CANDLESTICK

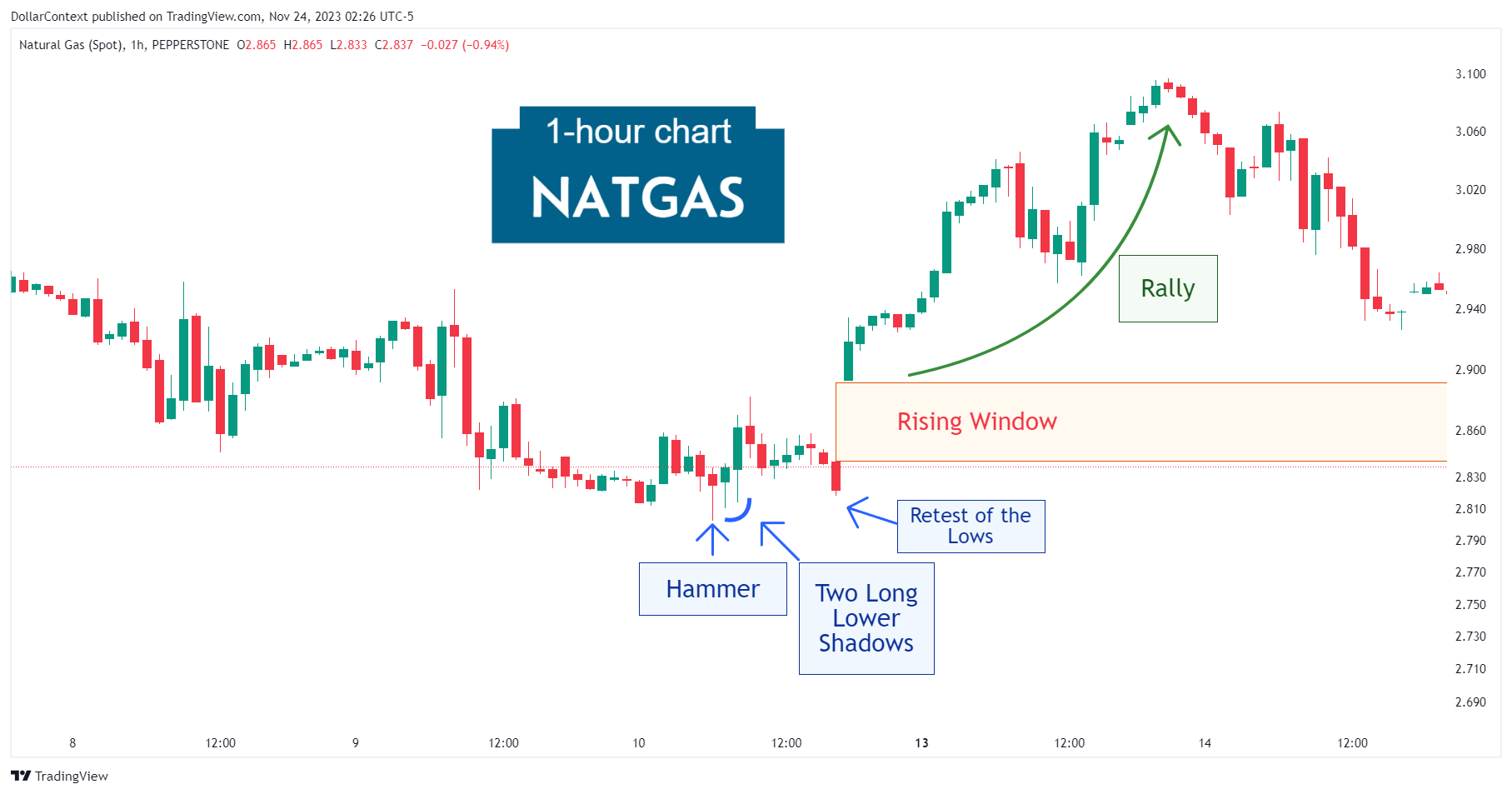

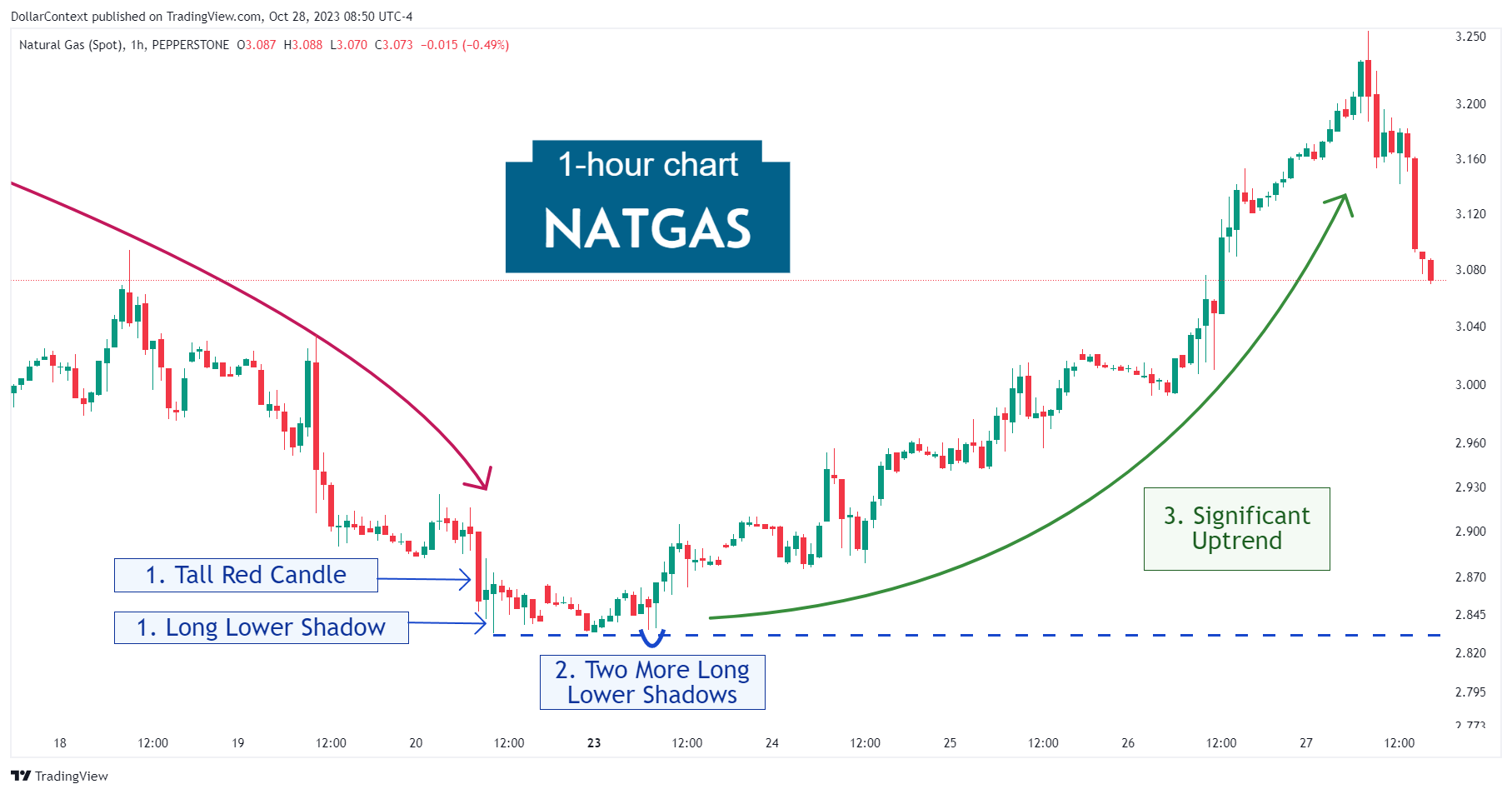

Case Study 0028: Hammer and Long Lower Shadows (Natural Gas)

In this article, we will examine the performance of the natural gas market after the emergence of a hammer and two long lower shadows.

CANDLESTICK

In this article, we will examine the performance of the natural gas market after the emergence of a hammer and two long lower shadows.

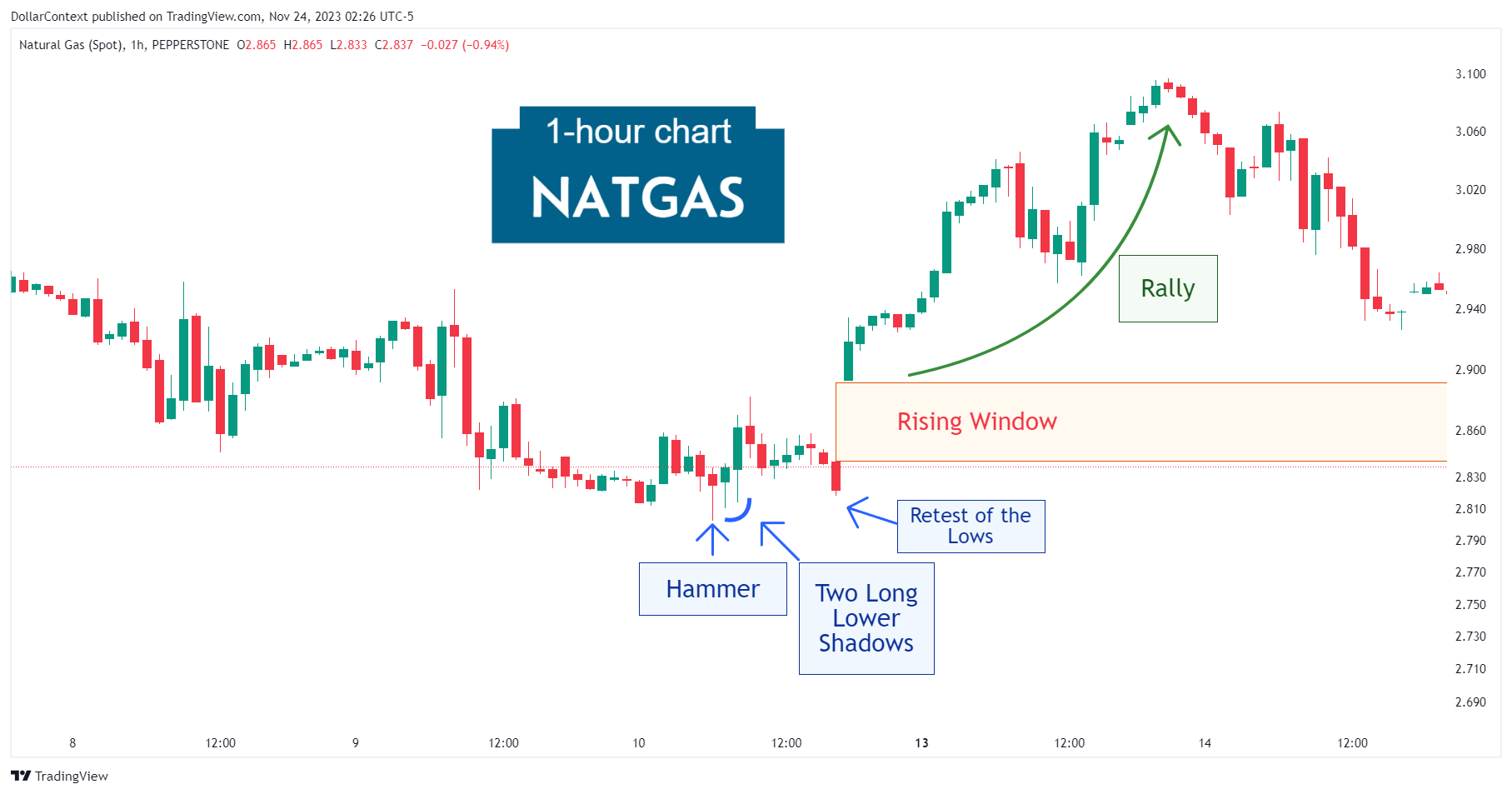

CANDLESTICK

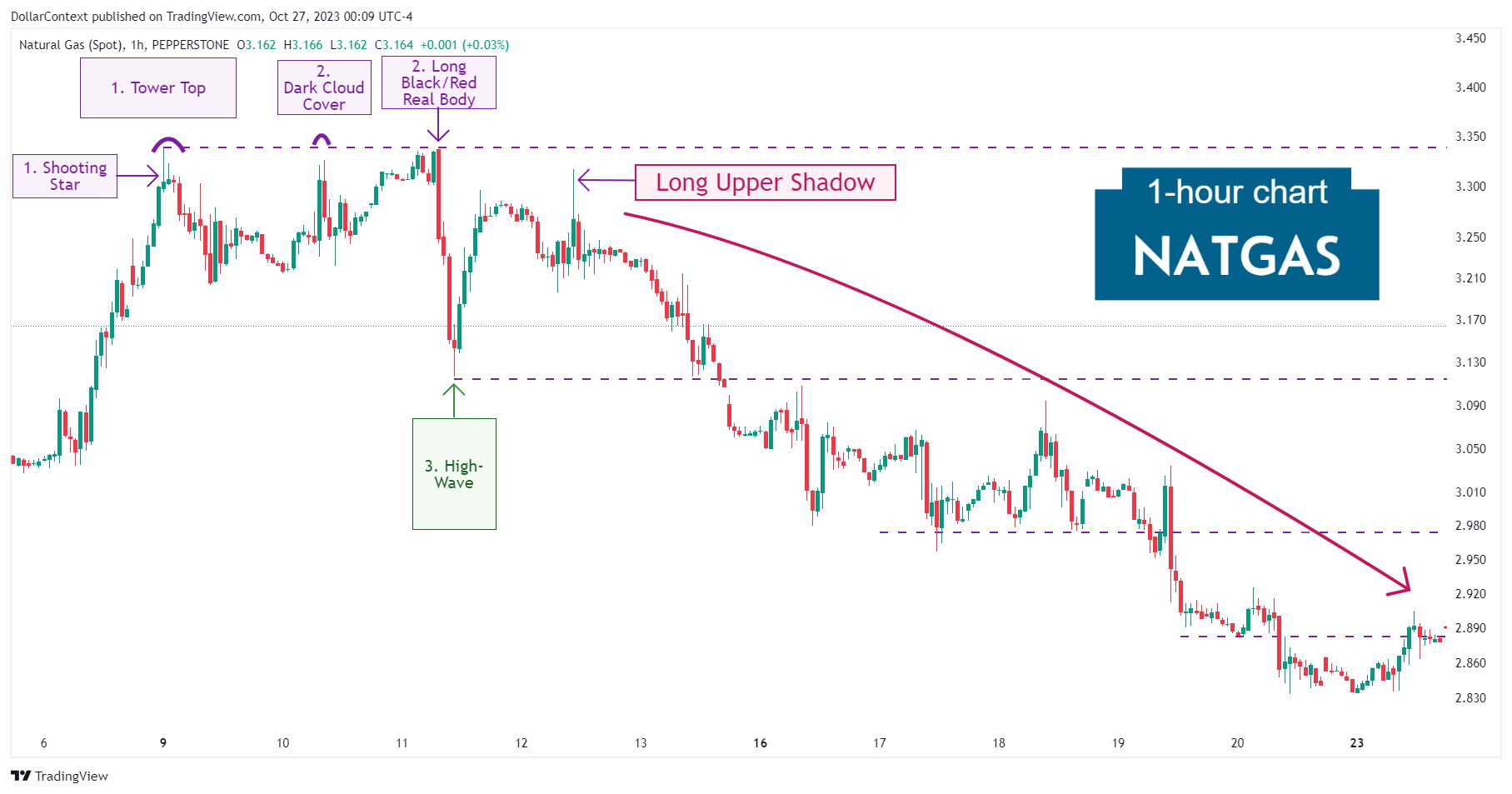

In this article, we will examine the performance of the natural gas market after the emergence of a dark cloud cover and a long black real body.

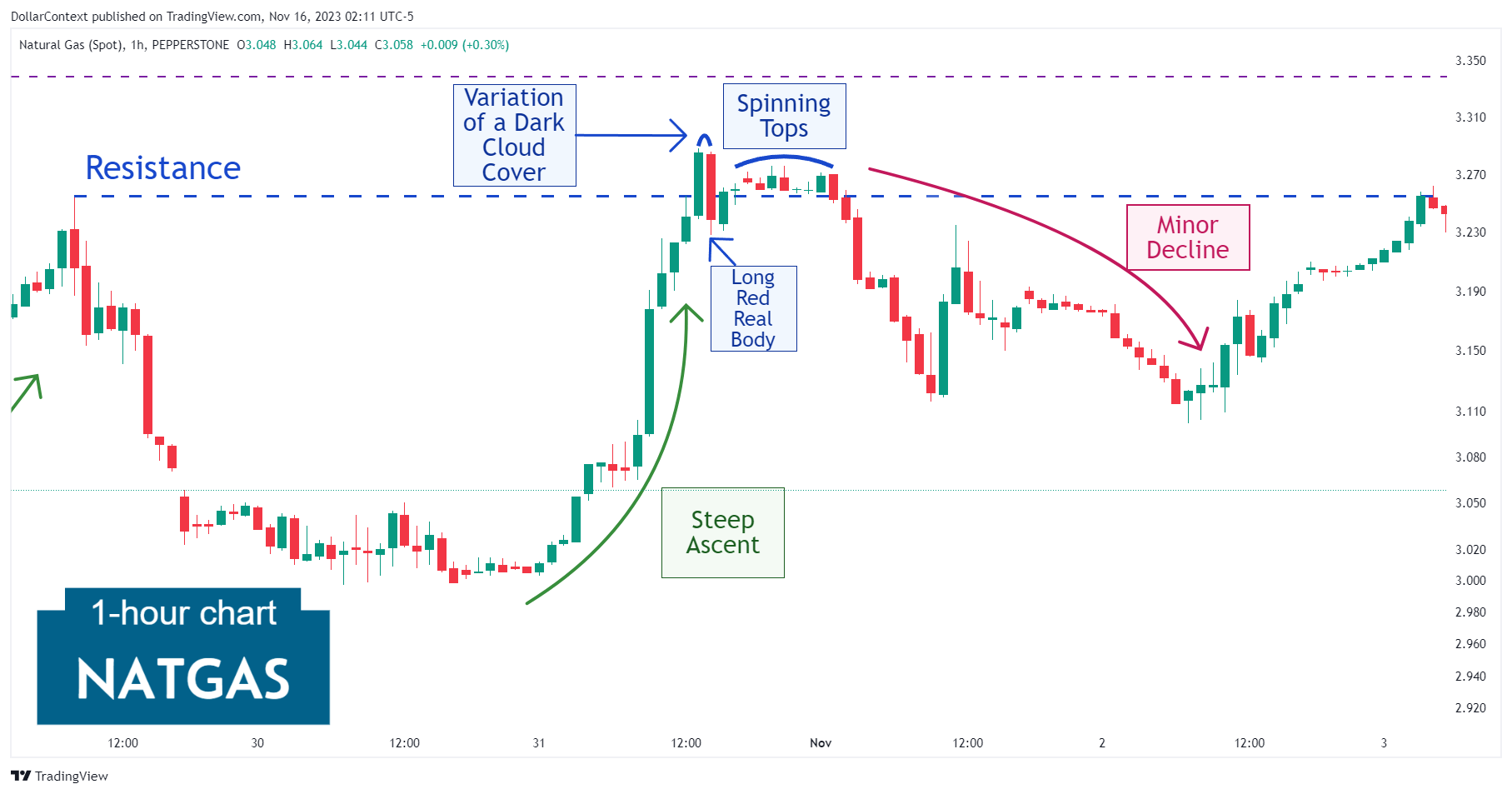

CANDLESTICK

In this article, we will discuss the performance of natural gas prices after the emergence of a shooting star and a dark cloud cover.

CANDLESTICK

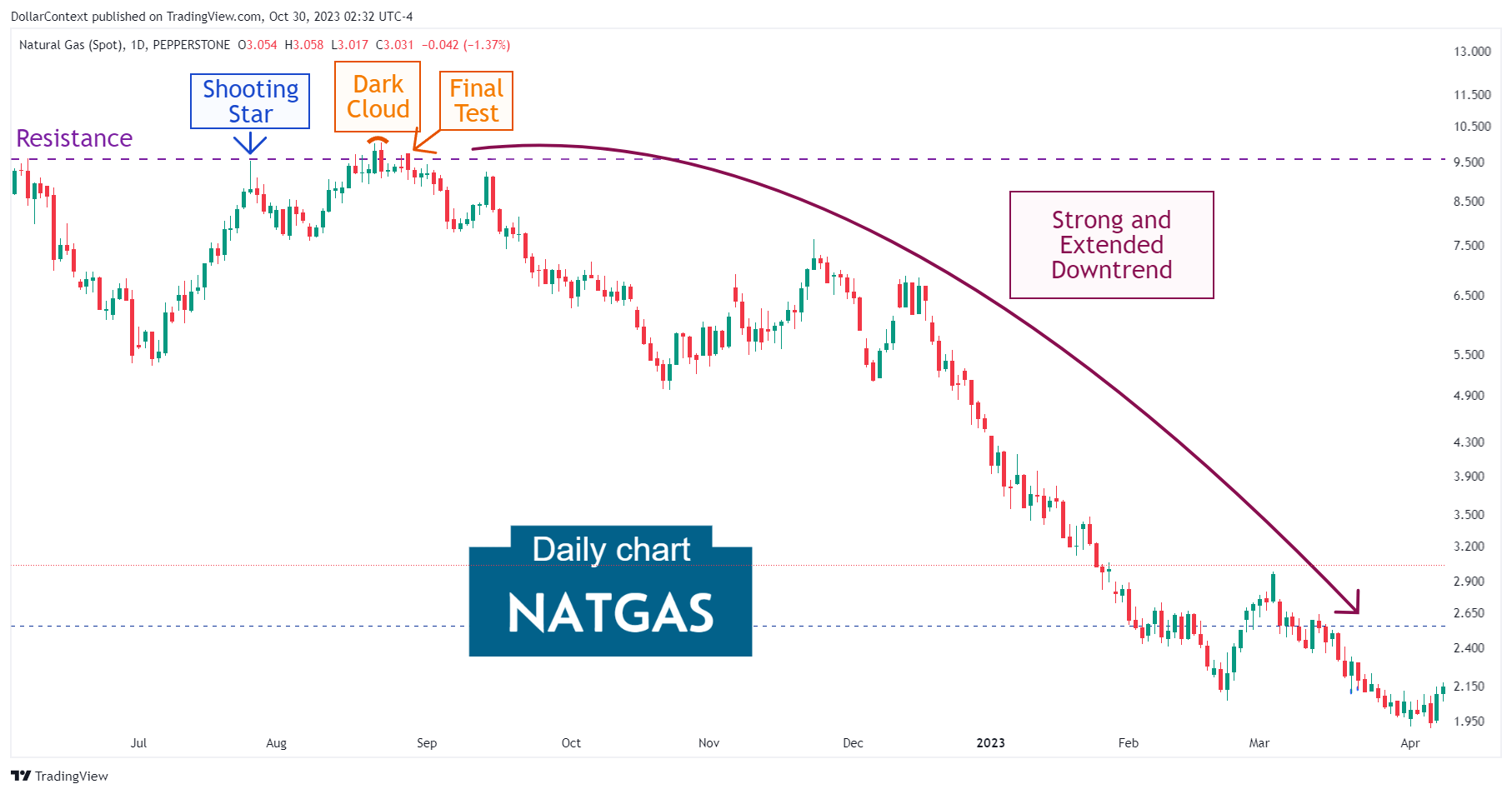

In this article, we will examine the performance of the natural gas market after the emergence of a series of long lower shadows.

CANDLESTICK

In this article, we will examine the performance of the natural gas market after the emergence of a tower top.

CANDLESTICK

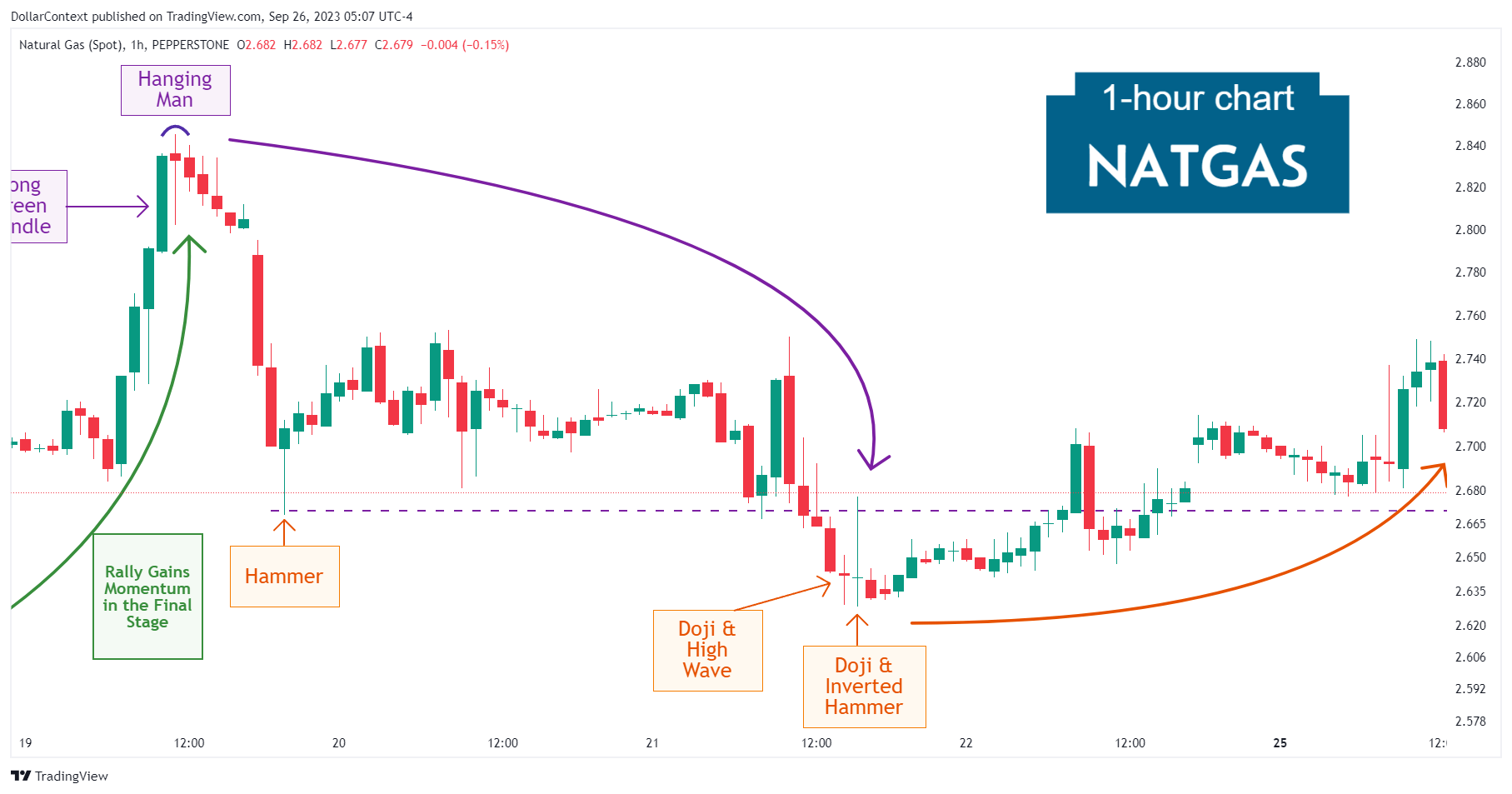

In this article, we will discuss the performance of a highly volatile market in which specific candlestick patterns effectively signaled price tops and bottoms.

COMMODITIES

We explore the factors that have impacted natural gas prices since 2020, and detail our view on future trends in this market.

NATURAL GAS

After the dramatic decline since August 2022, the market might be entering a transition phase in which the trend goes from down to a period of relative stability.