CANDLESTICK

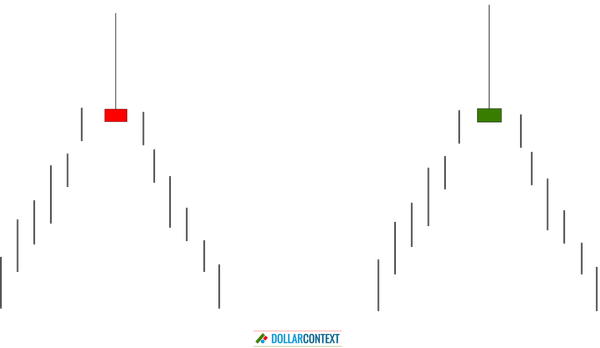

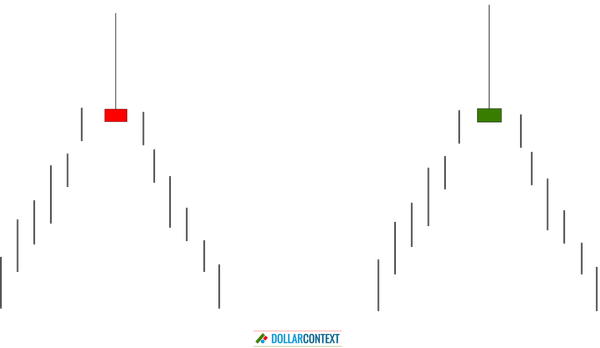

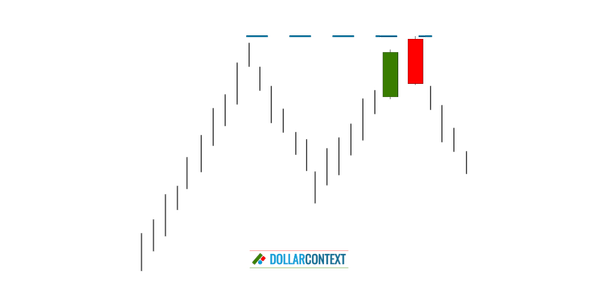

Different Variations of a Shooting Star Pattern

The shooting star pattern consists of a candle with a small real body at the lower end of the candle and a long upper shadow.

CANDLESTICK

The shooting star pattern consists of a candle with a small real body at the lower end of the candle and a long upper shadow.

CORN

We'll delve into the trends that have shaped the path of corn prices since 2020. Then, we'll provide our perspectives on the potential future course of this market.

CANDLESTICK

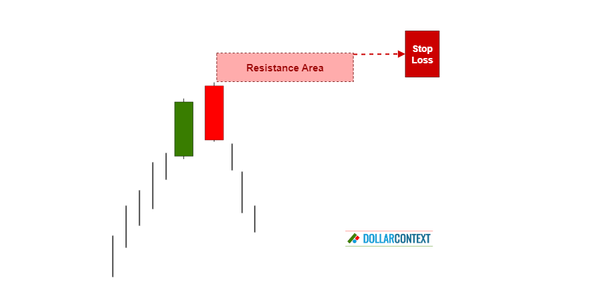

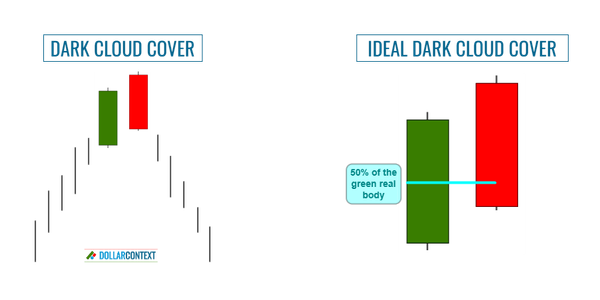

After either a mature or a sharp uptrend, a dark cloud cover can act as an indicator of reversal. This presents a potential opportunity for traders to establish short positions in the market.

SOYBEAN

From 2020 onwards, the commodity market, encompassing soybeans and other agricultural products, might have embarked on a supercycle period.

CANDLESTICK

The highs of a dark cloud cover usually becomes resistance. This level acts as a ceiling that price struggles to break through.

WHEAT

We delve into the key driving forces that have been shaping the wheat market since 2020. Then, we speculate on the potential trajectory this market might take.

CANDLESTICK

The highs of the dark cloud cover creates a resistance area. This resistance level represents your initial stop loss.

SILVER

Evidently, this particular scenario may not come to fruition. Nevertheless, we deem it a likely outcome. Episodes of profound collapses and panic, similar to the one observed in 2020, frequently precede commodity supercycles.

CANDLESTICK

This sudden reversal surprises those participants who had been expecting the upward trend to continue.

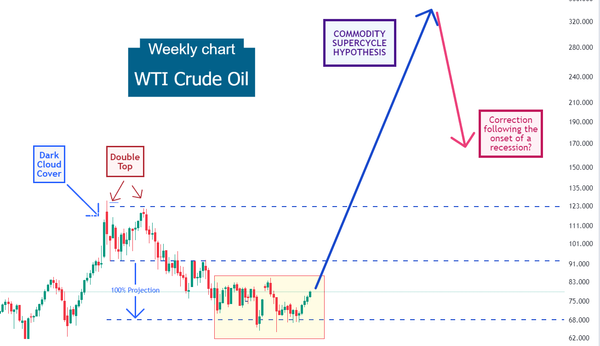

CRUDE OIL

Starting in 2020, the commodity market may have entered a supercycle phase. Such supercycles usually extend beyond 8 years and lead to substantial price escalations.

CANDLESTICK

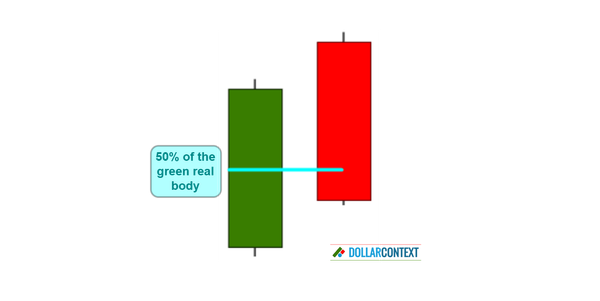

For an optimal dark cloud cover, the second session should ideally conclude below the midpoint of the preceding white/green candle.

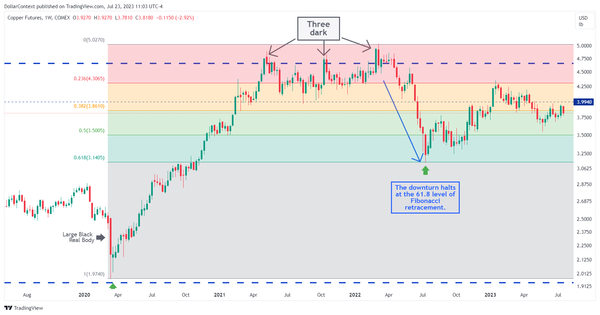

COPPER

Scenario 1. Since 2020, the commodity market might have been going through a supercycle. Scenario 2. Copper could be undergoing a brief correction phase before retesting the lows of 2022. The catalyst for this scenario might be a recession expected to materialize in 2024.