Morning Star Strategy: A Comprehensive Tutorial

In this tutorial, we explore the morning star, a three-candle formation found in the rich tapestry of Japanese candlestick charting techniques.

In this tutorial, we'll explore the morning star pattern, a three-candle formation found in the rich tapestry of Japanese candlestick charting techniques.

Let’s begin by outlining three pivotal attributes common to most candlestick configurations, including the morning star:

- Indication of Trend Reversal: A wide range of candlestick patterns signal that the previous trend may be exhausting its run, with a reversal on the horizon. The morning star typically makes its appearance following a prominent downtrend.

- Timeframe Versatility: Candlestick patterns and indicators display a remarkable flexibility, making them effective across a spectrum of timeframes. Whether one is examining the market on a minute-by-minute basis or over a span of months, these patterns hold their significance.

- Universal Applicability: The utility of candlestick patterns is not confined to a single market — they are equally potent whether applied to forex, stocks, commodities, or indices. This widespread significance is attributed to their grounding in price action, which mirrors the psychology of market participants.

Contents

1. Shape of the Morning Star

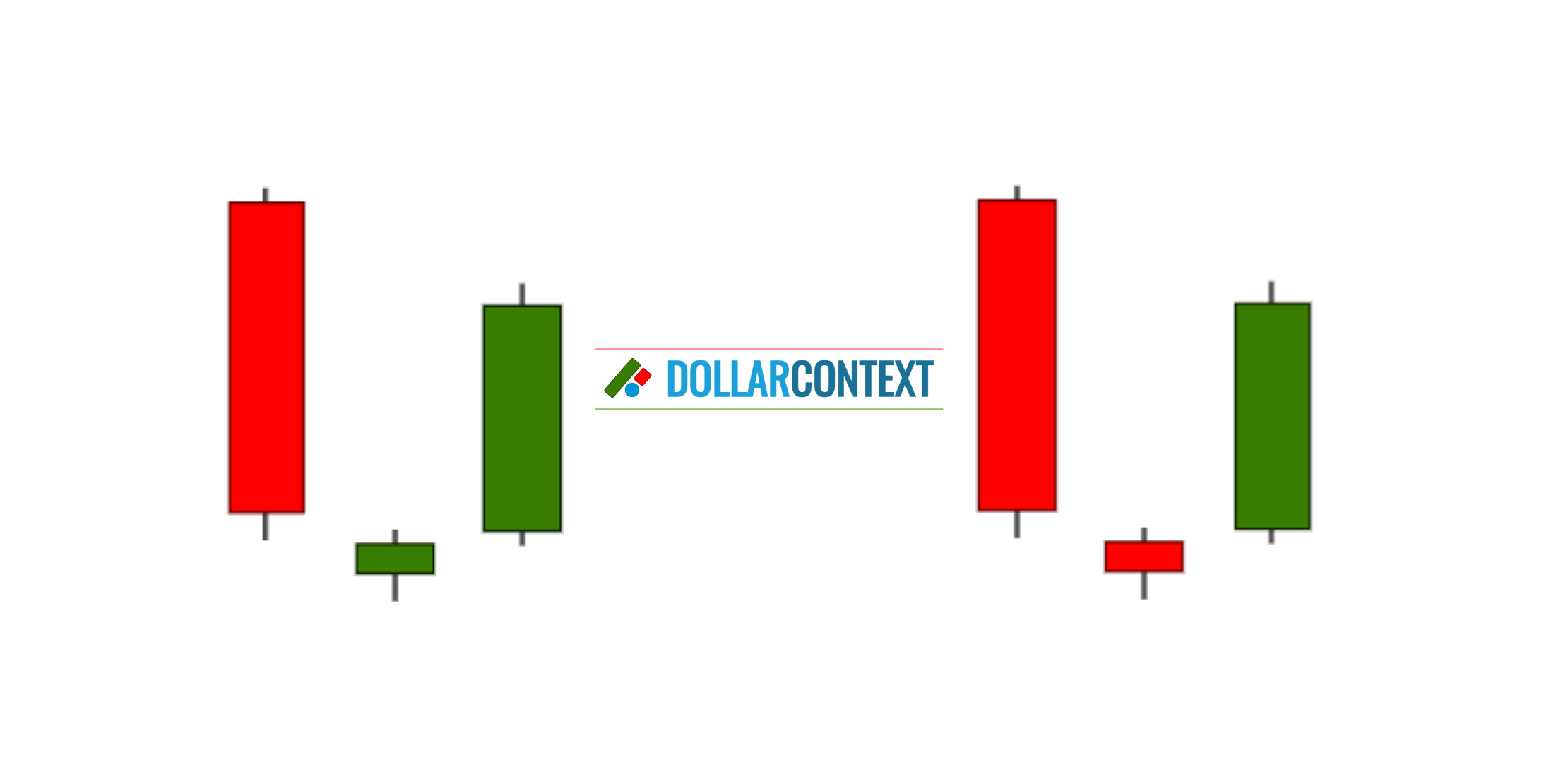

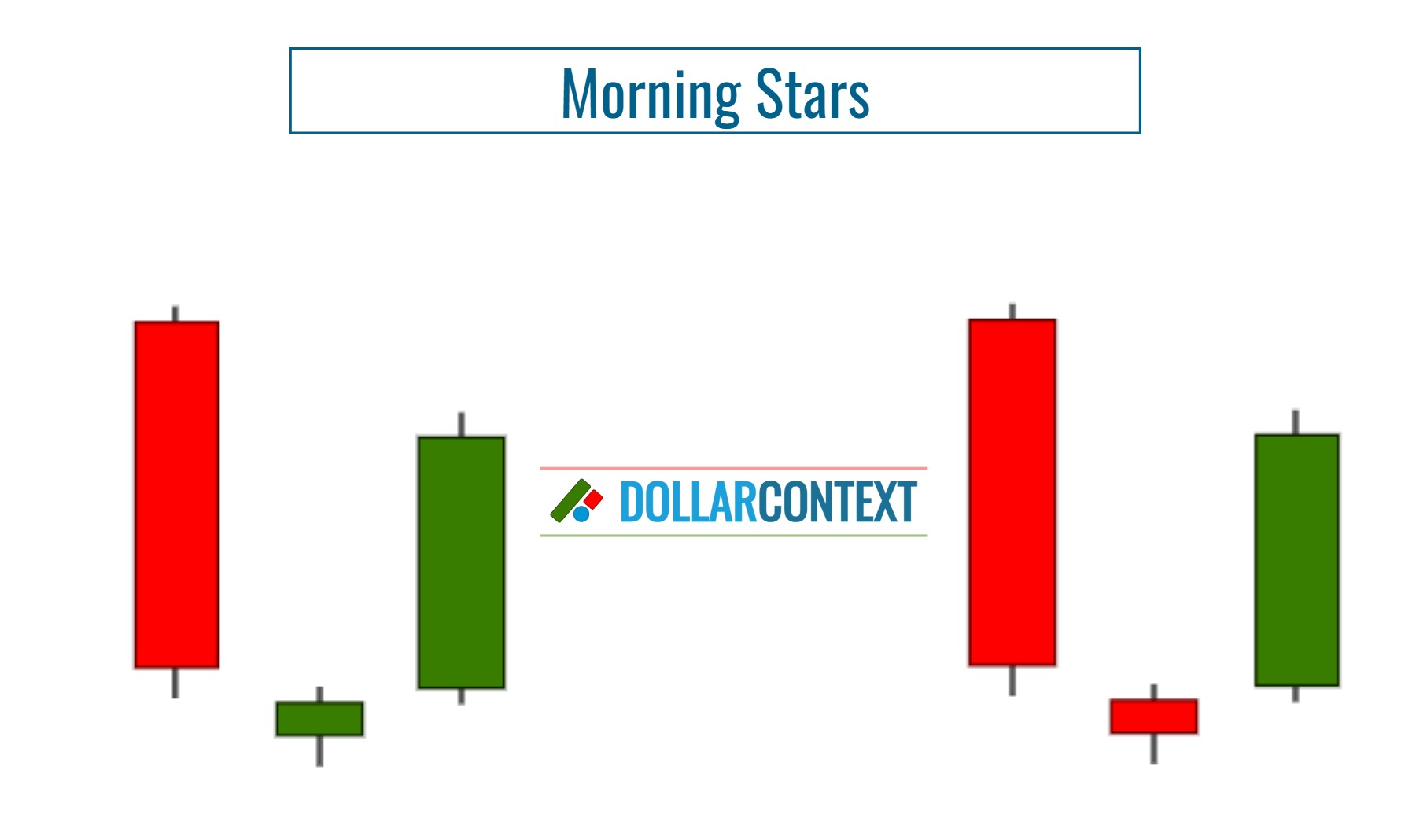

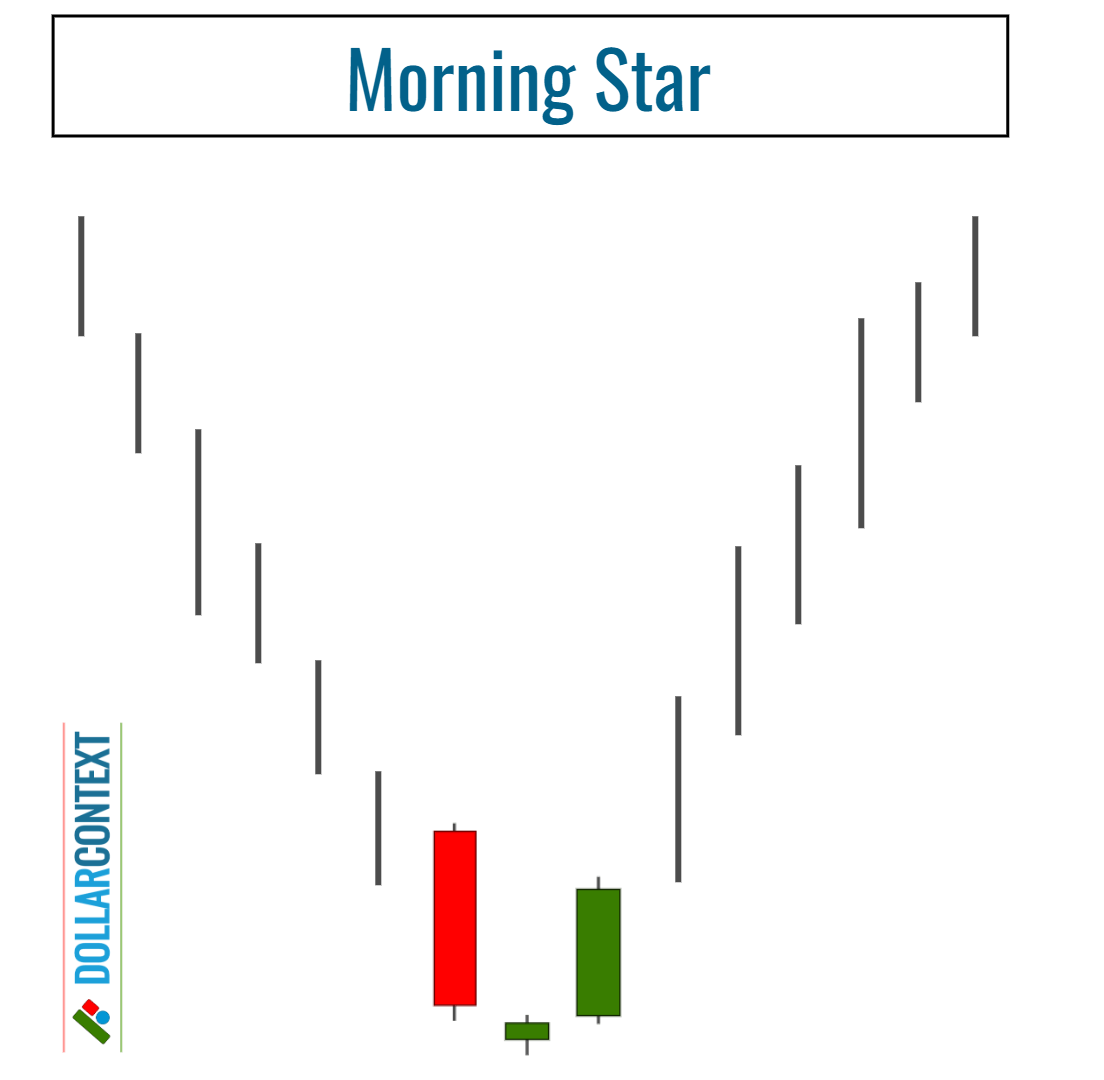

The shape of the morning star is characterized by three specific candles:

- The first candle is a large bearish candle (red or black) that continues the prevailing downtrend, signifying a strong selling session.

- The second candle is a smaller-bodied candle, which can be bullish or bearish (green or red), and it typically gaps lower than the first. The second candle represents indecision in the market and a potential slowing of the downtrend's momentum. The gap ensures that the second candle opens below the close of the first, creating a star-like appearance.

- The third candle is a large bullish one (green or white) that closes well into the body of the first candle, ideally above its midpoint. This candle signifies a strong buying day and suggests that the bears are losing control to the bulls, which could suggest the start of an uptrend.

The morning star is the bullish counterpart to the bearish evening star.

The characteristics outlined before depict the classic morning star pattern in its most recognized form. Yet, when it comes to actual trading scenarios, morning star variations that deviate from the textbook model may still be regarded as legitimate indicators of bullish reversals, depending on the prevailing market circumstances.

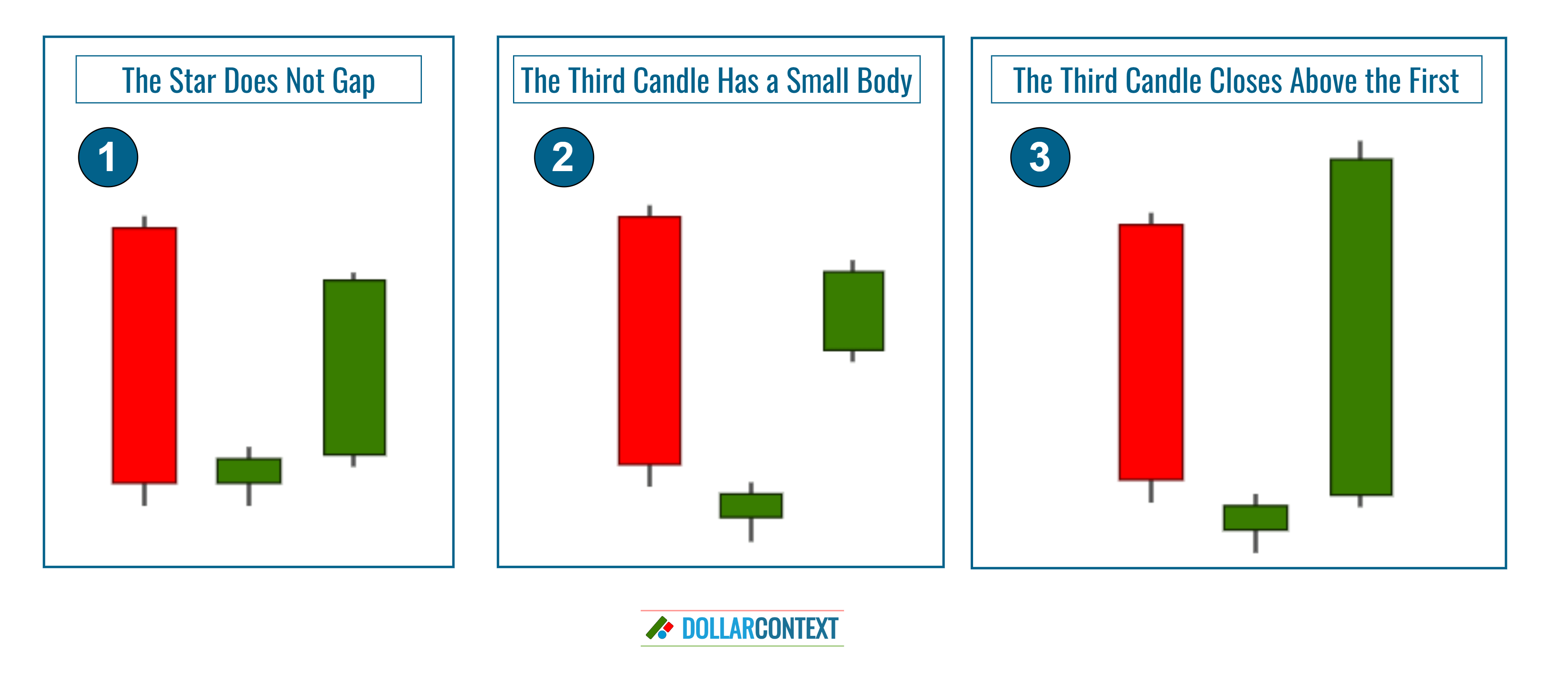

Below are some commonly observed variations of the morning star pattern:

- The Second Candle (Star) Does Not Gap: This is common in lower volatility markets and shorter-term charts (minutes or hours), where the middle candle—the star—does not exhibit a price gap. Under such circumstances, it may be prudent to seek further bullish confirmation before initiating a trade.

- The Third Candle Has a Small Red or Black Body: In such scenarios, confirm that the closing price of the third candlestick penetrates deeply into the real body of the first. If that's not the case, additional bullish patterns should be considered before taking trading action.

- The Third Candle Closes Above the First: Often in more established or mature markets, the third candle closing above the first is a common sight. Such a pronounced green (or white) candle is indicative of a shift in market dynamics, potentially signaling the beginning of a bullish trend.

To qualify as a morning star (or a morning star variation), the following conditions must be satisfied:

- Established Downtrend Requirement: The emergence of the pattern should follow a definitive downtrend in the market. The robustness of the signal is directly proportional to the length of the preceding downtrend and the degree to which the market conditions are oversold.

- Initial Bearish Candle: The pattern's commencement is marked by a sizable bearish candlestick, typically red or black, indicating strong selling pressure.

- Second Candle (Star): The key feature of this formation is a candle with a small body, irrespective of its bullish or bearish nature, that ideally gaps below the preceding candle’s close.

- Final Bullish Candle: The concluding candle should be a bullish one, with a close that significantly penetrates into the real body of the initial bearish candle, signaling the bulls taking control.

2. Context

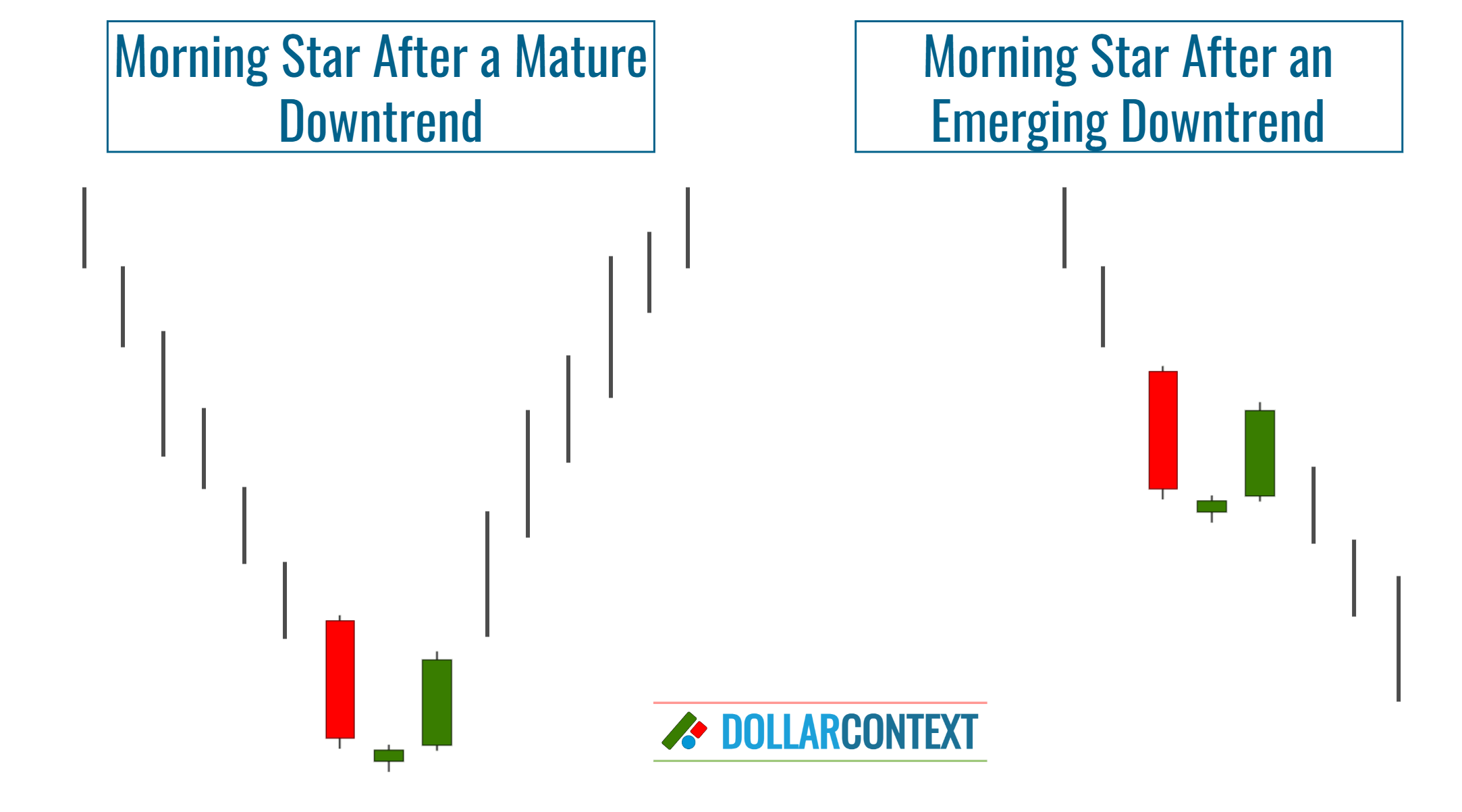

When assessing the implications of a morning star pattern, the context in which this formation appears is as important as the three-candle combination itself.

Because the morning star reflects a shift in market sentiment, and potentially a bullish reversal, it should emerge in the context of a clearly identifiable downtrend.

Mature vs. Emerging Trends: A morning star following a significant downward movement may suggest a market bottom. However, if the market has only recently started its downward trajectory, the chances of it being at its low are diminished.

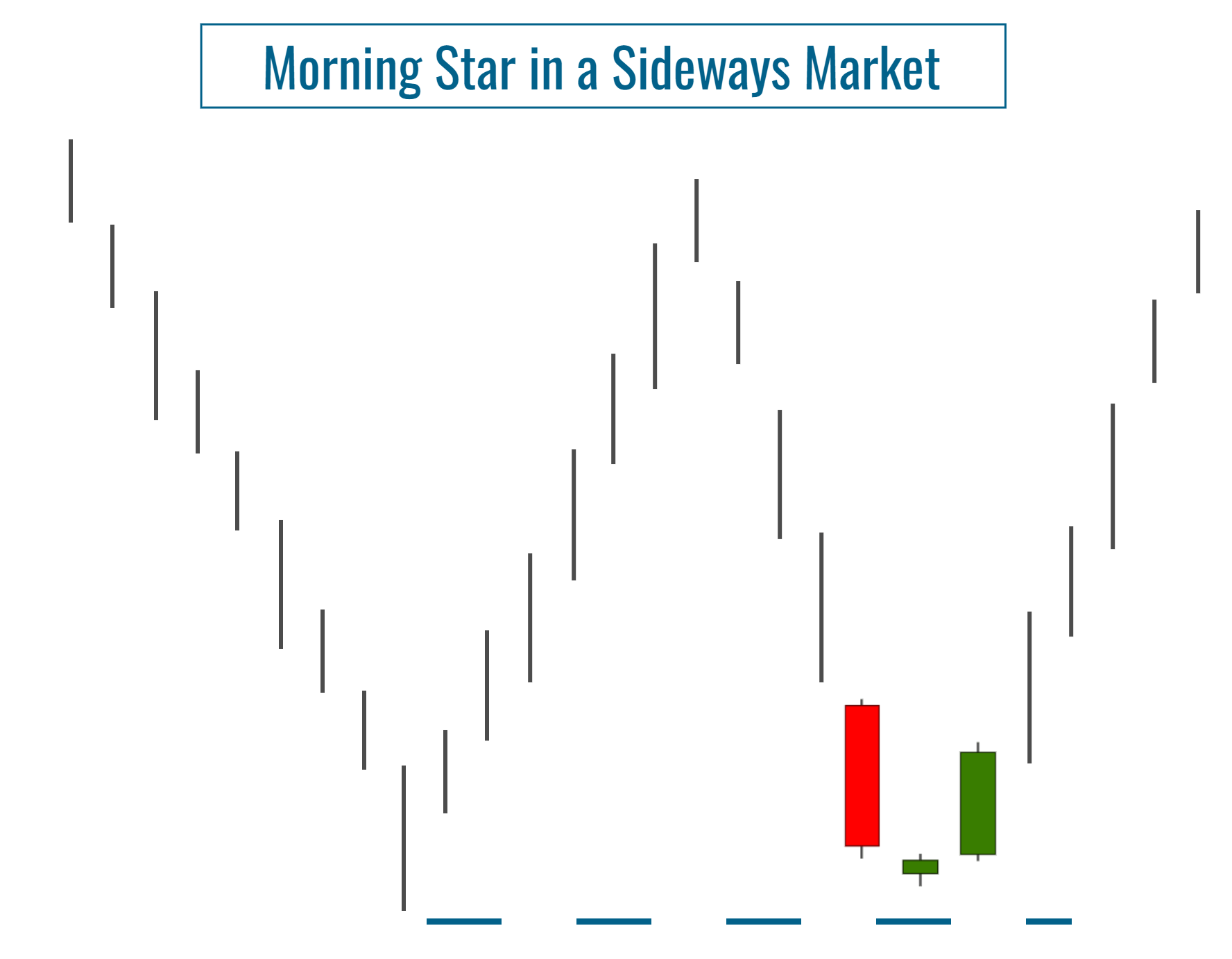

In sideways trading conditions, a morning star usually holds no significance. Having said that, if the pattern emerges near the lower limit of a wide trading range, it may suggest a potential move toward the opposite end of that range.

When determining the reliability of the morning star as a bullish indicator, consider these additional contextual factors:

- Disparity in Body Size: The larger the body of the first red candle and the smaller the star (second candle), the more significant the bullish signal.

- Presence in Support Zones: A morning star that appears in an established area significantly enhances its reversal implications.

- Confluence with Other Reversal Patterns: Sometimes, a morning star is accompanied by other reversal patterns within the same price range. The combined occurrence of these patterns enhances the probability of a genuine bottom reversal.

- Market Extremes: Following this pattern, a reversal becomes more probable when the market is nearing excessively oversold conditions.

3. Psychology Behind the Morning Star

Psychologically, a morning star reflects a shift in market sentiment. The initial bearish momentum, represented by the first large red candle, suggests a continuation of the downtrend. However, the emergence of the small-bodied star candle indicates hesitation among traders, signaling that sellers are losing their grip on the market.

This indecision is followed by a definitive bullish candle, which represents a clear change in attitude, as buyers take control and push prices up. The pattern as a whole captures the transition from bearish to bullish bias, hinting at an impending upturn as confidence increases and a new consensus forms among market participants.

4. Entry Points

To determine an entry point for a morning star pattern, you can implement one of the strategies detailed below.

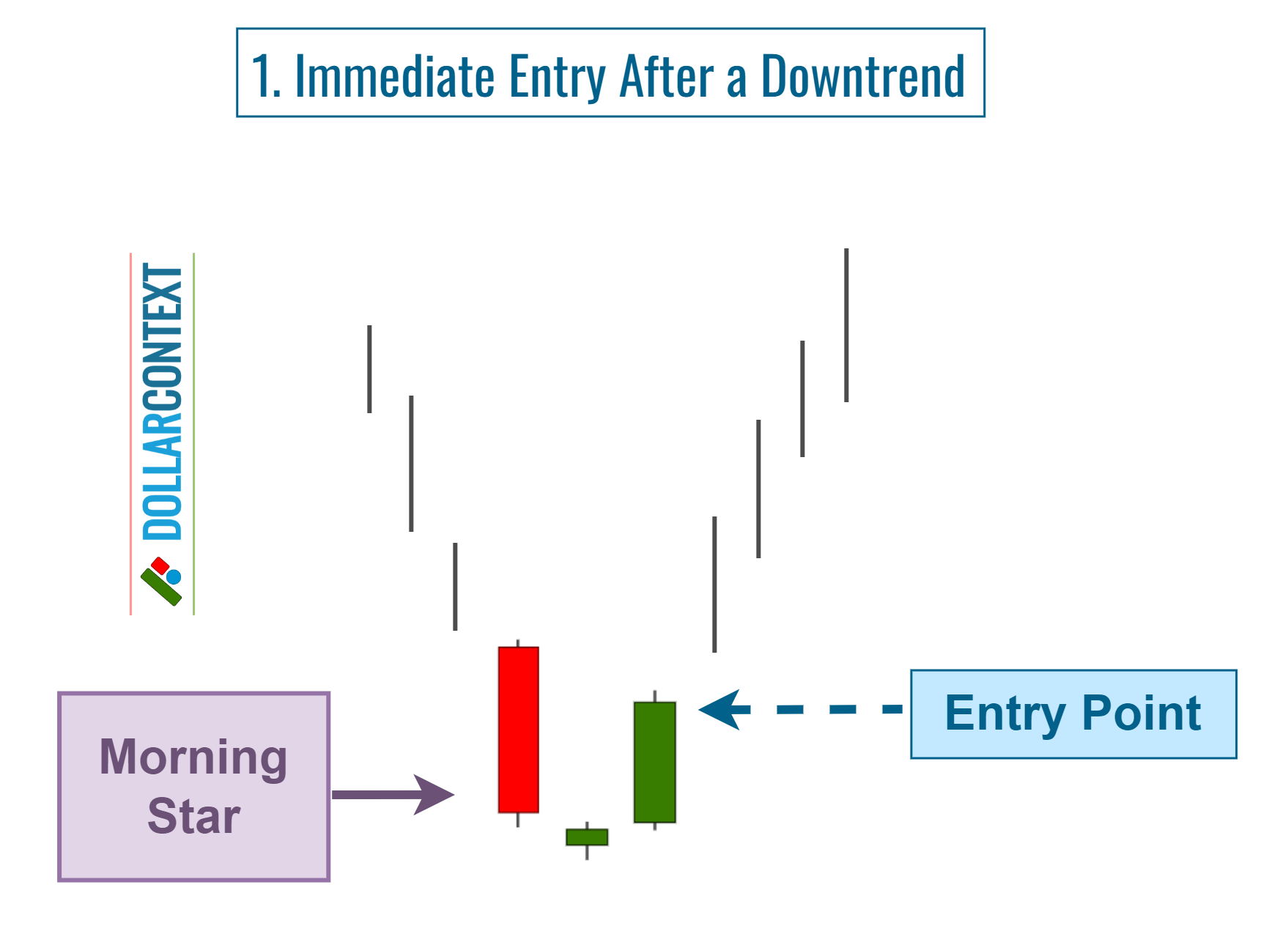

4.1 Immediate Entry

After the formation of the morning star, you could consider opening a position if the preceding downtrend is well-established and additional technical indicators suggest an imminent bottom reversal. This method is bolder, banking on the expectation of a rapid bullish reversal.

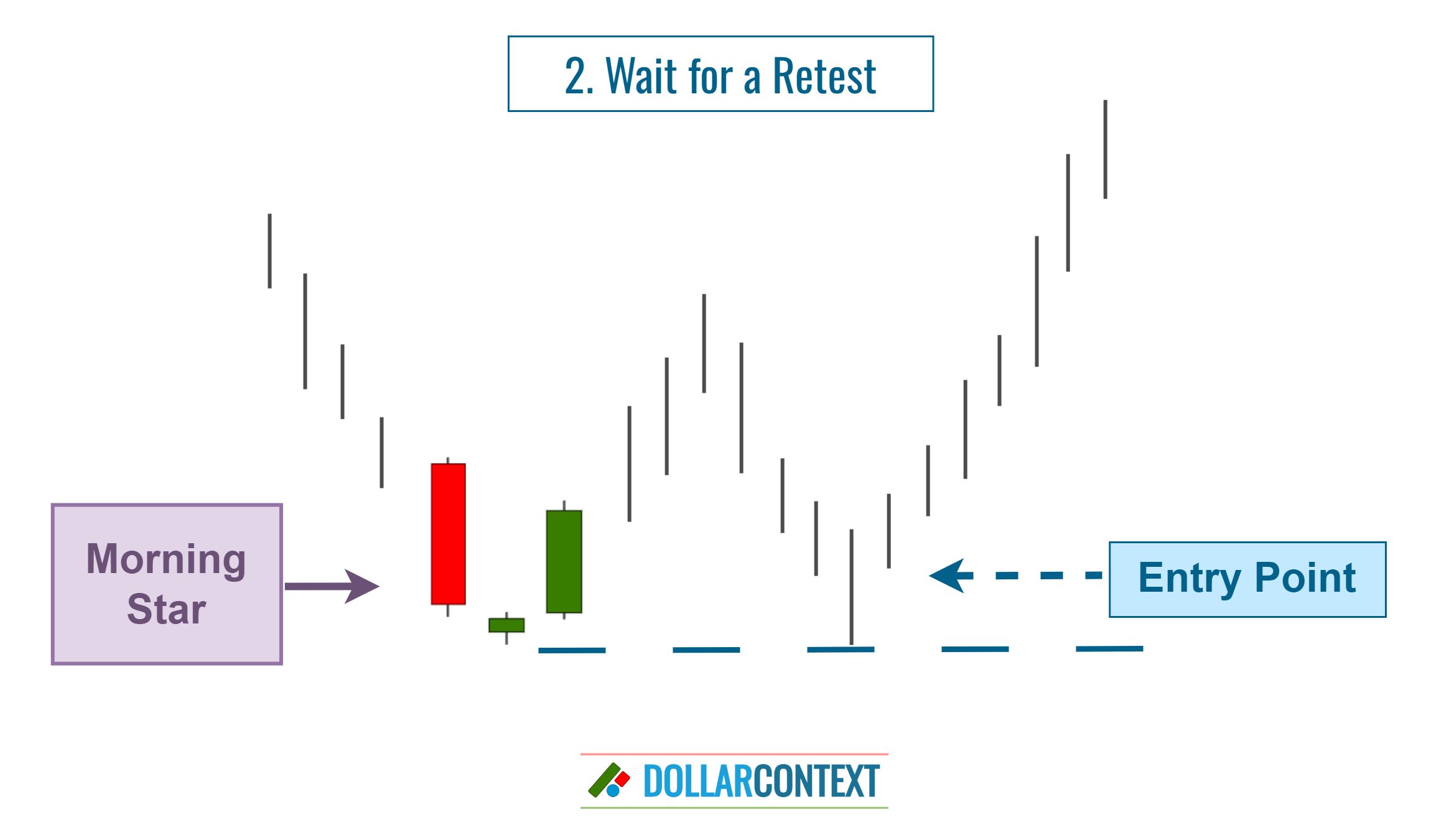

4.2 Wait for a Retest

It's important to admit that after a pronounced or mature downtrend, the appearance of a morning star might still face residual selling pressure in the short term. As a result, the initial upward move may not be reliable, causing the market to retest the lows of the pattern. This is why some traders prefer to wait for the market to revisit the lows of the morning star before initiating a long position.

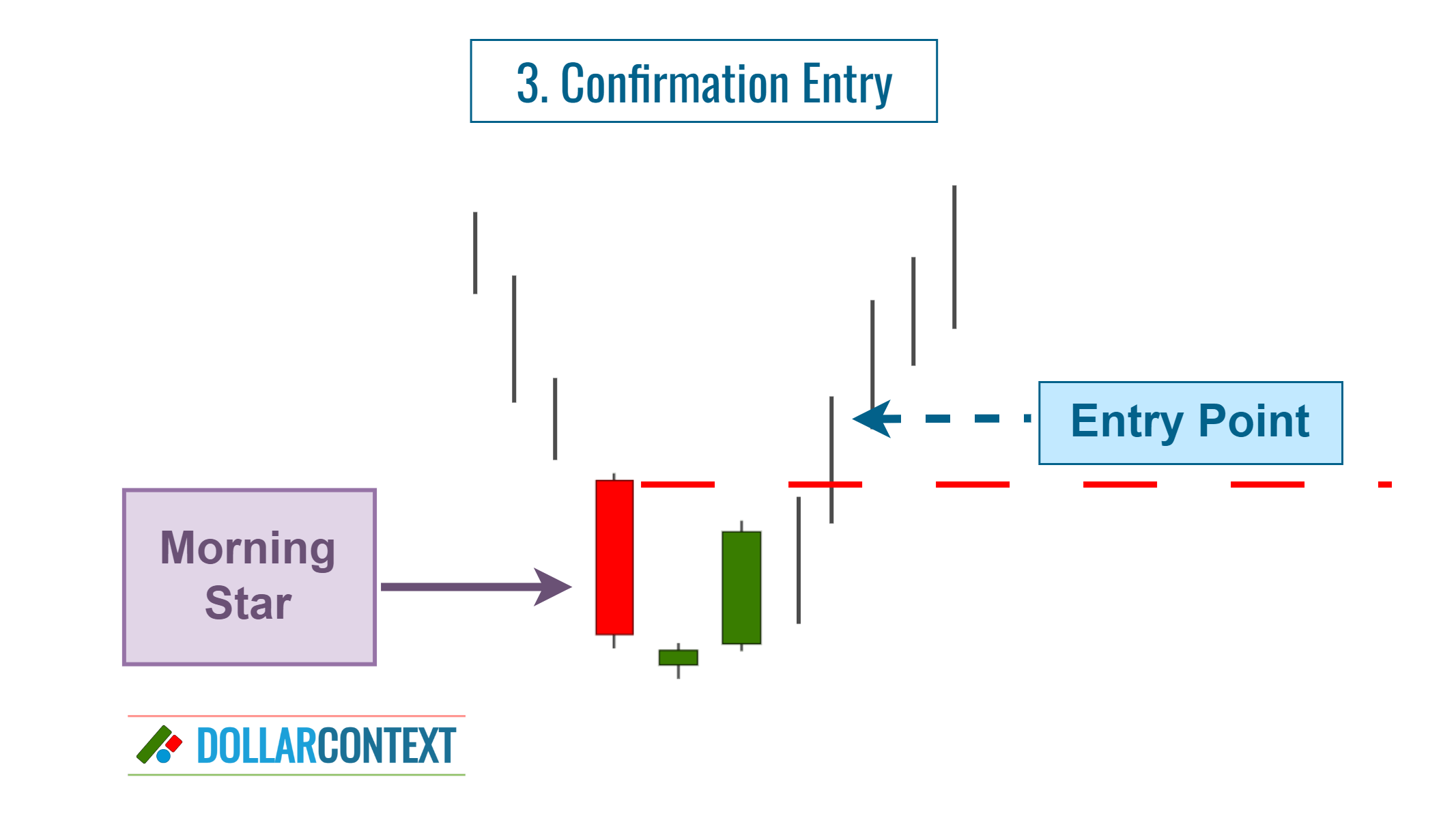

4.3 Confirmation

Following the morning star, initiate a trade once the price action confirms the onset of a new upward trend, ensuring a substantial shift in momentum before entering the market.

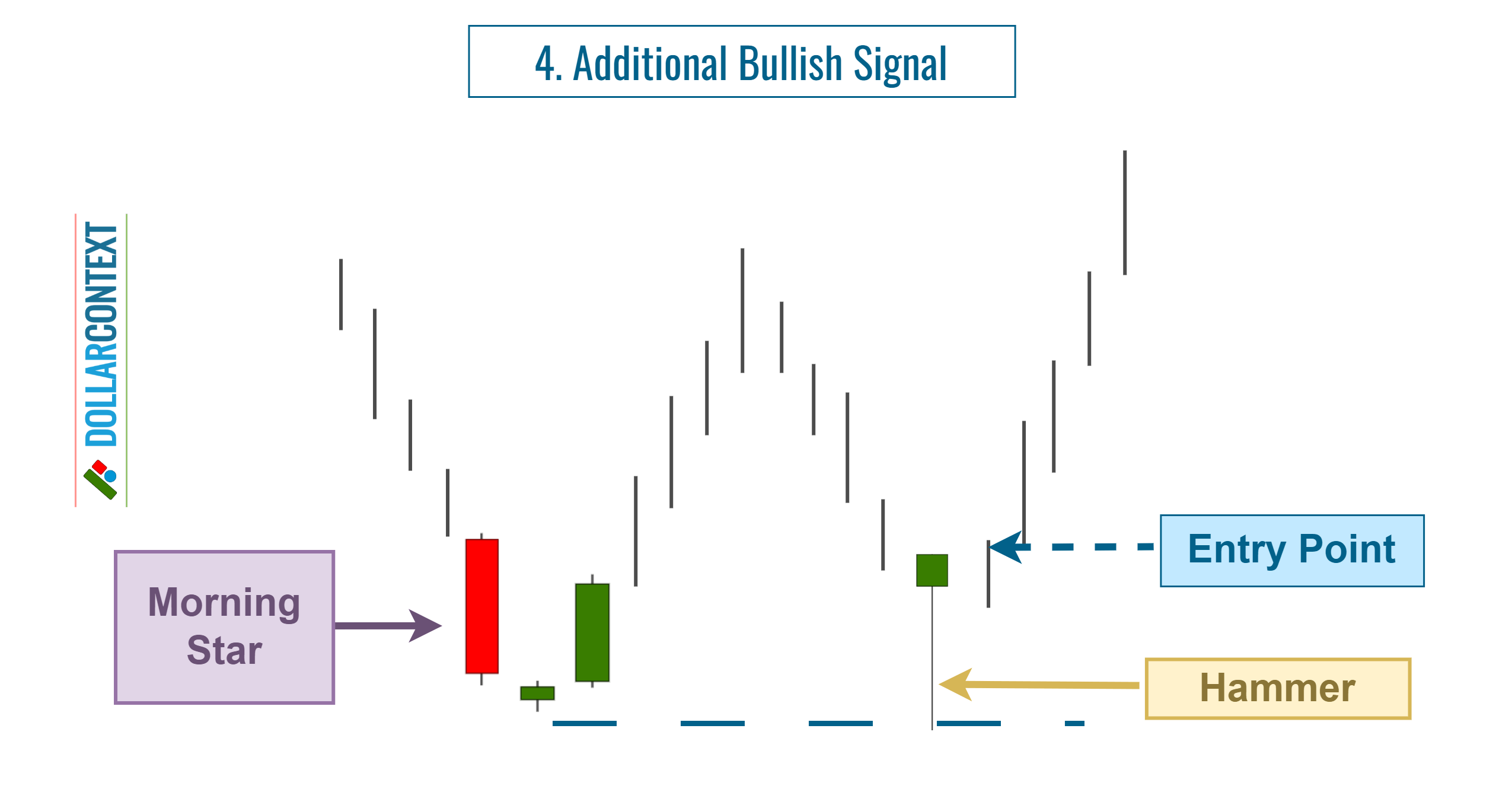

4.4 On an Additional Bullish Signal

After the morning star pattern, hold off on initiating a position until a subsequent reversal candlestick formation or indicator materializes, thereby bolstering the likelihood of a bullish trend reversal. This might manifest as a hammer or another reversal pattern. Be aware that the bullish pattern that reinforces the probability of the reversal may appear before the morning star.

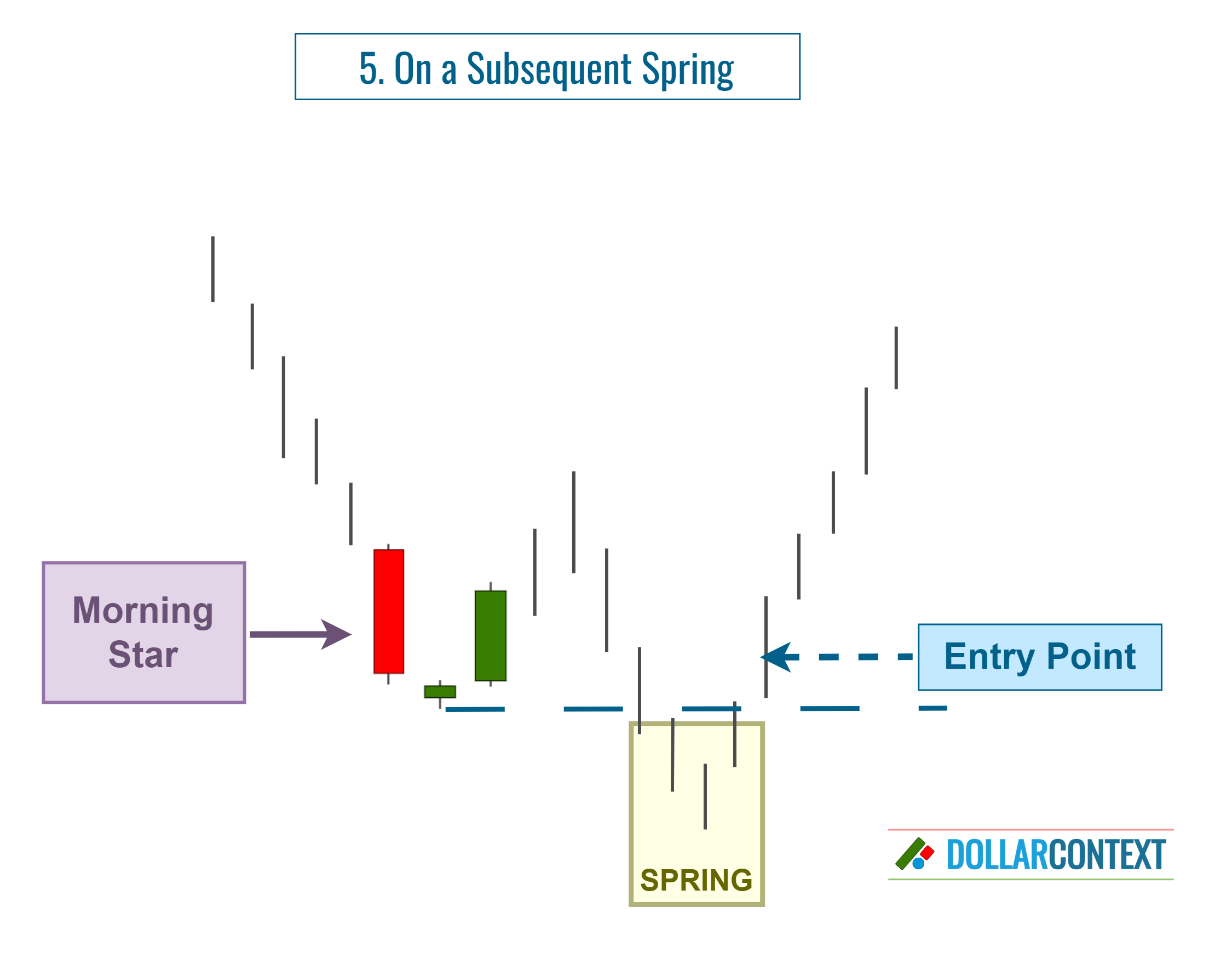

4.5 After a False Breakout (Spring)

A spring implies a situation where the market briefly breaks through a support level, but quickly reverses course to move in the opposite direction. Basically, it's a false downward breakout.

Springs suggest that the downward breakout might not be sustained, and a reversal into the opposite direction could be approaching.

4.6 Mixed Strategy

A mixed approach entails initiating a long position at the first indication of a morning star formation, and then incrementally increasing that position as additional bullish indicators materialize.

5. Stop-Loss

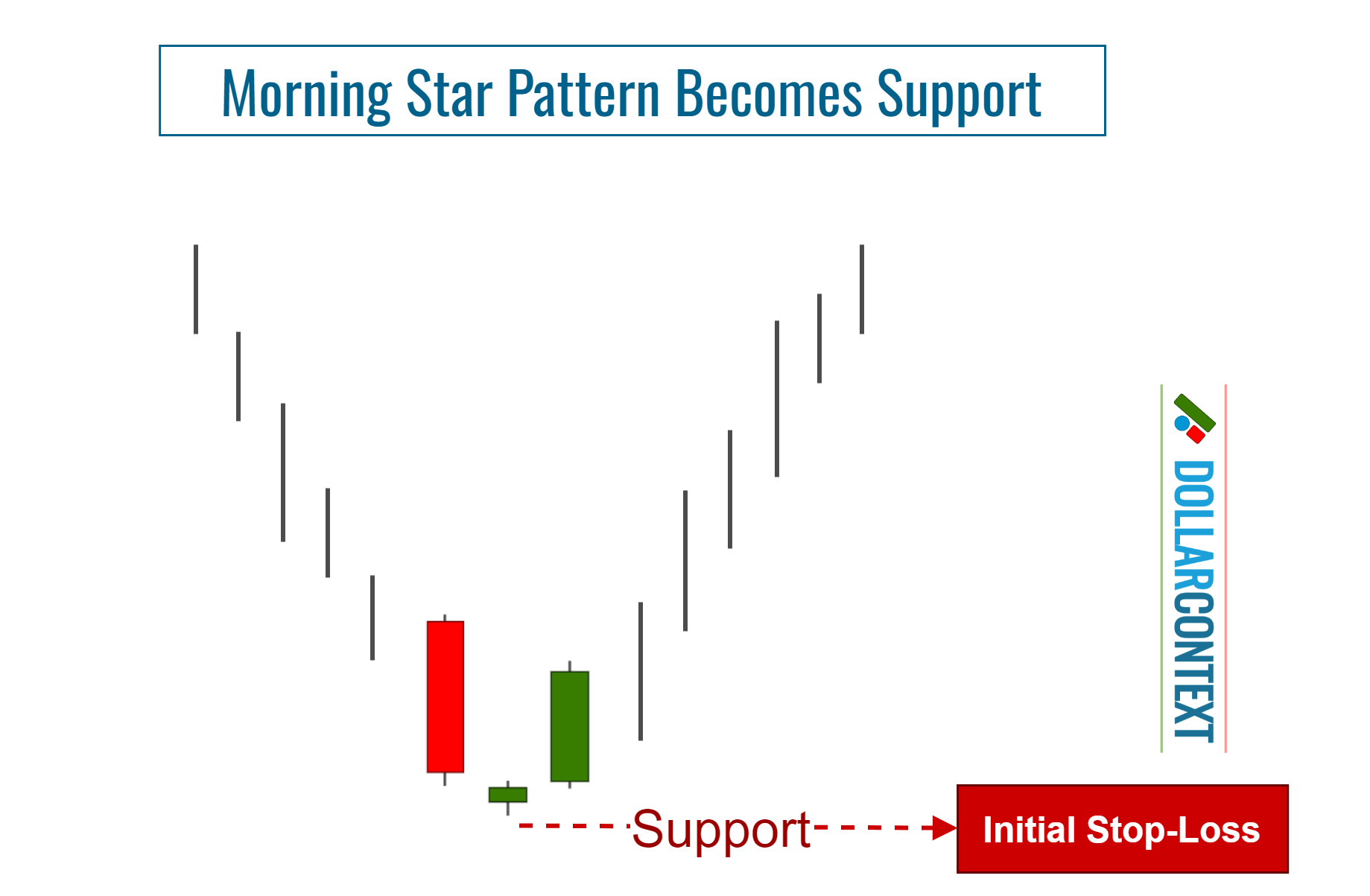

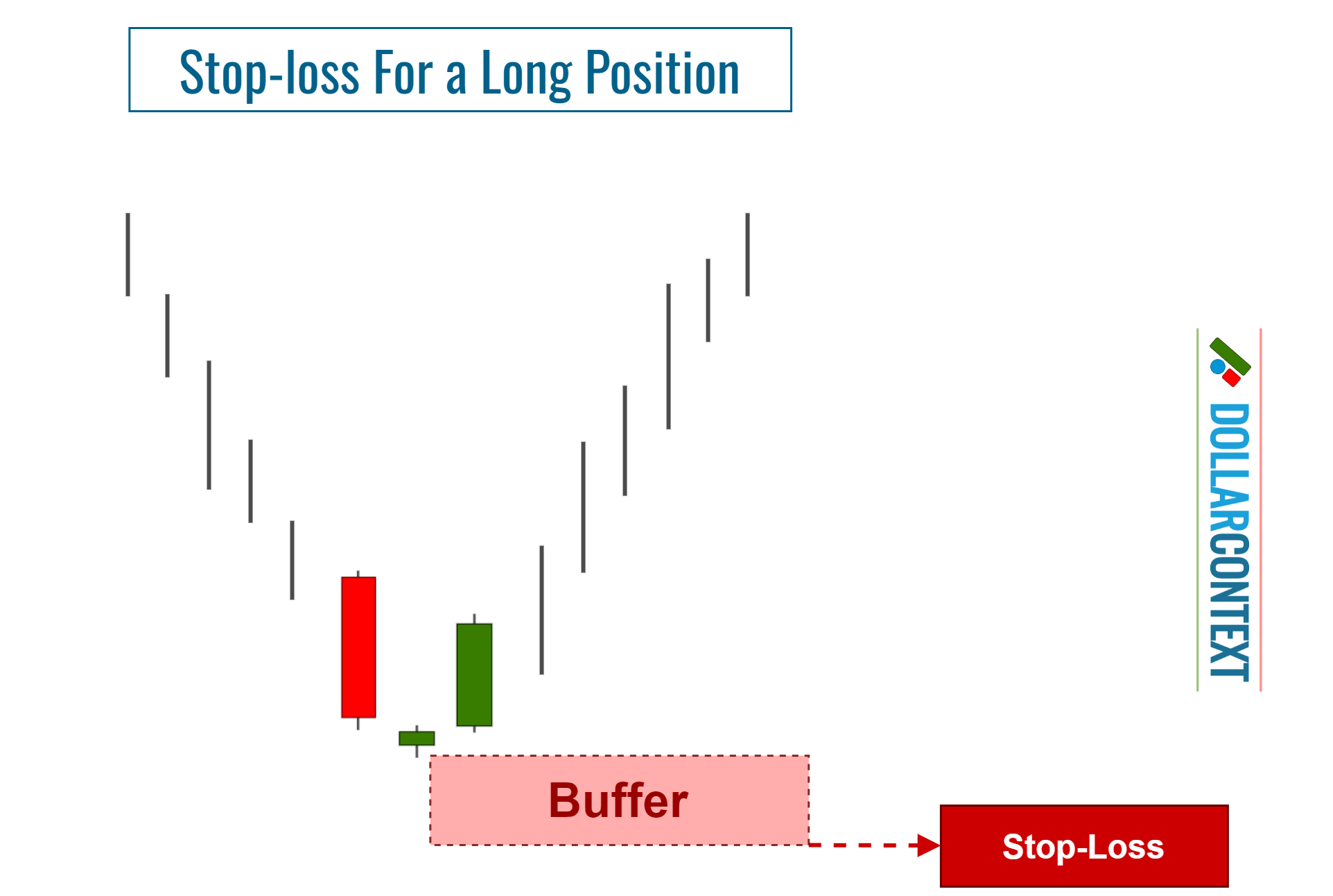

Following a downtrend, the price range of a morning star becomes support. Traders usually identify those levels to determine their initial stop-loss for a morning star.

However, to safeguard against premature exits prompted by market volatility or deceptive breakouts, take into account the following protective measures:

- Incorporate a buffer to mitigate the effects of deceptive breakouts to the downside.

- Set a stop-loss order that activates on closing prices, which offers a more dependable indicator than fleeting fluctuations within a session.

As your position progresses, additional candlestick patterns may emerge, reinforcing the support initially indicated by the morning star. When this occurs, consider adjusting your stop-loss to encompass the lowest level observed within these new patterns.

6. Profit Target

Although candlestick patterns often serve as indicators for trend reversals and potential trade entries, they inherently lack guidance on setting profit-taking targets. To determine the optimal exit strategy, traders may employ additional methods such as Fibonacci retracement levels, moving average indicators, or classical chart formations.

However, if you're in a profitable trade based on the morning star, and you observe the emergence of a bearish candlestick pattern, it could be prudent to interpret this new pattern as a cue to close your long position.

7. Subtypes (Morning Doji Star and Abandoned Baby Bottom)

There are two distinctive types of morning stars: the morning doji star and the abandoned baby bottom.

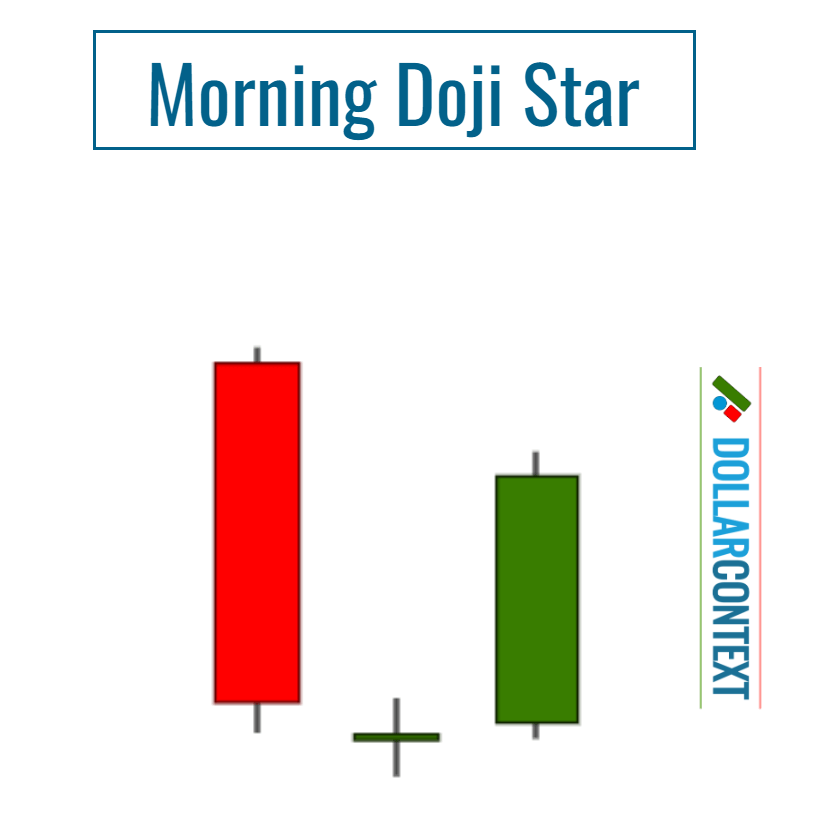

Morning Doji Star

The morning doji star stands out from the regular morning star. In the standard morning star, the second candlestick presents a small real body; however, in the morning doji star version, this second candlestick is replaced by a doji. This doji's inclusion intensifies the bullish signal of the pattern.

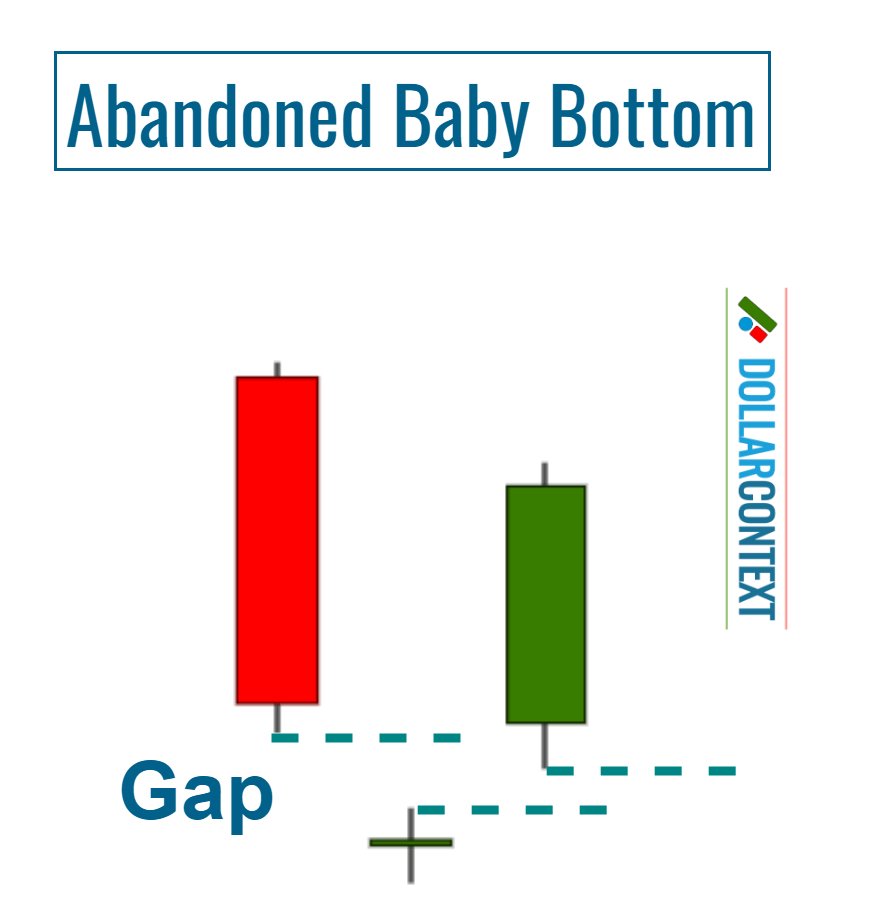

Abandoned Baby Bottom

If the star of this pattern is a doji that gaps lower (with its shadows not intersecting the previous session's shadows), and it is succeeded by a bullish candlestick that gaps higher (again, without its shadows overlapping the doji), this formation is seen as a potent indicator of a significant bullish trend reversal. Known as the "abandoned baby bottom," this pattern is particularly uncommon.

8. Examples

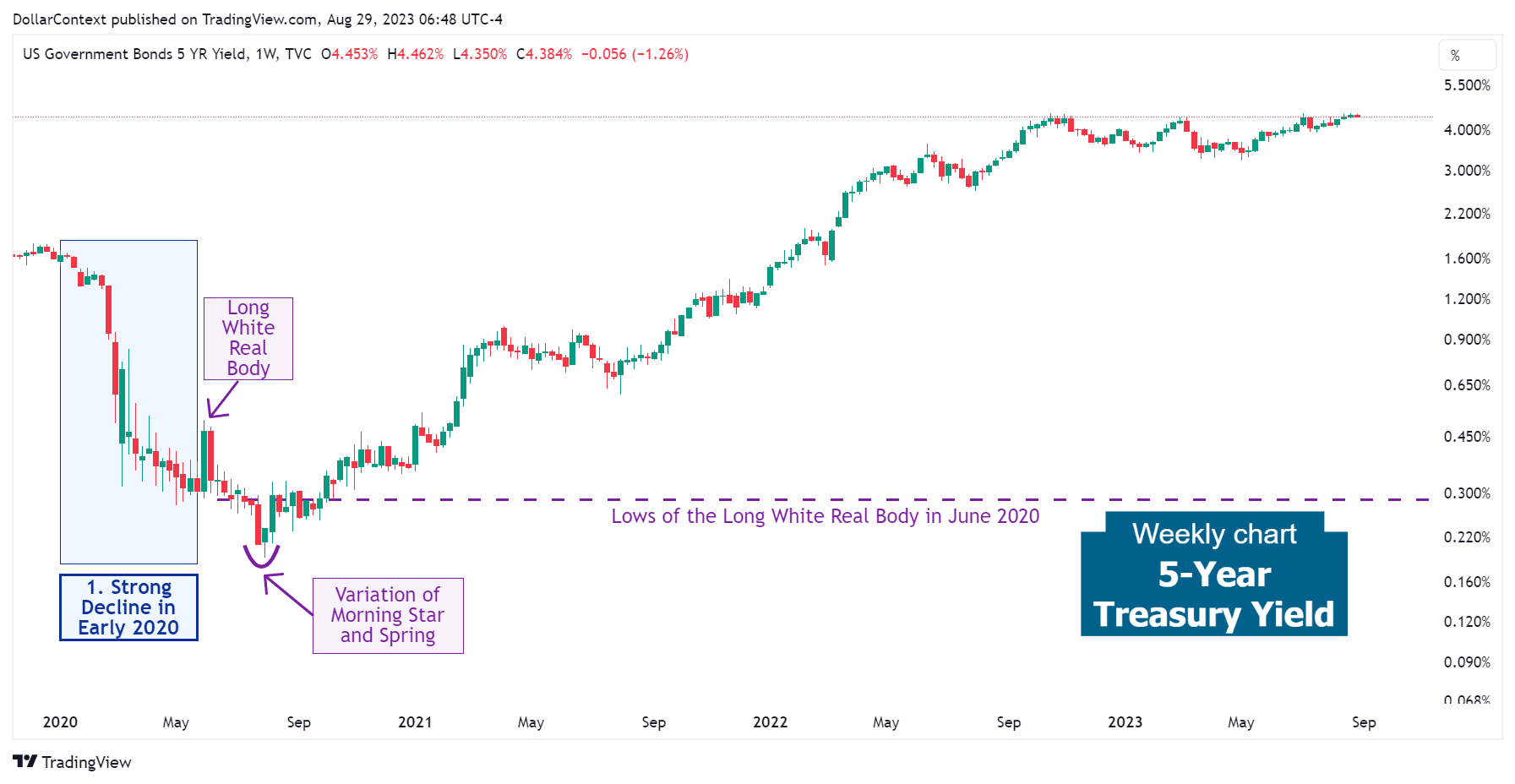

8.1 5-Year Treasury Yield (Weekly Chart)

In August 2020, the 5-year Treasury yield displayed a variation of a morning star pattern after a well-established downtrend. Observe that the morning star was also a spring, which marked the beginning of a decent uptrend.

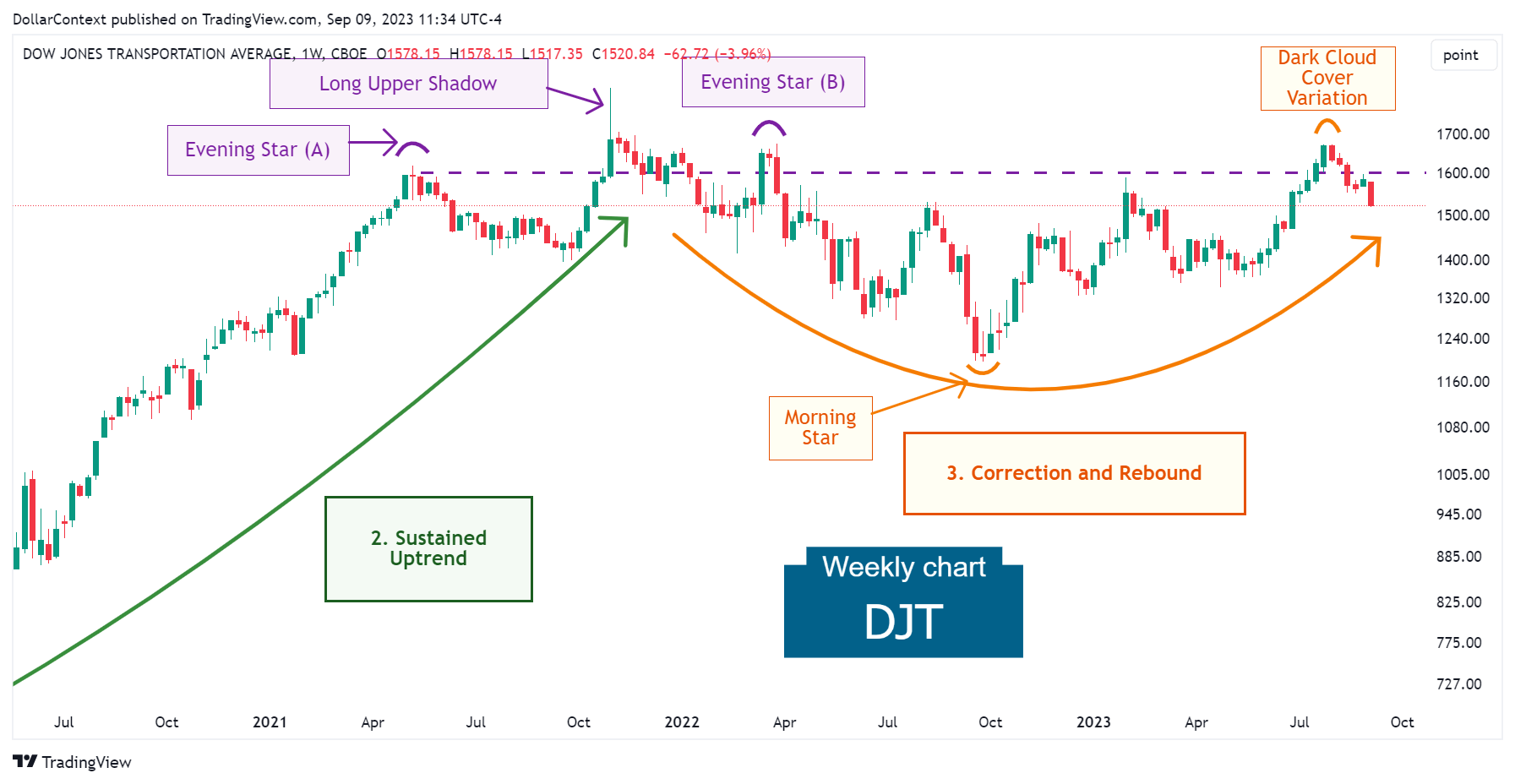

8.2 Dow Transports (Weekly Chart)

In October 2022, the Dow Transports underwent a retracement within a broader uptrend, culminating in a variation of the morning star pattern, marked by an orange label in the chart below.

8.3 More Examples (Case Studies)

- Case Study 0001: Doji and Morning Star After a Long Red Real Body (USD/JPY)