Case Study 0024: Bullish Engulfing Pattern and Inverted Hammer (Nasdaq-100)

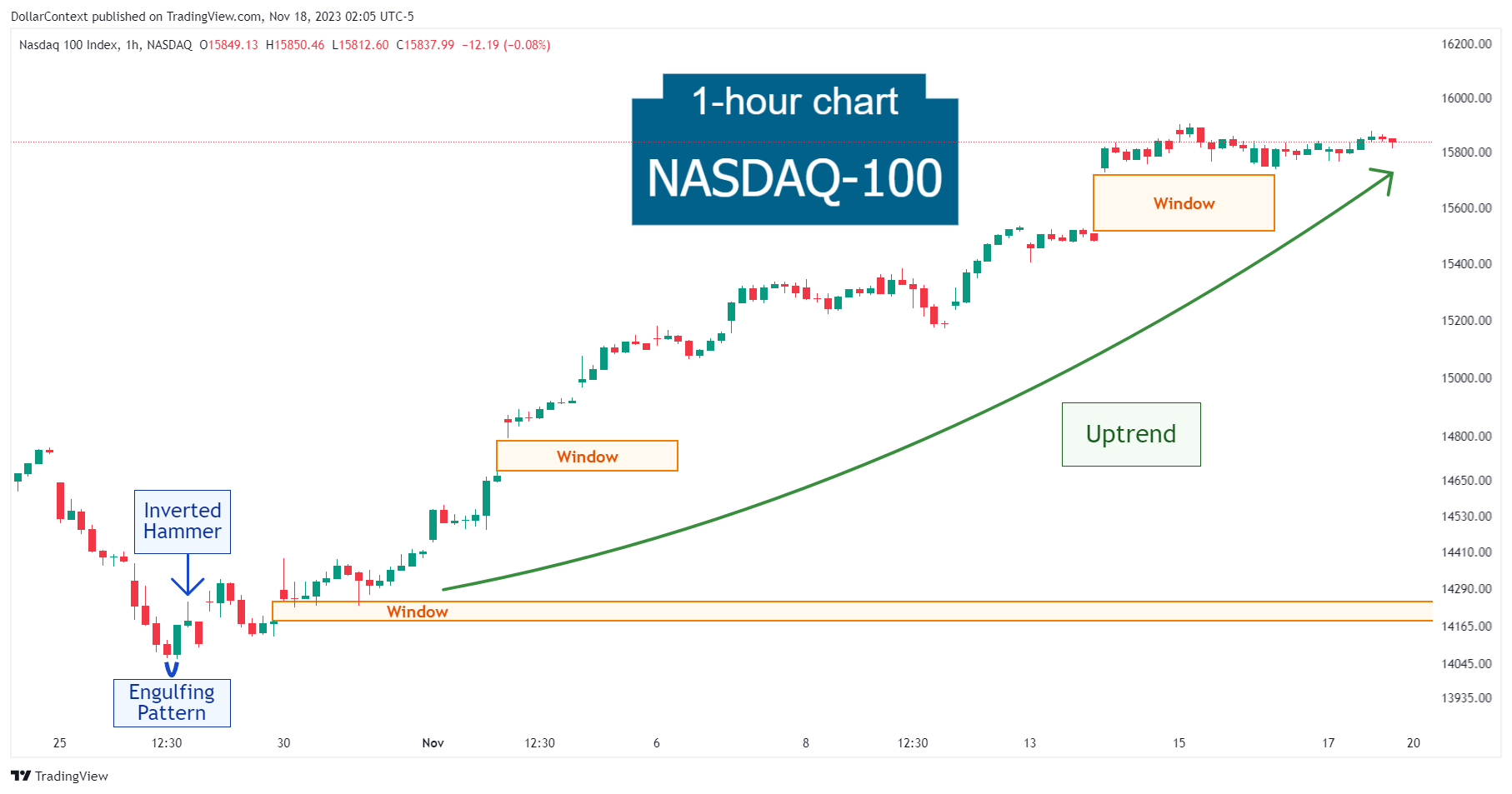

In this article, we will examine the performance of the Nasdaq-100 market after the emergence of an engulfing pattern, an inverted hammer, and a rising window.

This case study examines a historical market setup observed in Nasdaq in October 2023. It is intended for educational purposes and illustrates how specific candlestick patterns behaved in real market conditions.

Case Study Data Sheet (Historical)

- Reference: CS0024

- Security: Nasdaq-100

- Timeframe: Hourly Chart (October 26, 2023)

-

Patterns:

- Bullish Engulfing Pattern (variation)

- Inverted Hammer

- Rising Window

1. Signal Formation

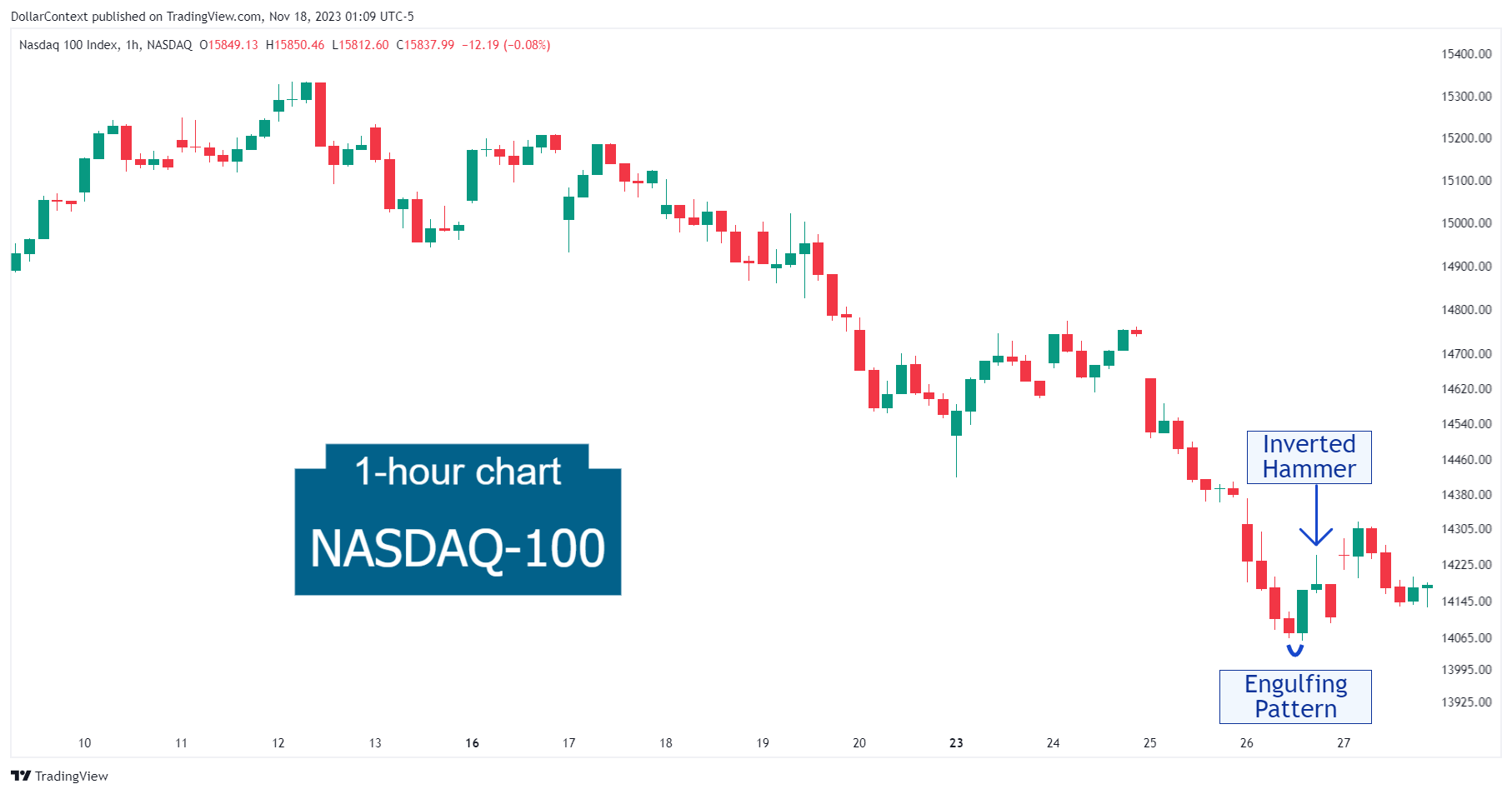

After an extended downtrend (not fully shown in the chart below), the Nasdaq-100 index displayed a variation of the bullish engulfing pattern.

Observe how the engulfing pattern was then followed by an inverted hammer session.

2. Early Market Transition

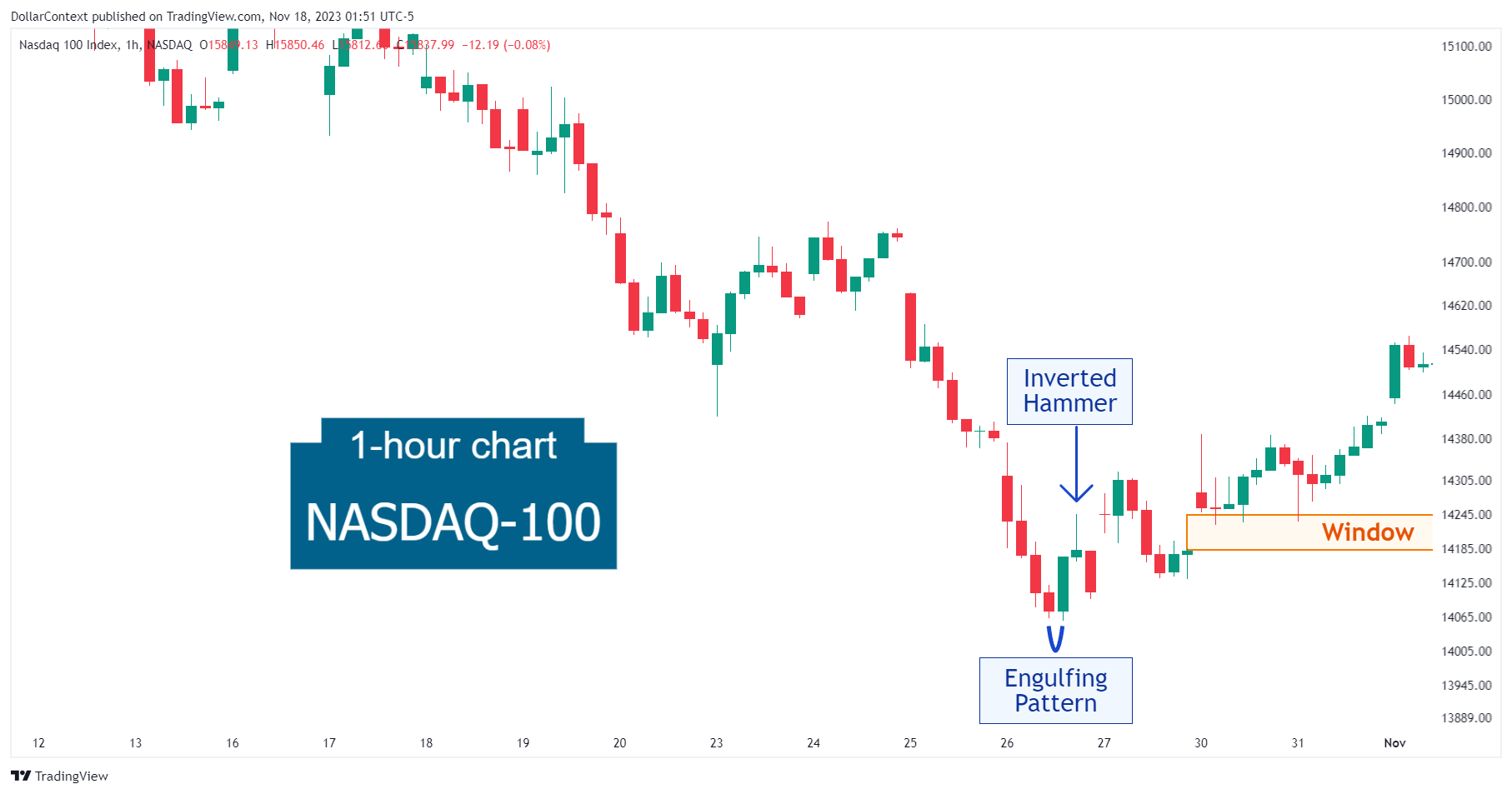

A few sessions later, a rising window (gap) emerged. In this case, the window should be interpreted as a signal that the incipient uptrend might become more established.

The window served as an effective support zone, as a series of market responses halted within its range. Remember, during an uptrend, the window should be the limit on a reaction.

3. Resolution

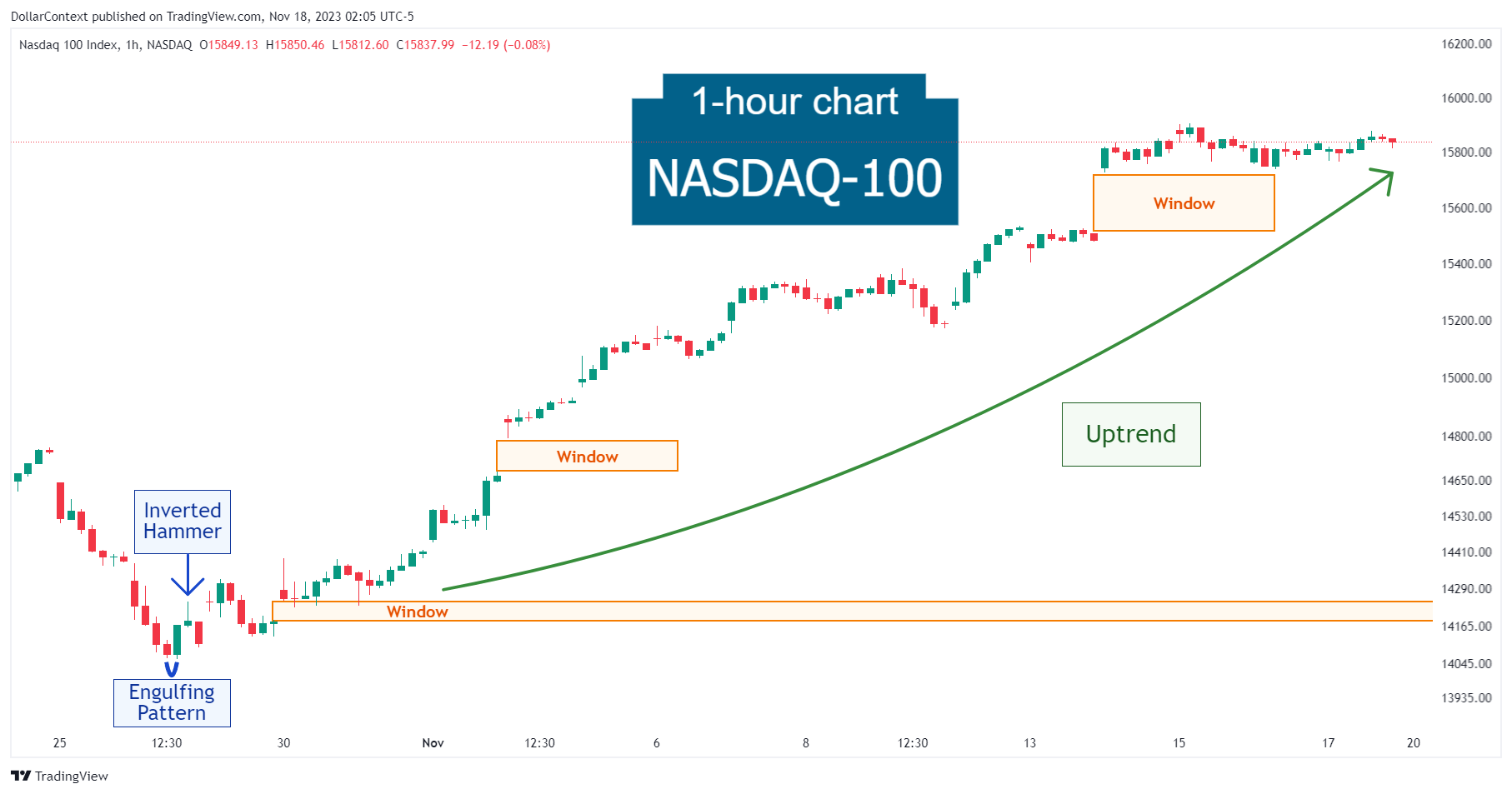

The reversal transitioned into a prolonged and solid uptrend, during which the Nasdaq-100 saw two additional rising windows, as you can observe from the chart below:

4. Conclusion and Retrospective Assessment

It is important to not underestimate the reversal signals that minor patterns, or a variation of them, can offer to traders, especially when followed by a window aligning with the reversal's direction. This is what unfolded with the Nasdaq-100 index as the market staged a bullish reversal after an engulfing pattern, an inverted hammer, and a rising window.