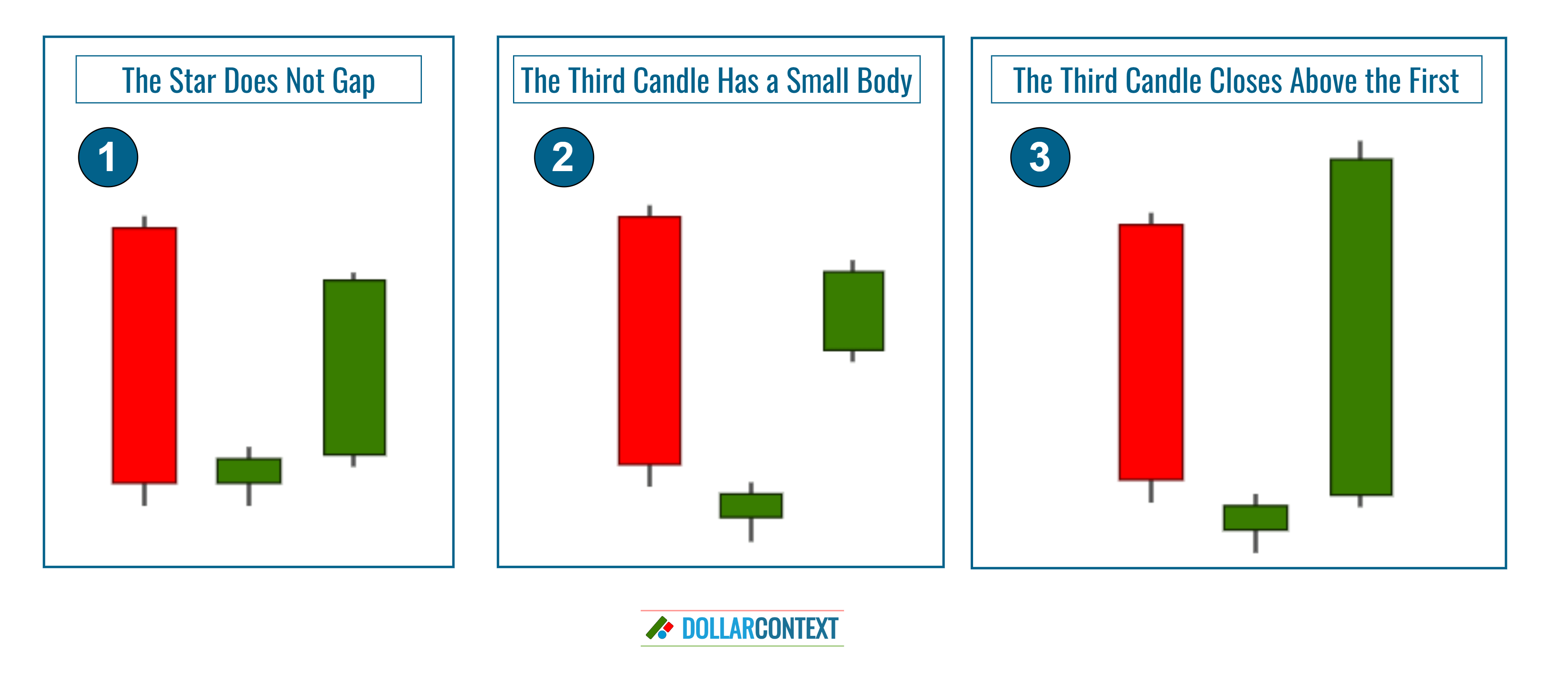

The checklist detailed above provides the classical definition of a morning star pattern. However, real-world instances might see slight variations still accepted by traders as valid morning stars, provided the essential characteristics of the bottom reversal are present.

Here are the common variants of the morning star pattern you might encounter:

- Non-Gapping Star: This is often seen in markets with lower volatility or on shorter timeframes, where the star candle may not exhibit a downward gap. In such scenarios, traders are usually advised to seek further bullish confirmation before engaging.

- Modestly Sized Third Candle: In this case, it's important to verify that the third candle penetrates deeply into the terrain of the first. A shallow close requires additional corroborative signals before opening a long position.

- The Third Candle Closes Above the First: This configuration suggests a strong bullish conviction. A third candle closing above the first's opening underscores a robust sentiment shift, possibly prefacing a bull market inception.