U.S. Dollar Index (DXY) Deep Dive: Constraint Asset in a Post-2022 Adjustment Regime (January 2026 Analysis)

The U.S. dollar is no longer acting as a dominant trend driver. Instead, its post-2022 behavior reflects balance and constraint—raising a different question about what the dollar is really signaling in the current macro regime.

📊 DEEP DIVE ARCHIVE | Published: January 5, 2026

This is a comprehensive analysis from January 2026. For our current view on the U.S. Dollar Index (DXY):

→ U.S. Dollar Index (DXY) Hub Page

This archive piece remains valuable as a detailed framework reference and historical snapshot.

The purpose of this post is to assess whether the macro regime identified in recent equity and rate-market analysis is also being confirmed through the behavior of the U.S. dollar. Rather than introducing new assumptions, this post evaluates the dollar as a constraint asset — a market whose behavior helps validate or challenge regime coherence across assets.

In a regime defined by structurally higher inflation, policy patience, and fiscal constraints, the dollar should not function as a dominant trend driver. Instead, its role should be stabilizing: reflecting acceptance of higher rates through range-bound behavior, controlled adjustments, and orderly cross-asset interaction. The focus here is not on forecasting dollar direction, but on determining whether current price structure remains consistent with regime continuity.

This post follows the interpretive approach outlined in How DollarContext Interprets Markets , where structure, regime context, and cross-asset confirmation take precedence over directional forecasts.

• Inflation is structurally higher than the pre-2020 norm

• Monetary policy prioritizes risk management over suppression

• Fiscal dynamics constrain extreme rate and currency outcomes

Executive Summary

-

🧭 Macro regime:

The post-2020 macro environment favors a constrained dollar regime, shaped by structurally higher inflation, policy patience, and fiscal limits that restrict sustained USD dominance or disorderly weakness. -

🧠 Positioning & psychology:

Dollar-market sentiment reflects normalization without stress—positioning has adjusted away from extremes, internal rotation dominates, and volatility remains episodic rather than systemic. -

📈 Technical structure:

Higher-timeframe charts show a post-2022 adjustment phase, with price action contained within defined boundaries rather than resolving into a new secular trend. -

⚖️ Structural context:

Following a long bull phase, the dollar is now adapting through range and rotation, functioning as a constraint asset that stabilizes cross-asset relationships rather than driving direction. -

🔎 What matters next:

The key question is not near-term direction, but whether price behavior remains contained within structural boundaries—or whether sustained breaks force a reassessment of the dollar’s role within the current macro regime.

This analysis builds on the recent S&P 500 structural outlook, where equity price action was interpreted as consolidation within a structurally inflationary regime rather than the start of a new trend cycle.

1. Macro Setup: Structural Inflation, Policy Patience, and Dollar Constraint

Macro forces translated into direct implications for the U.S. dollar, emphasizing limits on sustained trend behavior rather than directional narratives.

Within the current macro regime, the dollar functions less as an independent trend driver and more as a balancing variable across rates, risk assets, and global capital flows. The prevailing environment favors range formation and controlled adjustments rather than persistent dollar strength or disorderly weakness.

Macro Translation Snapshot (Key Forces):

1.1 Federal Reserve: Policy Patience Reduces Dollar Impulse

- The Federal Reserve currently operates under policy patience, not urgency toward renewed tightening or rapid easing.

- This stance reduces the probability of sharp interest-rate differentials emerging versus other developed economies.

- Leadership signaling and communication emphasize risk management and optionality over directional commitment.

- As a result, monetary policy generates fewer shocks capable of sustaining prolonged dollar trends.

DXY implication:

Policy patience dampens the dollar’s ability to sustain momentum driven by rate expectations, favoring range-bound behavior over directional breakouts.

1.2 Short-Horizon Inflation: Sticky, Tolerated, Dollar-Neutral

(Short-horizon inflation refers to the Fed’s policy reaction window, not the secular inflation regime.)

- Inflation remains above pre-2020 norms but shows limited acceleration.

- The Fed tolerates modest overshoots as long as:

- Inflation expectations remain anchored

- Financial conditions stay orderly

- This tolerance reduces pressure for both aggressive tightening and premature easing.

DXY implication:

Sticky but stable inflation supports the dollar against sharp depreciation while limiting upside repricing driven by renewed hawkish expectations.

1.3 Long-Term Inflation Regime: Structural Support Without Trend Extension

The post-2020 period likely represents a structural break in the inflation regime, with implications for long-term real-rate differentials.

- The end of the multi-decade disinflation cycle supports higher equilibrium real rates.

- This provides a structural floor for the dollar relative to pre-2020 norms.

- However, absent accelerating inflation or policy divergence, this regime does not inherently justify sustained dollar uptrends.

DXY implication:

The long-term inflation regime anchors the dollar structurally higher, but favors stability and consolidation rather than secular appreciation.

1.4 Fiscal Constraints: A Ceiling on Sustained Dollar Strength

- Persistent fiscal deficits raise sensitivity to financing conditions and currency strength.

- Excessive dollar appreciation risks:

- Tightening global financial conditions

- Increasing debt-service burdens

- Amplifying external stress

- These dynamics create implicit pressure against sustained USD overvaluation.

DXY implication:

Fiscal realities act as a soft ceiling on prolonged dollar strength, encouraging mean reversion rather than trend extension.

1.5 Global Growth: Supportive Demand Without Crisis Premium

- Global growth remains uneven but non-crisis in character.

- No systemic stress currently forces persistent safe-haven dollar demand.

- Capital flows reflect relative opportunity rather than defensive liquidation.

DXY implication:

Global conditions support orderly dollar demand without generating the crisis dynamics necessary for sustained USD spikes.

Macro Bottom Line for the U.S. Dollar (DXY)

Taken together, the macro environment positions the dollar as a constraint asset rather than a trend driver. Policy patience, structural inflation, and fiscal limits favor range persistence and controlled adjustments, reinforcing regime continuity rather than signaling a transition toward sustained dollar dominance or decline.

2. Market Positioning & Psychology: Acceptance Without Dollar Capitulation

Positioning and sentiment indicators translated into behavioral signals within the U.S. dollar market.

Current dollar-market psychology reflects acceptance and normalization rather than fear-driven positioning. Flows and sentiment suggest adjustment to a higher-rate, policy-patient regime without the stress dynamics that typically accompany dollar-driven regime shifts.

Taken together, these indicators suggest a dollar market that has adjusted to the prevailing macro regime without capitulating or becoming structurally defensive. Positioning reflects normalization rather than stress, reinforcing regime continuity.

2.1 Dollar Repricing Pressure Has Dissipated — Without Reversal

Dollar-market psychology has shifted from episodic repricing phases to measured reassessment.

- Speculative USD positioning has been reduced gradually, not forcefully unwound.

- Market participants increasingly favor relative-value and carry strategies over directional USD bets.

- The absence of violent positioning shifts suggests pressure has diffused rather than inverted.

Psychology implication for DXY:

Dissipating repricing pressure supports consolidation, suggesting that dollar expectations are largely aligned with the prevailing macro regime, reducing the scope for sustained directional moves in either direction.

2.2 Headline Risk Is Absorbed Through FX Crosses, Not the Dollar Index

The FX market continues to face overlapping uncertainty catalysts:

- Geopolitical tensions

- Policy divergence narratives

- Global growth asymmetries

Despite this, stress has largely been expressed through cross-currency adjustments rather than broad-based dollar dislocations.

Why this hasn’t translated into dollar stress

- FX volatility spikes remain localized and short-lived.

- Liquidity in major FX pairs remains robust.

- No evidence of widespread funding stress or USD hoarding.

Positioning implication for DXY:

Headline-driven moves are more likely to produce rotation within FX markets than regime-defining dollar trends.

2.3 Dollar Psychology Reflects Range Acceptance, Not Stress

Dollar-market behavior currently reflects range acceptance rather than fear-driven positioning. Participants appear to be treating the dollar as a balancing variable within the prevailing macro regime, not as a market requiring defensive hoarding or aggressive directional expression.

- Dollar exposure appears increasingly tactical and relative-value in nature, rather than built around a dominant USD narrative.

- Demand for dollars is primarily expressed through routine transactional and portfolio flows, rather than broad-based safety bids.

- Episodes of USD strength tend to reflect localized repricing across specific FX crosses, not a generalized flight-to-cash dynamic.

- There is limited evidence of the funding-driven behavior typically associated with dollar scarcity and systemic stress.

Dollar-market psychology implication:

This pattern is consistent with a dollar that is being priced as a constraint asset: moves are more likely to be absorbed and mean-reverting than to evolve into sustained, fear-driven USD trends.

Market Positioning Bottom Line for the U.S. Dollar (DXY)

Current dollar-market psychology reflects acceptance without capitulation. Positioning has normalized following earlier repricing phases, without the fear-driven behavior, liquidity stress, or funding pressure that typically precede dollar-centric regime shifts. This psychological backdrop reinforces macro coherence, supporting range persistence and controlled adjustment rather than sustained dollar dominance or breakdown.

3. Technical Structure & Candlestick Confirmation

Structural Validation Across Monthly and Weekly Timeframes

While positioning and sentiment suggest acceptance without capitulation, the higher-timeframe price structure provides the decisive test. The key issue is not short-term direction, but whether the post-2022 behavior of the U.S. Dollar Index (DXY) reflects regime consolidation within a broader range or the early stages of a structural downshift.

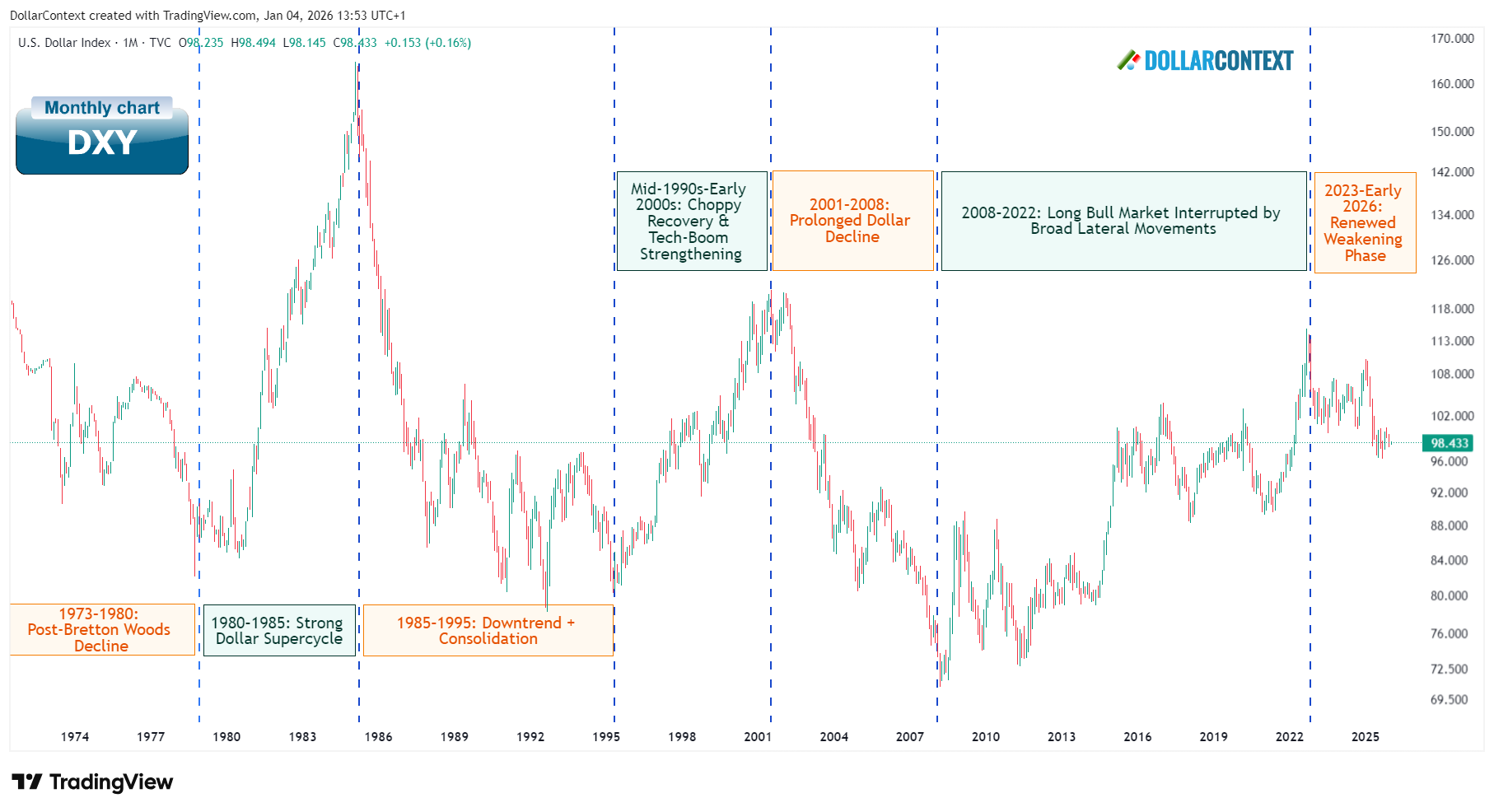

3.1 Monthly Chart — Seven Macro Regimes and the Limits of Trend Interpretation

Viewed on a monthly logarithmic scale, the U.S. Dollar Index (DXY) has moved through multiple structurally distinct macro regimes since the early 1970s. These phases align more closely with shifts in inflation dynamics, policy frameworks, and global capital flows than with conventional technical cycles.

Across five decades, the dollar has alternated between prolonged advances, extended declines, and wide-ranging consolidation phases—often violating prior support and resistance zones in the process.

Summary of major dollar regimes:

- 1973–1980: Post–Bretton Woods adjustment and inflation-driven decline.

- 1980–1985: Volcker-era tightening and strong-dollar supercycle.

- 1985–1995: Plaza Accord–driven decline followed by extended range behavior.

- Mid-1990s–2001: Partial recovery during U.S. economic outperformance.

- 2001–2008: Prolonged decline amid twin deficits and global diversification.

- 2008–2022: Long bull market with internal consolidations, driven by crisis dynamics, relative growth strength, and persistent safe-haven demand.

Following the conclusion of the 2008–2022 bull phase, the dollar entered a new phase beginning in late 2022.

Post-2022 Adjustment Phase

- The DXY has moved lower in a controlled, non-disorderly manner.

- Declines have occurred without sustained funding stress or crisis-driven dollar demand.

- Notably, during episodes of equity volatility—such as the April 2025 selloff—the dollar failed to exhibit strong safe-haven behavior.

From a structural perspective, the repeated violation of historical support and resistance zones underscores a key limitation of technical interpretation at this horizon: long-term dollar behavior is regime-driven, not level-driven.

The DXY’s multi-decade history shows that major turning points tend to coincide with fundamental regime shifts rather than durable respect for technical price levels. The post-2022 period represents a new macro phase following a prolonged bull market, but the monthly structure alone does not yet distinguish conclusively between extended consolidation and the early stages of a broader downshift. What it does confirm is a transition away from trend dominance toward a regime where dollar behavior is increasingly constrained and context-dependent.

3.2 Weekly Chart — Channel Containment and Symmetric Rejection

While the monthly timeframe establishes the broader regime context, the weekly chart illustrates how the post-2022 adjustment phase is being expressed through structure. Price action continues to resolve within a well-defined descending channel, reinforcing containment rather than trend acceleration.

Weekly Structure Context

Following the September 2022 peak, the DXY entered a descending parallel channel that has governed price behavior across multiple cycles. Both advances and declines have repeatedly stalled at channel boundaries, highlighting the absence of sustained directional control.

Recent price action shows the index stabilizing near the lower boundary of this channel, after testing support in mid- and late-2025.

Weekly Candlestick Behavior

The second test of the lower boundary in September 2025 formed as a hammer candlestick, signaling absorption of selling pressure rather than capitulation. This mirrors earlier interactions with the upper boundary, where advances stalled via long upper-shadow candles and a double-top formation.

For a standalone explanation of how this candlestick is interpreted in this framework, see the hammer candlestick tutorial.

This symmetry in candlestick behavior suggests that both sides of the channel are being actively defended, reinforcing the channel’s validity as a structural constraint.

The hammer’s relevance is amplified by its formation at a confluence of support:

- The lower boundary of the descending channel

- Horizontal support defined by the late-June 2025 low

Weekly structure implication for the DXY:

The weekly chart supports a framework of range-bounded adjustment. Counter-trend advances may unfold within the channel, but until the upper boundary is structurally reclaimed, price action remains consistent with consolidation rather than a renewed dollar trend.

The weekly chart reinforces the monthly message: the U.S. Dollar Index is navigating an adjustment phase within a broader regime transition. Price action remains contained within a well-defined channel, with repeated absorption at both boundaries. There is no technical evidence yet of a disorderly breakdown or a renewed trend impulse.

3.3 Key Structural Levels — Regime Validation, Not Trade Signals

After examining the monthly and weekly structure, the technical picture of the U.S. Dollar Index (DXY) resolves into a limited set of structural reference zones. These levels are not tactical triggers; their function is to determine whether the current post-2022 adjustment regime remains intact or begins to deteriorate.

- Upper channel boundary (descending): The upper boundary of the post-2022 descending channel defines the ceiling of counter-trend advances. Repeated rejection at this zone confirms the absence of sustained dollar dominance.

- Mid-range equilibrium zone: The central portion of the channel has acted as a frequent rotation area, reflecting balance rather than directional conviction. Interaction with this zone reinforces the dollar’s role as a constraint asset.

- Lower channel boundary and horizontal support: The confluence of the channel’s lower boundary with prior horizontal lows has repeatedly absorbed downside pressure. This zone currently defines the lower limit of orderly adjustment.

From a regime perspective, invalidation would require more than temporary weakness or isolated volatility. A structural challenge would emerge only if:

- Sustained weekly and monthly closes occur below the lower channel boundary and established support, and

- Such breaks are accompanied by expanding real bodies and follow-through, rather than long lower shadows, compression, or rapid mean reversion.

As long as the DXY remains confined within these structural boundaries, price action should be interpreted as controlled adjustment within a broader regime transition, not as confirmation of either sustained dollar weakness or renewed secular strength.

Key levels in the U.S. Dollar Index define regime integrity rather than direction. Contained price behavior within a descending channel, combined with repeated absorption at both boundaries, supports the view that the dollar is functioning as a constraint asset— adjusting to a new macro environment rather than signaling a decisive regime break.

4. Scenarios & Regime Interpretation

Scenarios are interpretations, not forecasts — they define how to read dollar structure under different conditions.

The U.S. Dollar Index is currently navigating a post-2022 adjustment phase following a prolonged bull market. The central question is not near-term dollar direction, but how the observed consolidation and channel behavior resolve structurally — and what that resolution implies about the dollar’s role within the broader macro regime.

4.1 Base Case — Adjustment Through Range and Rotation

In the base case, the dollar continues to adapt to the post-2020 macro environment through range persistence and internal rotation rather than sustained directional movement. The descending channel remains intact, functioning as a containment mechanism rather than a trend accelerator.

Defining characteristics:

- Price action remains confined within the established weekly channel.

- Both upside and downside tests are absorbed near structural boundaries.

- FX volatility remains episodic and localized, without systemic funding stress.

Interpretation:

This outcome implies that the dollar is fulfilling its role as a constraint asset, balancing higher U.S. rates, global growth differentials, and risk conditions without asserting dominance. In regime terms, consolidation reflects macro accommodation, not indecision.

4.2 Controlled Extension — Conditional Upside, Not Dollar Dominance

An upside resolution becomes relevant only if counter-trend advances evolve into structurally accepted price behavior, rather than short-lived reactions. Even in this case, the outcome would represent extension within the existing regime — not the start of a new dollar supercycle.

What would define this outcome:

- Weekly and monthly closes above the upper boundary of the descending channel.

- Follow-through marked by expanding ranges and sustained participation.

- Dollar strength occurring alongside orderly global financial conditions.

Interpretation:

Importantly, an upside resolution in the dollar is not symmetric with downside outcomes. Sustained dollar strength would likely require renewed policy divergence or a re-emergence of global stress conditions that force capital concentration into USD assets. Absent such catalysts, upside moves are more likely to be absorbed as part of the dollar’s constraint role rather than develop into renewed dominance.

4.3 Structural Breakdown — Regime Reassessment Required

A bearish scenario for the dollar requires more than gradual weakening or range drift. Structural breakdown would imply that the post-2022 adjustment phase is giving way to a deeper regime reorientation.

What would invalidate the current regime interpretation:

- Sustained weekly and monthly closes below the lower channel boundary and established support.

- Downside expansion characterized by large real bodies and follow-through, rather than long lower shadows, compression, or rapid mean reversion.

- Confirmation via broader macro repricing, such as systemic funding stress, abrupt policy shifts, or a sharp deterioration in U.S. relative growth.

Interpretation:

This scenario would indicate that the dollar is transitioning from adjustment to structural repricing. Until such conditions are met, weakness should be interpreted as a stress test of the existing structure rather than confirmation of a new secular decline.

Scenario Summary — What Matters Most

Across all scenarios, structure takes precedence over narrative:

- As long as price remains contained within defined structural boundaries, regime continuity is the default interpretation.

- Upside resolution is possible, but is conditional and asymmetrical — typically associated with renewed divergence or stress rather than balance.

- Structural failure requires sustained breaks and downside expansion, not volatility spikes or incremental drift.

These scenarios translate current dollar behavior into conditional interpretations. They do not predict direction; they define when the dollar’s role as a constraint asset remains valid — and when that interpretation must be reassessed.

5. Practical Implications — How to Read the Dollar in the Current Regime

This section translates structure into interpretation, not trades.

The purpose of this section is to clarify how the macro, positioning, and technical conclusions of this analysis should inform the way the U.S. Dollar Index (DXY) is interpreted within portfolios, macro narratives, and cross-asset analysis. It is not a guide for timing, positioning, or directional forecasting.

5.1 How to Interpret Dollar Fluctuations

Within the current adjustment regime, dollar movements should be interpreted primarily as tests of balance and constraint, not as immediate signals of trend emergence.

- Moves occurring within the established range or channel reflect ongoing adjustment to post-2020 macro conditions.

- Headline-driven USD strength or weakness should be viewed as stress tests of structure, not regime statements.

- Absent structural breaks, dollar fluctuations are more likely to be rotational and mean-reverting than trend-defining.

Dollar volatility without structural damage is information, not confirmation.

5.2 How to Think About Dollar Exposure

The current regime does not reward extreme directional assumptions about the dollar. Instead, it favors context awareness and disciplined interpretation of relative balance.

- Expectations anchored to renewed dollar dominance require evidence of divergence or stress, not just persistence.

- Conversely, assumptions of sustained dollar weakness remain premature without structural breakdown.

- Dollar exposure should be evaluated as a portfolio constraint and interaction variable, not a standalone conviction trade.

The regime favors balance over bias and interpretation over extrapolation.

5.3 How to Use Technical Levels Going Forward

In this framework, technical levels in the DXY function as regime checkpoints, not tactical signals.

- Channel boundaries and major support zones define the limits of orderly adjustment.

- Rejections and failed extensions reinforce the dollar’s constraint role.

- Only sustained, multi-timeframe breaks justify reassessing the macro interpretation.

Levels indicate when regime assumptions change — not when to act.

5.4 What Would Force a Change in Interpretation

A shift from regime continuity to regime reassessment would require clear and persistent structural evidence rather than incremental drift.

- Sustained weekly and monthly closes outside the established structural boundaries.

- Directional expansion accompanied by follow-through, not rapid mean reversion.

- Confirmation via macro developments such as renewed policy divergence, systemic funding stress, or abrupt global rebalancing.

Until such conditions emerge, the default interpretation remains intact.

Practical Bottom Line for the U.S. Dollar Index (DXY)

The current environment calls for disciplined interpretation rather than directional conviction. The U.S. dollar is adjusting to a new macro landscape, functioning primarily as a constraint asset rather than a dominant trend driver.

As long as structural boundaries hold, dollar volatility should be treated as part of an ongoing adjustment process — not as evidence of either renewed dominance or structural breakdown.

Conclusion

The behavior of the U.S. Dollar Index provides a cross-asset validation of the macro regime identified across equities and rates. Following a prolonged bull phase that culminated in 2022, the dollar has entered an adjustment period characterized by containment rather than dominance. This transition reflects adaptation to a post-2020 environment defined by higher inflation, policy patience, and fiscal constraint — not rejection of that regime.

Market psychology reinforces this interpretation. Positioning and sentiment point to normalization and internal rotation rather than defensive hoarding or speculative excess. Dollar volatility has been episodic and localized, with flows expressing balance across FX crosses rather than concentration into a single directional narrative.

From a structural perspective, higher-timeframe charts confirm that the dollar is operating within well-defined boundaries. Repeated absorption at channel limits and the absence of sustained breakout or breakdown behavior suggest that recent fluctuations represent adjustment within a regime, not the emergence of a new cycle.

Taken together, macro conditions, psychology, and technical structure argue against reactive interpretations of dollar movements. The dollar is neither signaling renewed dominance nor confirming structural failure. Instead, it is functioning as a constraint asset, helping stabilize cross-asset relationships during a period of macro transition.

Until price behavior delivers clear and persistent structural evidence to the contrary, interpretation rather than prediction remains the appropriate lens — allowing structure, not narratives, to determine when regime assumptions must be revisited.