Is the Dollar Setting Up for a Counter-Trend Rally? Four Red Flags to Watch

Four converging signals—Bitcoin's correlation breakdown, gold's violent post-Warsh reversal, a technical hammer, and three years of dollar weakness creating positioning consensus—suggest a potential counter-trend dollar rally toward 104-106 may be forming over the next 2-3 months.

The Case for a U.S. Dollar Rebound

A Dollar Bear Squeeze May Be Forming: A constellation of technical and cross-asset signals point toward a potential 2-3 month rally back toward the 104-106 zone.

📊 SIGNAL #1 (BITCOIN)Correlation breakdown with equities and gold—anticipating dollar strength?

📊 SIGNAL #2 (GOLD)Violent two-day reversal after Warsh nomination signals positioning extreme

📈 SIGNAL #3 (TECHNICAL)Hammer at ~96 confluence support with extreme lower shadow rejection

📈 SIGNAL #4 (POSITIONING TRAP)Three years of dollar weakness creates anchoring—consensus vulnerable to squeeze

⚠️ INVALIDATION SCENARIOSBreak below 95.5, Bitcoin resuming equity correlation, gold reclaiming highs, failure at 101-102, or Fed dovish surprise would challenge this tactical view.

The Thesis: A Dollar Bear Squeeze May Be Forming

The U.S. Dollar Index has been in a structural weakening phase since late 2022, declining in what our comprehensive DXY analysis describes as an orderly post-bull adjustment. Over three years into this downtrend, the question now facing investors isn't whether the dollar can weaken further—it's whether we're approaching a meaningful counter-trend rally that could catch markets off guard.

While three years might seem substantial, trend maturity alone provides no timing signal—markets don't reverse simply because a trend is "old." However, recent developments across multiple markets suggest something more concrete may be emerging: a constellation of technical and cross-asset signals that, taken together, point toward a potential 2-3 month dollar rally back toward the 104-106 zone.

This tactical view doesn't invalidate the medium-term bearish case articulated in our Dollar Index hub—fiscal constraints, safe-haven erosion, and the post-2022 regime shift remain intact. But it does suggest that market participants heavily positioned for continued dollar weakness may face an uncomfortable squeeze in the coming weeks.

The Case: Four Converging Signals

1. Bitcoin's Correlation Breakdown

The cryptocurrency market's behavior since October 2025 has been quietly extraordinary. Bitcoin's sharp drawdown—initiated precisely as institutional acceptance was accelerating—has disrupted the correlations many macro investors had come to rely on:

- Positive correlation with equities broken: Bitcoin historically moved with the S&P 500 and tech stocks, particularly during risk-on periods. This relationship has decoupled sharply.

- Gold relationship fractured: The "inflation hedge" narrative that drove Bitcoin and gold together has collapsed, with the two assets now moving independently.

- Dollar inverse correlation disrupted: Bitcoin traditionally rallied when the dollar weakened. That relationship no longer holds.

This leaves two interpretations: either Bitcoin is simply too unique and volatile to be understood through macro frameworks—a position many would find unsatisfying—or Bitcoin is discounting something the rest of the market hasn't priced yet: a significant dollar rebound.

Cryptocurrency markets, with their 24/7 liquidity and retail-dominated positioning, often move faster than traditional assets during regime shifts. Bitcoin's weakness may not be idiosyncratic—it may be anticipatory.

2. Gold's Violent Reversal After Warsh Nomination

Gold's near-vertical ascent through 2024-2025 reflected deep skepticism about fiat currencies and expectations of persistent dollar weakness. That narrative faced a severe test last Friday.

The nomination of Kevin Warsh—perceived as a potential hawkish Fed Chair—triggered an almost unprecedented two-day selloff in gold markets. While prices have partially recovered, the violence of the reversal carries significance beyond the specific catalyst:

- Extreme volatility often marks turning points: Sharp, multi-day swings of this magnitude typically (though not always) coincide with trend exhaustion rather than healthy corrections within ongoing bull markets.

- Narrative shift evident: Markets suddenly questioning the "dollar debasement forever" thesis, even if only temporarily, suggests positioning may have become dangerously one-sided.

- Cross-asset confirmation potential: If gold's weakness persists or accelerates, it would provide secondary confirmation of dollar strength emerging across precious metals markets.

Gold may be the second domino falling in a broader reassessment of dollar weakness positioning.

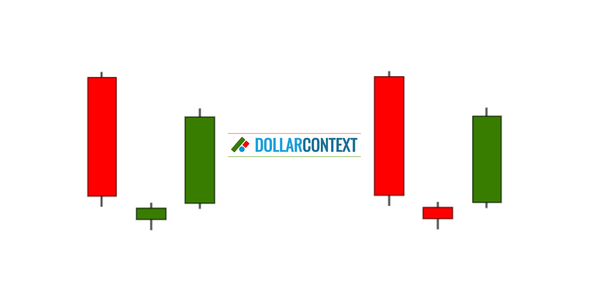

3. Technical Confluence: The Hammer That Matters

The late-January weekly candle on the DXY chart produced a textbook reversal signal at a critical juncture (see chart below):

- Confluence support defended: The ~96 level represents the intersection of three support elements—the descending channel's lower boundary, horizontal support from the June 2025 double bottom, and a prior hammer formation from September 2025.

- Extreme rejection visible: The long lower shadow extended well below support before closing near the week's highs, demonstrating aggressive buying absorption rather than gradual stabilization.

- Conviction present: The magnitude of the rejection—not just its location—suggests this wasn't passive drift but active defense of the support zone.

Within the context of a descending channel, rallies back to the upper boundary (104-106 area) are not trend reversals—they're normal range behavior. But the technical setup suggests such a rally may now be underway, with the hammer providing the initial spark.

4. The Positioning Trap

Perhaps most importantly, dollar bearishness has become consensus. While our DXY hub notes that positioning shows "reluctant bull" characteristics rather than euphoria, three years of persistent weakness has created a psychological anchoring effect: investors now expect dollar weakness to continue indefinitely.

This creates asymmetric risk. Markets positioned for one outcome—even cautiously—remain vulnerable to sharp reversals when that consensus is challenged, particularly when technical and cross-asset signals begin aligning against it.

Cross-Asset Implications

If this dollar rally scenario unfolds, several additional market moves become probable:

- Equity market pressure: Dollar strength typically weighs on multinational earnings and risk sentiment. The S&P 500's bullish positioning could face near-term headwinds, though this wouldn't necessarily invalidate the medium-term bull case.

- Treasury yield support: A stronger dollar through interest rate differential dynamics could provide temporary support for 10-year yields, potentially delaying any consolidation or correction within the triangle pattern.

- Emerging market stress: Currency pairs like EUR/USD, USD/JPY, and emerging market currencies would face renewed pressure, potentially triggering volatility in international equity markets.

- Commodity weakness: Beyond gold, industrial metals and energy could face headwinds as a stronger dollar reduces commodity purchasing power and signals tighter global financial conditions.

Invalidation Scenarios

This tactical bullish view on the dollar would be challenged or invalidated by:

- Break below 95.5 on a weekly closing basis: Would signal that the late-January hammer failed and the channel breakdown is accelerating, confirming the structural weakening thesis without counter-trend relief.

- Bitcoin resuming correlation with equities: If Bitcoin and the S&P 500 rally together while the dollar remains weak, it would suggest the correlation breakdown was temporary noise rather than anticipatory signal.

- Gold reclaiming recent highs: A swift recovery in gold above its pre-Warsh levels would indicate the selloff was purely event-driven rather than the beginning of a broader precious metals correction.

- Failure at 101-102 resistance: If the DXY cannot push through this intermediate level with conviction, it would suggest the rally lacks the momentum necessary to reach the upper channel boundary.

- Fed dovish surprise: Any unexpected Fed pivot toward aggressive easing—whether through rate cuts, QE resumption, or significantly dovish communication—would undermine the dollar strength thesis.

Time Frame and Conviction

Expected Duration: 2-3 months for a move toward 104-106, assuming technical and cross-asset confirmation continues.

Conviction Level: Monitoring scenario with rising probability—not yet high conviction, but the confluence of signals warrants close attention and tactical positioning adjustments.

Strategic Context: This potential rally fits within the descending channel framework and doesn't invalidate the medium-term structural weakening thesis. Think of it as a counter-trend bounce within an established downtrend—tradeable, but not a regime change.

Conclusion

Markets don't reverse on schedule, and trend maturity alone provides no edge. But when technical signals, cross-asset behavior, and positioning dynamics begin converging, probabilities shift. The four red flags outlined here—Bitcoin's correlation breakdown, gold's violent reversal, the technical hammer at confluence support, and consensus dollar bearishness—don't guarantee a rally. They suggest one is becoming plausible enough to warrant preparation.

For investors holding positions sensitive to dollar strength, the next 4-8 weeks could prove uncomfortable. For those willing to trade against the prevailing medium-term trend, a tactical opportunity may be emerging. The key is distinguishing between a counter-trend rally worth participating in and a regime change worth repositioning for—this appears to be the former, not the latter.

This analysis reflects market conditions and information available at the time of publication. It is provided for informational and educational purposes only and does not constitute financial, investment, or legal advice.

The financial markets are inherently volatile, and past performance is never a guarantee of future results. Readers should conduct their own independent research or consult with a licensed professional before making any investment decisions. Any actions taken based on the content of this report are at the sole discretion and risk of the reader, and the author assumes no liability for any potential losses or damages.