Case Study 0002: Weak Engulfing Pattern Transitions Into a Pullback (10-Year Treasury)

Following the appearance of the bearish engulfing pattern, there was a high likelihood of either a sideways trading range or a minor retracement.

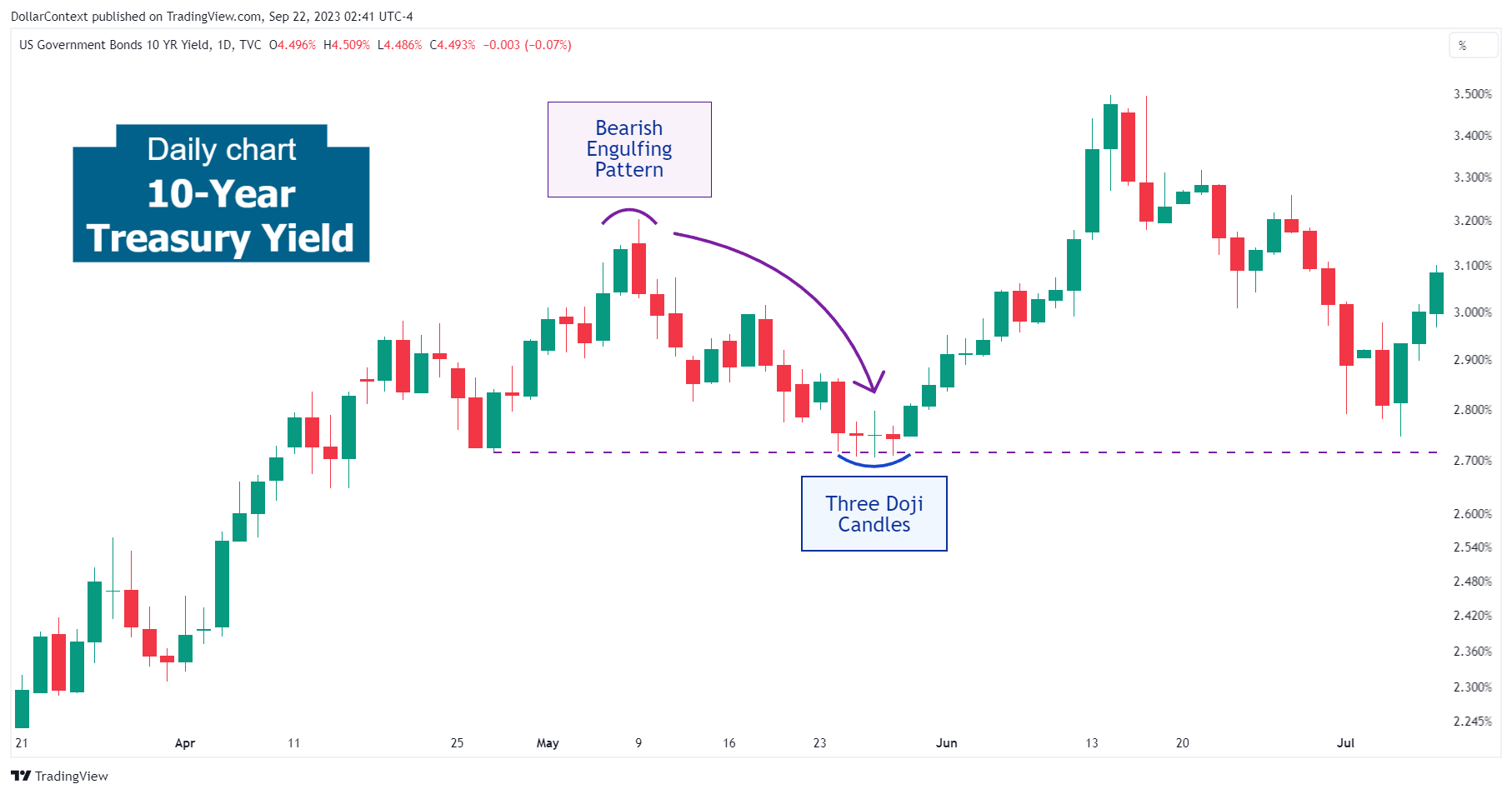

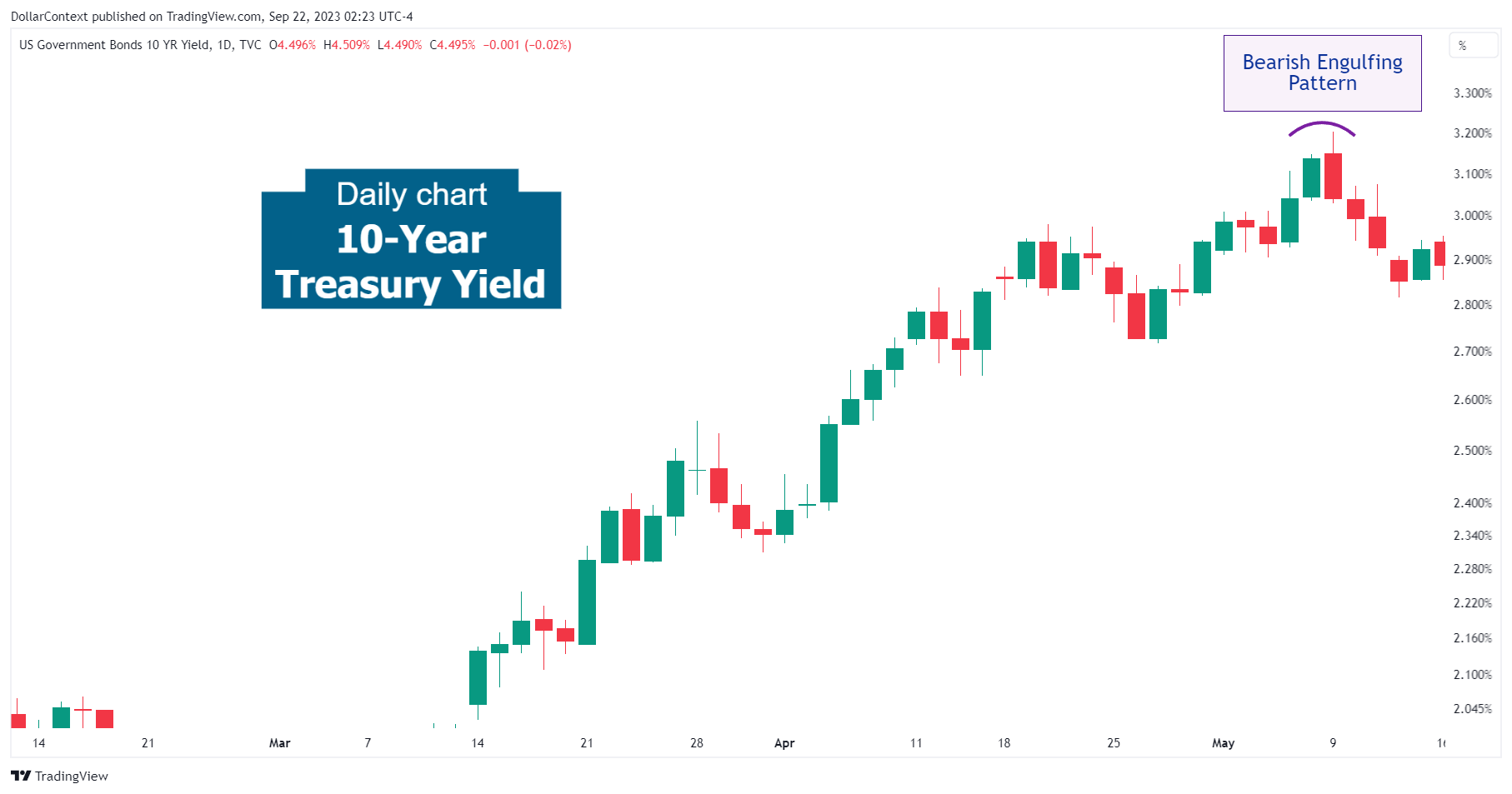

This case study examines a historical market setup observed in the 10-Year Treasury Yield in May 2022. It is intended for educational purposes and illustrates how specific candlestick patterns behaved in real market conditions.

Case Study Data Sheet (Historical)

- Reference: CS0002

- Security: 10-Year Treasury Yield

- Timeframe: Daily Chart (May 2022)

- Patterns:

1. Signal Formation

In May 2022, after an extended uptrend that began in 2020, the 10-year Treasury yield displayed a weak bearish engulfing pattern. Note how the green and red candles of this pattern were about equal.

Why do we categorize this pattern as a weak engulfing pattern? An ideal engulfing pattern has a large body enveloping a small green body. The small size of the first small body of a bearish engulfing pattern shows that the momentum of the prior rally is slackening. The subsequent tall red body confirms the bears' dominance over the bulls.

However, if there are two almost equal size candles that comprise the engulfing pattern, the market may move into a lateral band or a minor pullback.

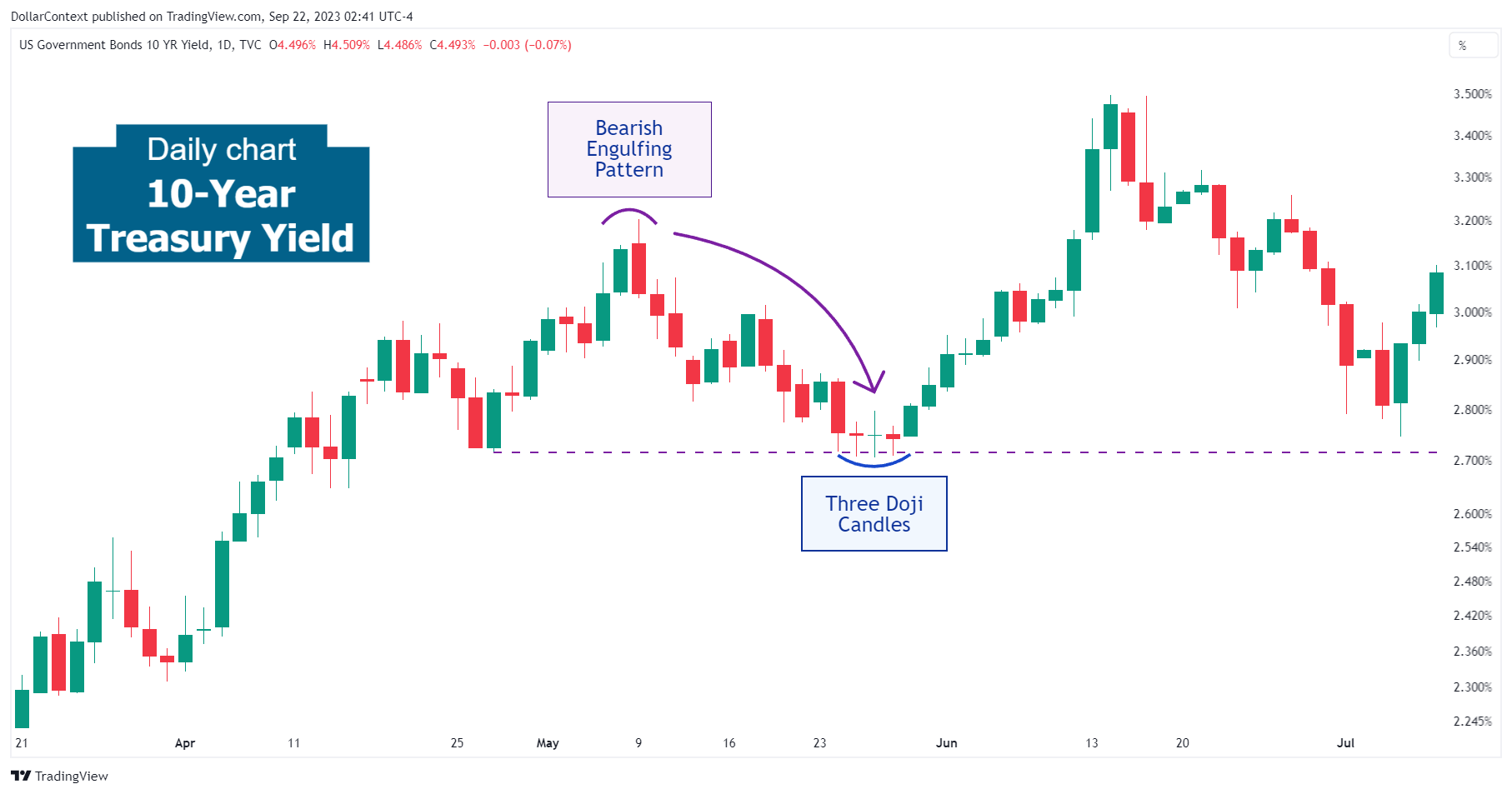

2. Early Market Transition

As illustrated in the chart above, following the engulfing pattern, the market began to decline immediately, without any further delays or retesting of the pattern's highs.

3. Resolution

Following the engulfing pattern, a short-term reversal ensued. The retracement concluded with a sequence of three doji sessions at a minor support level set by the recent lows.

4. Conclusion and Retrospective Assessment

4.1 Pattern Development

Following the appearance of the bearish engulfing pattern, there was a high likelihood of either a sideways trading range or a minor retracement.

4.2 Outcome Analysis

The short-term decline indeed occurred, and ended with three doji candlesticks near the recent lows.